Japan's share market defies global sell-off

- Published

Stocks in Japan ended a four-day losing streak and closed higher, despite shares in the US and Europe falling sharply on Tuesday on worries over the UK's referendum on EU membership.

Japan's benchmark Nikkei 225 index closed up 60.58 points, or 0.4%, at 15,919.58.

The rise came amid the Bank of Japan's two-day policy meeting, which will finished on Thursday.

However, analysts are not expecting major action by the central bank.

Shares in the US and Europe dropped sharply on Tuesday as polls indicated rising support for the Leave campaign in the UK's upcoming EU referendum.

Some analysts have said leaving the political and economic union could harm the UK's economy, although the effects would not be immediate.

"The economic impact would occur over months and years, not immediately," London-based analyst Michael Metcalfe said.

"But financial markets are constantly trying to look forward and discount what's going to happen."

In Australia, the S&P/ASX 200 index finished the session down 1.1% at 5,147.1, dragged down by commodity-related stocks.

South Korean shares were also down, with the benchmark Kospi index finishing 0.2% lower at 1,968.83.

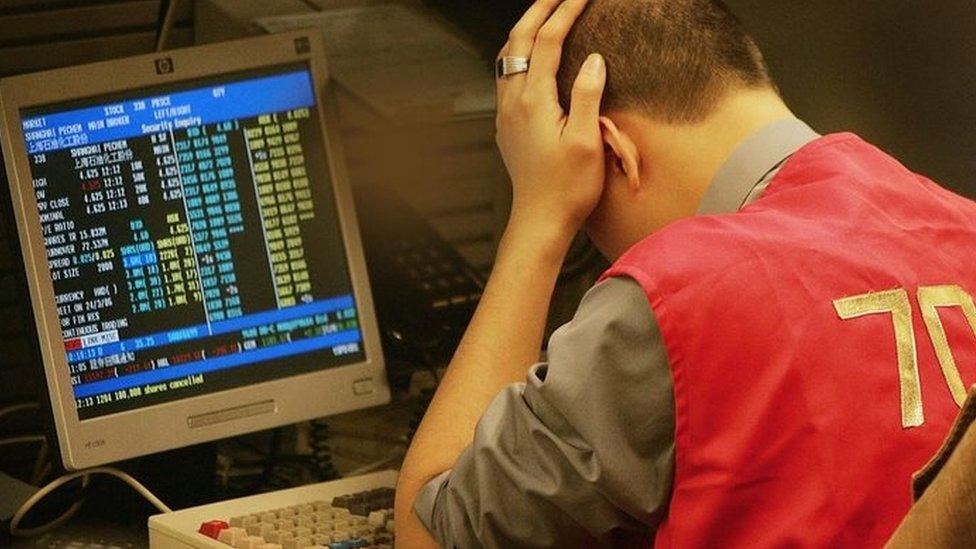

Foreign investors in China

Investors were watching mainland Chinese stocks closely on Wednesday after the world's biggest stock index provider, MSCI, delayed including the country's A shares on its emerging market index.

Inclusion on the index would have been a major step forward for Beijing as it attempts to open up its financial markets and attract foreign capital.

However, stock markets in Hong Kong and China did not seem troubled by MSCI's knock back.

Hong Kong's Hang Seng reversed earlier losses and closed up 0.4% at 20,467.52, while the Shanghai Composite ended the day 1.6% higher at 2,887.21.

MSCI, which is the world's biggest stock index provider, said on Tuesday that China's authorities had demonstrated "a clear commitment", external in bringing accessibility of their A shares market closer to international standards.

It also said it was looking forward to the "continuation of policy momentum in addressing the remaining accessibility issues".

- Published15 June 2016

- Published9 June 2015

- Published9 June 2015