Singapore seizes $177m as part of Malaysia corruption probe

- Published

Singapore plans to take "firm regulatory actions" against four major banks over their dealings with scandal-ridden Malaysian state fund 1MDB.

1MDB is at the centre of a global corruption investigation.

The local units of Standard Chartered and UBS, Southeast Asia's biggest lender DBS and Falcon Bank were all found to have "lapses and weaknesses in anti-money laundering controls".

Standard Chartered, DBS and UBS said they were cooperating with authorities.

Falcon Bank was not immediately available for comment.

Malaysia 'to co-operate' with 1MDB probe

The US v The Wolf of Wall Street

The case that's riveted Malaysia

Singapore prosecutors have also seized $177m (£134m) in assets linked to 1MDB, half of which belong to a Malaysian financier facing many of the fraud allegations.

The US government said on Wednesday that $3.5bn was "misappropriated" from 1MDB and that "the Malaysian people were defrauded on an enormous scale".

US prosecutors are now looking to seize $1bn in assets linked to 1MDB, which includes plush properties in New York and Los Angeles and a private jet.

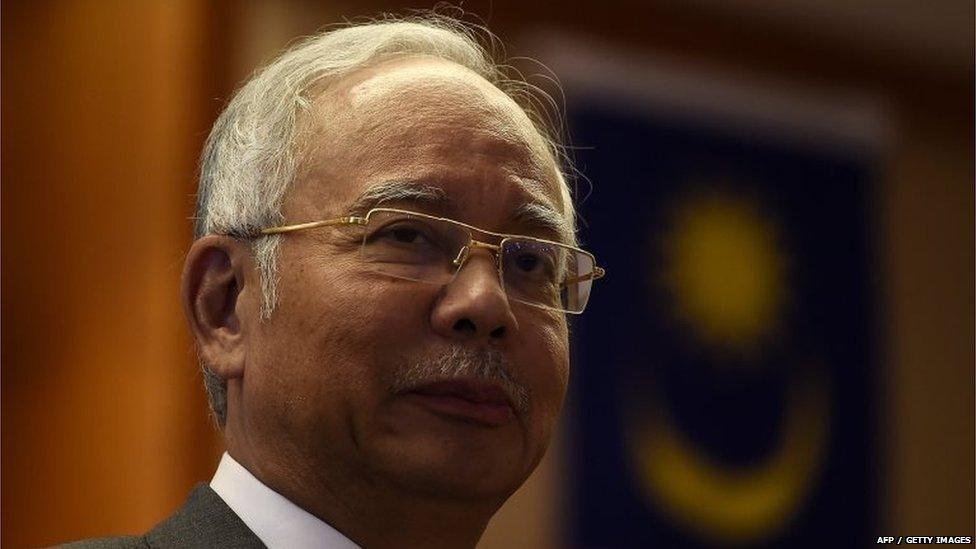

Mr Najib and 1MDB have consistently denied any wrongdoing.

Complex web

Singapore is one of several global authorities investigating alleged fraud at 1MDB, which was set up by Malaysian Prime Minister Najib Razak in 2009.

The country's financial regulator said in a statement on Thursday investigations into 1MDB began in March 2015.

"They revealed extensive layering of transactions and subterfuge aimed at disguising the nature of certain activities and fund flows," the Monetary Authority of Singapore (MAS) said.

"In some instances, shell or unauthorised companies domiciled in various jurisdictions were used to conceal the true beneficiaries of the funds."

"Standard Chartered takes financial crime compliance very seriously," a spokesperson told the BBC.

"We have strengthened our anti-money laundering controls and processes and will continue to play an active role in the fight against financial crime."

"Egregious financial crime is highly sophisticated and intentionally designed to evade systems and controls," a DBS spokesperson said. "We take our anti-money laundering obligations seriously".

UBS also said it was constantly enhancing its anti-money laundering processes.

"In this case, UBS self-reported the suspicious transactions and is working closely with regulators to address this matter," a spokesperson for the bank told the BBC.

"Serious breaches"

Singapore is trying to maintain its reputation as a corruption-free international finance and banking hub and is taking a stern stance towards any illicit fund flows.

Swiss bank BSI was kicked out of the city in May for "serious breaches" of Singapore's anti-money laundering rules in its business dealings with 1MDB.

Switzerland has since launched a criminal investigation into the private bank.

Certain financial institutions were "used as conduits" for a "complex international web of transactions," MAS said on Thursday.

A local money changer and remittance agent that had "weak management oversight" is also facing potential penalties.

Out of the four banks identified, MAS said Falcon Private Bank had "substantial breaches" of its anti-money laundering laws, including a failure to report suspicious transactions.

However, MAS said the oversight and management of certain key client relationships were done out of the bank's head office in Switzerland.

- Published21 July 2016

- Published21 July 2016

- Published22 July 2016