BHS store closures: Filling the gaps on the High Street

- Published

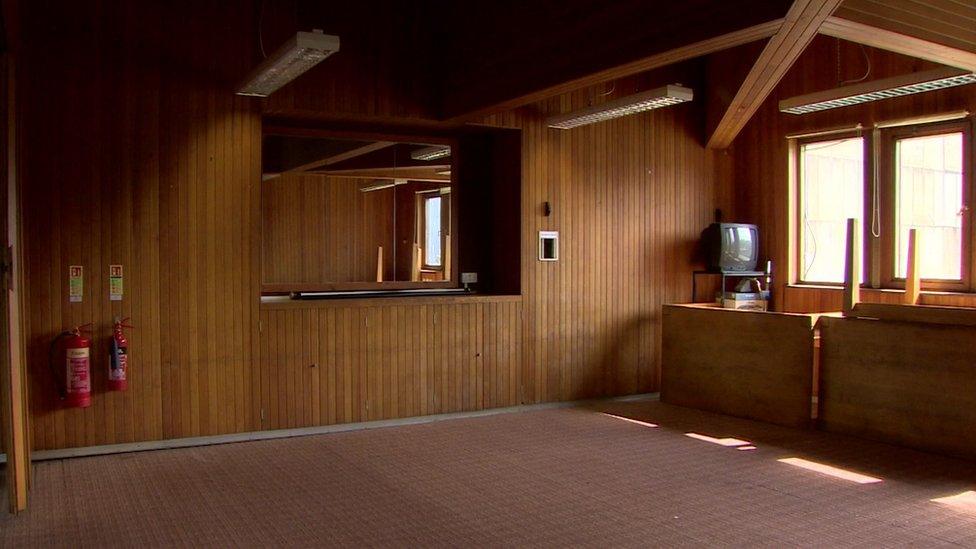

A tour inside a BHS "ghost store" in Edinburgh

The last BHS stores will close this weekend, bringing to an end nearly 90 years of British retail history. BBC business correspondent Emma Simpson looks at what the closures will mean for our High Streets.

They don't come much bigger than the BHS store on Edinburgh's Princes Street.

Its three huge trading floors now lie eerily empty apart from the odd piece of furniture and signs.

"It's an unusual building... as there weren't many purpose-built stores of that era [the 1960s]. A lot of what you can see was put here in the 1960s and that's very unusual - even the escalators [and] the lifts date back to that period," says Steve Spray from LaSalle Investment Management.

The company is leading the development of this 120,000 sq ft site on behalf of the owner.

As well as the three floors for retail, there are more floors above, including a huge rest area for staff still decked out with the original brown carpets and wooden panelling.

The original 1960s design is still in place

"This space was used as a staff refectory, management offices, staff welfare facilities - it's something of a time warp," adds Mr Spray.

"Of the five storeys of this building BHS only ever traded on three. The building was designed to be that way. It reflects a day when stores held a lot more stock on premises than they do now. They definitely don't make them like this any more."

Human scale

We then came across the old locker room tucked away off one of the corridors. It has row after row of empty metal cupboards, a stark reminder of the jobs lost.

"This is a measure of the human scale of what's happened to BHS," says Mr Spray.

"There are 250 lockers in here, which reflects the number of people employed in this store at one time. It was the heyday. I suspect that number of people probably haven't been employed here for a while, but the fact that they once were is amazing."

Thousands of jobs have been lost across the country as a result of the demise of BHS

It is hard to believe this building has been underused for so long. It's a prime spot on Edinburgh's main shopping centre with incredible views of its famous castle and old town. And Mr Spray's company wants to make the most of it.

It hopes to attract another retailer to open a new flagship store, and has plans for a 140-bed hotel and a rooftop restaurant.

"This is a great development opportunity which doesn't exist in many of the other BHS stores," says Mr Spray.

"Nobody would've wanted the set of circumstances that led to BHS failing. But luckily for us this is the right building in the right place... to deliver something really world class for Edinburgh."

The new developer's plans include building a rooftop restaurant

But what will happen to the other 162 stores dotted across the UK?

'Challenging' future

BHS had some of the biggest stores on our High Streets - buildings that have been starved of investment.

This portfolio of real estate is a real mixed bag. Many of the stores, including the Princes Street one, are riddled with asbestos that will cost landlords many millions of pounds to bring up to scratch.

According to Matthew Hopkinson, founder of the Local Data Company, which tracks the health of our High Streets, some BHS stores will be easier to re-let than others.

The last BHS stores will close their doors for the final time this weekend

"There will be some landlords who will be delighted BHS has gone because it was a tired, old brand and they can bring in someone new and vibrant and it will be part of their overall strategy. But you also have a large number of stores in weaker towns, some of which are likely to remain empty for many years to come.

"The real issue lies in whether they will ever be reoccupied. To do so will require finding retailers who are willing to move into that space, which may be the wrong size and format. But also you have to factor in a landlord that is willing and able to invest vast sums as some of the stores are in a real state of disrepair. It's going to be quite challenging."

The collapse of BHS has been the biggest retail failure on our High Streets since Woolworths in 2009. Woolies had hundreds more stores than BHS and today the overwhelming majority of them have been let, thanks to the likes of Poundland and Iceland.

There may be fewer BHS stores, but the gaps left behind will be far bigger and trickier to fill. It will also be a barometer for how much demand there is for new space in the current economic climate and fast-changing retail landscape.

- Published2 August 2016

- Published25 July 2016

- Published15 June 2016

- Published2 June 2016

- Published2 June 2016

- Published2 June 2016

- Published25 April 2016