Risks in steel workers' pension deal, says PPF

- Published

The lifeboat scheme that protects pensions when a company fails has raised concerns over a government plan for steel workers' pensions.

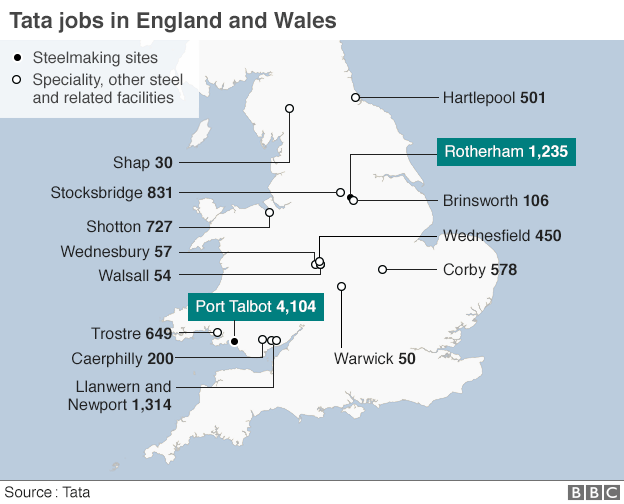

The government believes a £485m pension deficit has been deterring potential buyers of Tata Steel's UK business, putting 10,000 jobs at risk.

It outlined a series of proposals to alter the terms of the pension scheme.

Now, the Pension Protection Fund (PPF) has warned that such plans held big risks for other pension savers.

It said that the plans risked setting a precedent that would lead to other employers and industries attempting to dilute their pension promises.

Were the plans to be given the go-ahead but then fail, then this could lead to a big hit for the PPF itself.

Support and criticism

India's Tata is still considering bids for its UK steel business

A consultation, external on the British Steel Pension Scheme's future has been launched by ministers.

It includes a "full range of options" such as "whether it will be necessary to reduce the benefits within the scheme", according to the Department for Work and Pensions (DWP).

One option is to base the scheme's annual increase on the Consumer Prices Index (CPI) inflation measure, which is usually below the Retail Prices Index (RPI) measure currently used. Others include separating the scheme from the employer or transferring savers and pensioners to a new scheme altogether.

The plan has been supported by some union leaders and the British Steel Pension scheme.

However, it has been criticised by the former pensions minister, Steve Webb, who said that "rushed changes to pension rules risk driving a coach and horses through the pension security of hundreds of thousands of workers well beyond the steel industry".

Backstop

Mr Webb's argument has, in part, been echoed by the PPF.

In its response to the consultation, the PPF said: "There is a risk of setting a precedent. Although the government has been at pains to stress the unique circumstances surrounding the British Steel Pension Scheme, we would nevertheless expect other employers or industries to seek similar arrangements to reduce their pension scheme liabilities - effectively transferring value from scheme members to shareholders."

It said that, for thousands of pensioners themselves, there would be little difference between the amount of pension they would receive under the revised terms that have been proposed and the amount they would receive if the PPF took on the liabilities.

It also raised concerns about one idea of allowing the pension scheme to continue, but with only a "shell" company behind it. In other words, there would be no backstop to deal with any growing deficit in the scheme.

"With no genuine employer to act as a buffer and provide additional contributions when needed, the risk of the scheme's investment strategy failing would either fall on the scheme members or - if it was decided to maintain PPF eligibility - be directly underwritten by the PPF," it said.

It suggested that even if there were a "low risk investment strategy" there was a possibility that the burden would eventually fall on the PPF. This could hit the PPF's own level of funding which is in place to protect pensioners with defined benefit workplace pensions if any employer goes under.

One solution according to the PPF, if this government plan went ahead, would be to remove the safety net that the PPF provides. Under these circumstances, the British Steel Pension Scheme would no longer pay the regular levy to the PPF, and the PPF would not cover the cost of compensation payments to pensioners if, at some point in the future, the pension scheme's trustees decided its assets could not cover pension payments.

Tata is still considering bids for its UK steel business, with a shortlist expected soon.

- Published26 May 2016

- Published25 May 2016

- Published28 April 2016