How the interest rate cut affects you

- Published

After almost endless speculation, the Bank of England has announced a cut in interest rates to 0.25%. So, how will the move affect you?

Generally, a Bank rate cut is regarded as good for borrowers - particularly those with a mortgage - and bad for savers.

Millions of people in the UK fall into both categories, so what aspects of the family budget do they need to review?

Mortgages

A mortgage is by far the biggest debt taken on by the majority of households in the UK.

An estimated 11.1 million households have one. The typical amount still left to pay on each home loan in the UK is £116,000, according to the Council for Mortgage Lenders.

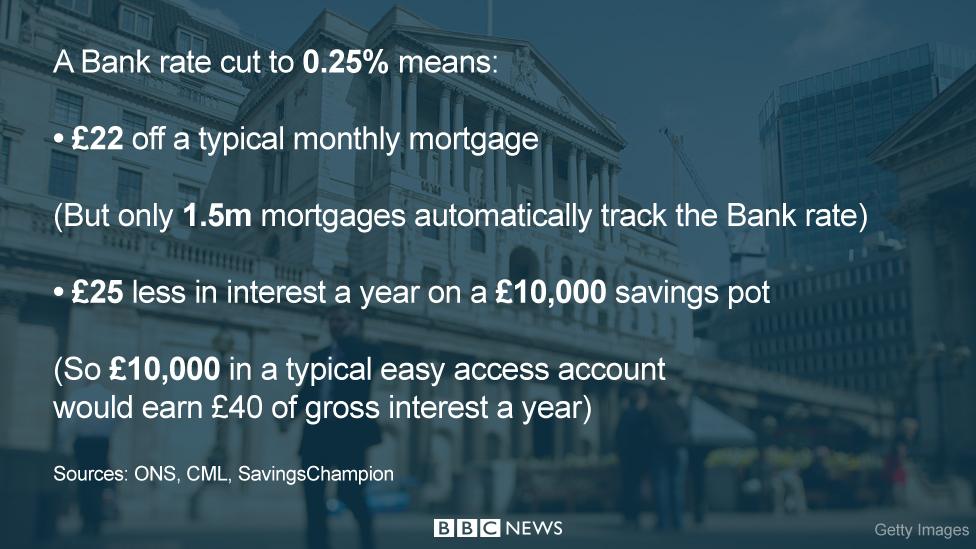

Using Office for National Statistics (ONS) house price data, a cut to 0.25% means a £22 monthly reduction in the bill for a variable 25-year repayment mortgage on a typically priced home of £211,000 having taken a 20% deposit into account.

So that is a £22 cut on a monthly mortgage bill of about £779.

Key to when this saving is made - if at all - depends on the kind of mortgage that people have.

Those who will see an immediate benefit are those on Bank rate tracker mortgages - in other words, home loans with an interest rate that goes up or down in direct relation to the Bank of England's decision.

One in five mortgage holders have this type of loan.

Approaching a third of mortgage holders (29%) have home loans that are on the standard variable rate - the default option after a fixed term has run its course.

They will be in the hands of the lender. Some mortgage providers may pass on the cut in full, some may decide on a partial cut, others may make no change at all given the historical low levels on interest rates.

A handful of banks quickly announced that they would pass the cut on in full from September, with others expected to follow suit. A separate scheme announced by the Bank - called the Term Funding Scheme - is designed to ensure that banks pass on the rate cut.

In fact, Bank governor Mark Carney said banks had "no excuse" not to pass on the cut to households.

Finally, there are those on fixed rate mortgages - equating to nearly half (46%) of all mortgage holders.

They will see no change. However, if their mortgage term is up soon, they may find they pay less if and when they sign up to a new one. Fixed mortgage rates on new deals have been falling - even when there was no change to the Bank rate.

An increasing number of people have signed up to longer term fixed rate deals - locking them in for up to 10 years. For them, this change is fairly irrelevant.

Savings

The theory of a Bank rate cut is that consumers see a cut in their mortgage bill, and a worsening return on their savings, so they go out and spend. Hence, there is a boost to the economy. The same is basically true for businesses who will be more minded to invest.

That is the relatively simplistic explanation but it does make it clear that a Bank rate cut is bad for savers.

At the moment, the average interest rate on an easy access savings account is 0.65%. If that average mirrors a change in the Bank rate, this will drop to 0.4%.

So, for anyone with £10,000 saved in such an account, they will receive £40 a year in gross interest, which is £25 less than before the cut.

Rates have been fairly pitiful for years, and even those locking in their savings for five years are only getting an average of 1.97% in interest.

One thing to consider is that a cut is not automatic.

In fact, providers have not waited for a Bank rate change to cut the returns they offer.

"It look like rates have taken a hammering in the last week, and the base rate had not even changed," said Susan Hannums, of SavingsChampion.co.uk.

"Many savings accounts could not even suffer a quarter point cut. With almost a third of easy access accounts currently paying 0.25% or less, savers need to act now to better their returns."

For every savings rate that has been increased in 2016, around nine have been cut, according to data from financial information service Moneyfacts.

About three-quarters of bank current accounts do not pay interest at all.

Pensions

The Bank of England also added further stimulus measures to the rate cut - namely, the purchase of government and corporate bonds.

This will have no effect on the state pension.

It will, however, add extra pressure on the deficits facing defined benefit pension schemes, such as final-salary pensions, putting increased pressure on businesses to plug that gap or reduce the availability of such pensions.

Those who are buying an annuity, a retirement income for life, from their defined contribution pension pot may also now get a worse deal.

"The decision to reduce interest rates could add insult to injury for pension savers already reeling from the Brexit vote," said AJ Bell senior analyst Tom Selby.

"Insurers use government gilt yields to price annuities, so a cut in the base rate puts further downward pressure on UK gilt yields and, in turn, annuity prices."

The flipside is that share prices have been driven up by the Bank's decision. That means those still paying into a private pension - and, indeed, investors in general - will see a boost in the value of these investments.

Pensions and other investments are, of course, a long-term project so the long-term health of the economy is arguably the most important element to consider.

Holiday money

The decision by the Bank of England has led to an immediate fall in the value of the pound.

Although this remains higher than its lowest point of recent weeks, it may mean UK holidaymakers get a bit less for their money when buying foreign currency than they did earlier this week.

- Published1 August 2016

- Published2 August 2016

- Published22 July 2016

- Published15 July 2016