1MDB: The United States v The Wolf of Wall Street

- Published

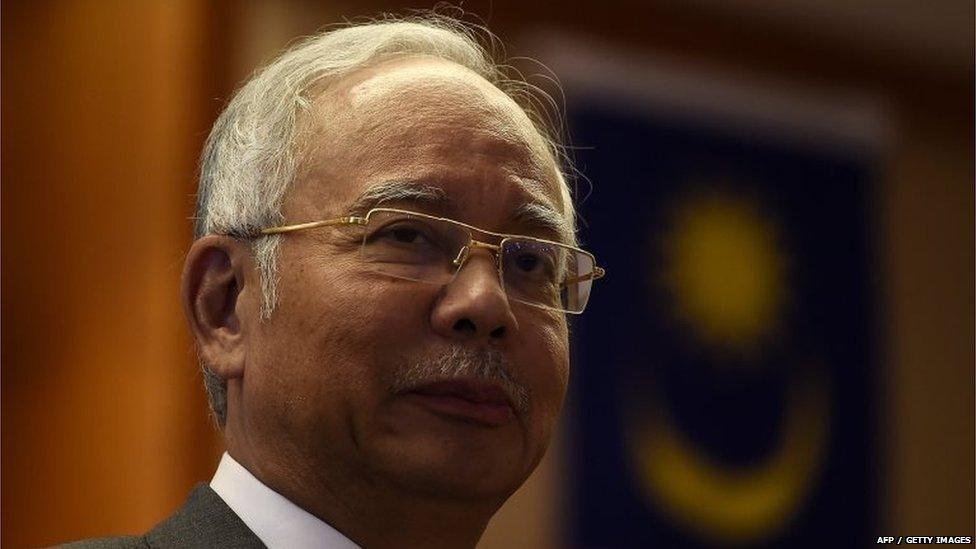

Loretta Lynch did not explain why Malaysia's prime minister was not named in the legal case

There is a scene in the 2013 Hollywood smash hit The Wolf of Wall Street where Leonardo DiCaprio, playing corrupt stock trader Jordan Belfort, is chatting with his mentor Mark Hanna, portrayed by Matthew McConnaughey. Hanna explains to him how to cheat clients of their money.

Mark Hanna: "The name of the game, moving the money from the client's pocket to your pocket."

Jordan Belfort: "But if you can make your clients money at the same time it's advantageous to everyone, correct?"

Mark Hanna: "No."

Going through the 136 page court filing from the US Department of Justice,, external which has filed a civil lawsuit against the makers of the Wolf of Wall Street, you wouldn't be blamed for thinking you were reading the script for a sequel.

The allegations are damning.

The FBI Deputy Director Andrew McCabe says that the "Malaysian people were defrauded on an enormous scale".

The lawsuits allege that public money stolen from the Malaysian state fund 1MDB - which was set up by the Prime Minister Najib Razak in 2009 - was used to buy a laundry list of expensive properties, and even finance the Wolf of Wall Street movie.

It alleges that among the things bought by the money were:

L'Ermitage hotel property and business

Park Lane Hotel assets in New York

Four California properties

Four New York properties

One London property

A private jet

EMI assets, including royalties

Van Gogh painting

Two Monet paintings

Red Granite, the production firm that made the Wolf of Wall Street, says none of the funding it received was illegitimate.

