Flights and fuel push everyday prices 0.5% higher

- Published

Inflation is rising but not by enough for central banks, says the BBC's Andy Verity

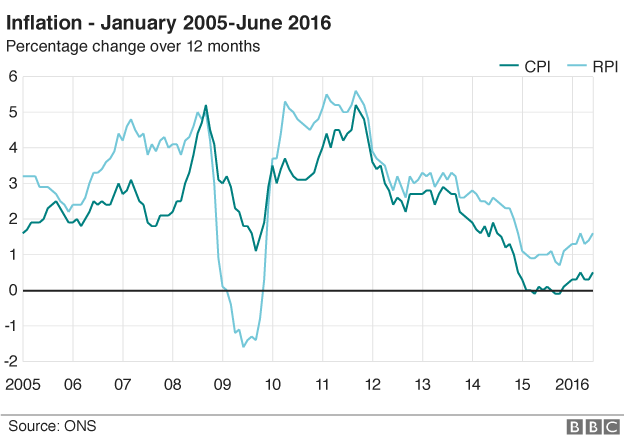

The average cost of everyday household goods and services went up by 0.5% in the year to June.

The UK inflation rate, as measured by the Consumer Prices Index (CPI), rose from 0.3% in May, official figures show.

The Office for National Statistics (ONS) attributed the rise to higher air fares, fuel and consumer spending.

Much of that was the result of European air travel, possibly connected to the Euro 2016 football tournament, it said.

The inflation figures are based on data collected before the EU referendum vote on 23 June.

The cost of flights jumped by a record 10.9% between May and June, ONS statistician Phil Gooding said.

What is CPI?

Essentially a very large 'shopping basket' full of goods and services on which people typically spend their money: "from bread to ready-made meals, from the cost of a cinema seat to the price of a pint at the local pub, from a holiday in Spain to the cost of a bicycle".

In total, more than 700 household goods and services are measured, external, to assess if they are generally rising or falling in price.

Prices are measured every month in 20,000 shops at 150 locations throughout the country.

Some 180,000 separate price quotations are used each month to compile the final figure.

"The growing cost of oil, feeding through to petrol prices, also helped to nudge up CPI," he added.

City analysts expect inflation to rise sharply in the coming months as the fall in the pound relative to other currencies following the Brexit vote makes goods imported into the UK more expensive.

The 0.5% annual increase in CPI matches that in March this year. It was last higher in November 2014.

But this measurement of the cost of living has remained well below the Bank of England's 2% target for more than two years.

5% inflation?

The weaker pound has also raised expectations that the Bank of England will look to cut interest rates in August to combat a possible slowdown in economic growth, as increased costs feed into the wider economy and impact on consumer spending and confidence.

The Bank will release its quarterly inflation forecasts next month, which are expected to include an analysis of the impact of the UK's vote to leave the EU.

But the cut in interest rates could be short-lived, as some economists have forecast inflation could peak as high as 5% next year.

That might force the Bank to raise interest rates sharply in order to bring inflation back under control.

Earlier this month Bank of England governor Mark Carney, giving evidence to the Treasury select committee, warned that homeowners should be prepared for a 3% rise in interest rates.

Chris Williamson, chief economist at IHS Markit, said the rise in inflation was "likely to be the start of a rising trend in prices as costs march higher in response to the recent slump in sterling."

He added inflation was likely to rise further in coming months as the impact of sterling's depreciation feeds through, "breaching the Bank of England 2% target next year, possibly by some margin".

However, policymakers are expected to 'look through' any rise in inflation caused by the Brexit-related slump in the pound, focusing instead on the job of shoring up economic growth, he said.

- Published14 July 2016

- Published15 July 2016

- Published14 July 2016