Softbank's acquisition of ARM is a big bet on the future

- Published

Imagine a future where your fridge, your washing machine, even your hairbrush, is a computer.

Everyday appliances, all of a sudden transformed into intelligent, thinking and analytical machines.

And then think - how much would you pay to own the technology behind those devices?

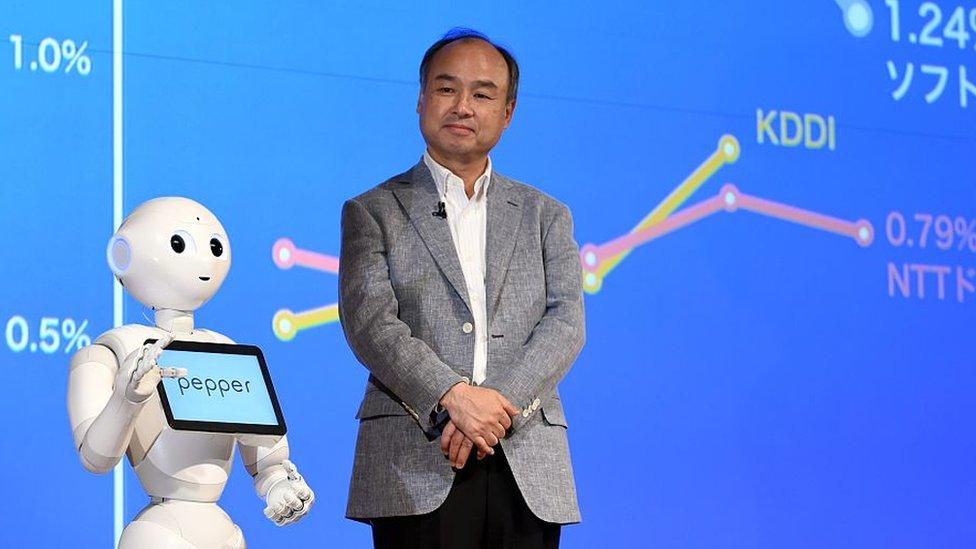

That might help to explain why Softbank's eccentric chief executive Masayoshi Son is paying close to a 50% premium for the UK's ARM Holdings.

ARM doesn't make the chips that will eventually go into some of these devices, but it does design many of the chips used in smartphone devices (Apple and Samsung for instance) and other sensory devices today. ARM makes its money from charging a small royalty on its intellectual property.

Betting on the future

"Softbank's acquisition is a huge bet on the future," says Marc Einstein of Frost & Sullivan in Tokyo.

"Masayoshi Son has a vision of the future of the telecoms and IT industry which will be designed around artificial intelligence, robots and the Internet of Things."

It's a big gamble, but then the Japanese technology entrepreneur has always been known to take big risks.

Will the robots eventually take over?

In a recent interview with Fortune, external, Nikesh Arora - the previous number two at Softbank - said this of his former boss: "Masa has an idea per minute. Recently he presented his views of 'The Singularity' to the Softbank board. He's also building a robot with a heart."

AI taking over?

The Singularity, if you didn't know already, is when artificial intelligence will overtake human intelligence. And Mr Son is a believer.

In an interview last month with the Nikkei, external, Mr Son said: "The Singularity is coming. Artificial intelligence will overtake human beings not just in terms of knowledge, but in terms of intelligence."

Crazy talk? Perhaps not, but the question is... how long will that vision of the future take to materialise?

And if you're going to spend $30bn (£22.7bn) on an investment, it had better start to pay off soon.

Industry experts tell me that that Mr Son has made a lot more money than anyone else in Japan - but he's also probably lost more money than anyone else in Japan too.

Softbank is currently in debt to the tune of around $100bn. The chief executive financed many of his acquisitions by borrowing heavily, but has recently been selling stakes in some of those purchases to help pay down this debt.

The Brexit effect

"Look at Softbank's investment activity in the first dotcom boom," says Harminder Singh, university lecturer at the Auckland University of Technology. "Some very ambitious plans that didn't work out."

"The departure of the previous heir-apparent Nikesh Arora may be an indicator of the tension this decision may have caused," Mr Singh explains.

"While the departure was publicly amicable, it's a fair bet that a decision to buy ARM, especially at such a high price, was not something Mr Arora was comfortable with."

As the pound falls, ARM has become quite a bit cheaper

It's probably helped that the sterling has weakened by more than 10% since Brexit - and conversely the Japanese yen has strengthened, making the ARM acquisition much cheaper for Softbank.

But cheaper doesn't mean cheap - and many Softbank investors will be wondering how long it will take for Mr Son to turn this gamble into returns for shareholders.

"It's really about the investment horizon," says Mr Einstein. "Is the Internet of Things going to happen in the next year? No. But the next 10, 20 or 30? Much more likely."

Mr Son is known to have an eye for potentially transformative industries and trends. He was an early investor in Alibaba and saw the potential in e-commerce before anyone else did. Shareholders in Softbank will be hoping that this pricey punt will pay off.

- Published18 July 2016

- Published16 February 2016