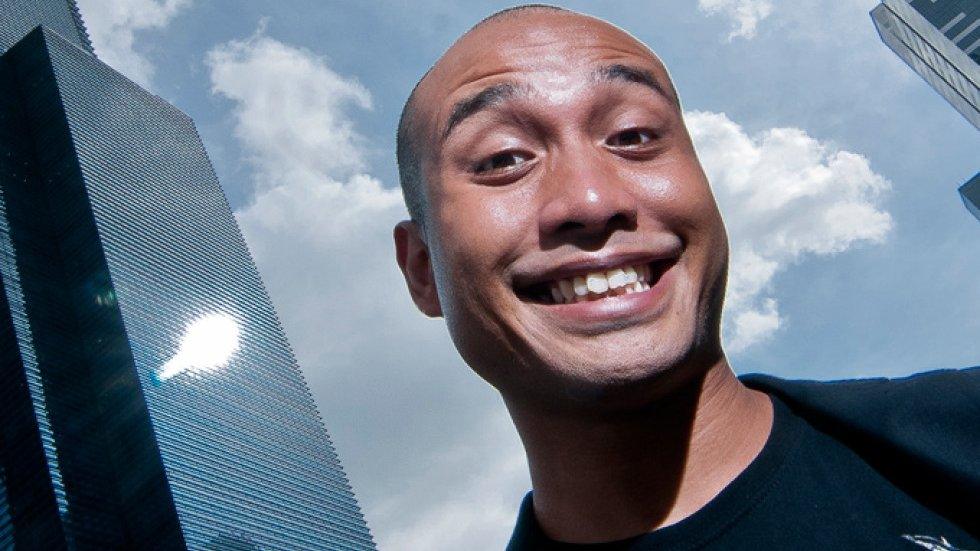

One of the co-founders of the firm is Riza Aziz, Mr Najib's stepson, who has been named as a relevant individual in the court filing.

The prime minister has always denied corruption allegations and has been cleared by Malaysian authorities

The Malaysian leader has not been named directly in the filing but documents clearly identify him as a high ranking Malaysian official only called "Malaysian official 1" - someone whose account has allegedly received huge sums of money.

When questioned why the US didn't name Mr Najib directly, US Attorney General Loretta Lynch refused to explain, but there is speculation that diplomatic considerations were taken into account. Muslim-majority Malaysia is a key ally of the United States in its war against Islamic militancy.

The suit neither provides evidence nor even alleges that Mr Najib spent any of the money himself, but it does say that the funds were taken from 1MDB and used for the personal benefit of public officials, their relatives and associates, and was not returned.

The fund was set up in 2009 to help develop Malaysia's economy. It has been mired in controversy and debt and is widely considered a financial failure.

When I spoke to the fund's CEO, Arul Kanda, in October last year, he told me "the value of assets outweigh the value of debt."

The US move failed to make the first editions of Malaysian papers on Thursday

But 1MDB had to sell some of its most prized assets in order to realise this value, and as one Malaysian opposition leader put it to me at the time, any business that has to do that isn't a successful business.

1MDB's financial mismanagement and the allegations of misconduct by the prime minister has raised concern amongst the foreign investment community that Malaysia's economy is in for a rough ride.

But there are bigger worries than just the financial performance of 1MDB. At the heart of it is the suggestion that Malaysia's public money has been stolen and used for personal gain.

Political analysts say Mr Najib is unlikely to see any blowback from the US move because the court filing doesn't name him directly and because his position within the ruling party in Malaysia is secure.

A quick glance through the main Malaysian newspapers and their websites on Thursday morning shows little or no mention of arguably the most important news story for the country this year.

"We see the how difficult it is for the media to cover and raise these issues publicly," Michael Vatiokiotis, a long time observer of Malaysian politics, told me. "And also we see the weakness of the opposition to raise anything like this in parliament because the government can consistently say the PM has been cleared."

The fund was meant to turn Malaysia is a global banking hub

But some opposition members are speaking out.

Tony Pua of the Democratic Alliance Party has reportedly said, external: "The shit has hit the fan now."

Don't expect protests on the streets of Malaysia though, or for the opposition parties to mobilise in a effective and co-ordinated way.

"There's a sedition law and a new national security act that are going to make it more difficult for the opposition to campaign openly," says Mr Vatikiotis, "So for now, more or less Najib is safe, politically."

And for the most part, that appears to be true. In recent months, the gossip around Mr Najib's involvement in 1MDB has been muted. Many Malaysians I've spoken to are resigned. That fatigue has effectively got Mr Najib off the hook.

Until now.

In another scene from The Wolf of Wall Street, Jordan Belfort is seen lamenting his situation: "I clean up my act, I did rehab, I'm a TV personality, I'm sober for two years, and THIS happens?"

Truth is often stranger than fiction. And one wonders what Mr Najib might make of those words as he wades through the US court filing this morning.

- Published21 July 2016

- Published4 July 2016

- Published26 January 2016

- Published27 January 2016

- Published1 February 2016

- Published1 October 2015