Business confidence is back in Brazil - but will it last?

- Published

Opening new stores during a recession requires bravery and faith.

Last year about 100,000 shops shut down across Brazil as the country's economic crisis reached new depths.

And there are no clear signs that the recession will be over in the near future, with the economy still shrinking rapidly and unemployment still on the rise.

Yet for Flavio Rocha, who leads Riachuelo, one of the country's biggest fashion retailers, confidence in the future of Brazil's economy is back for good.

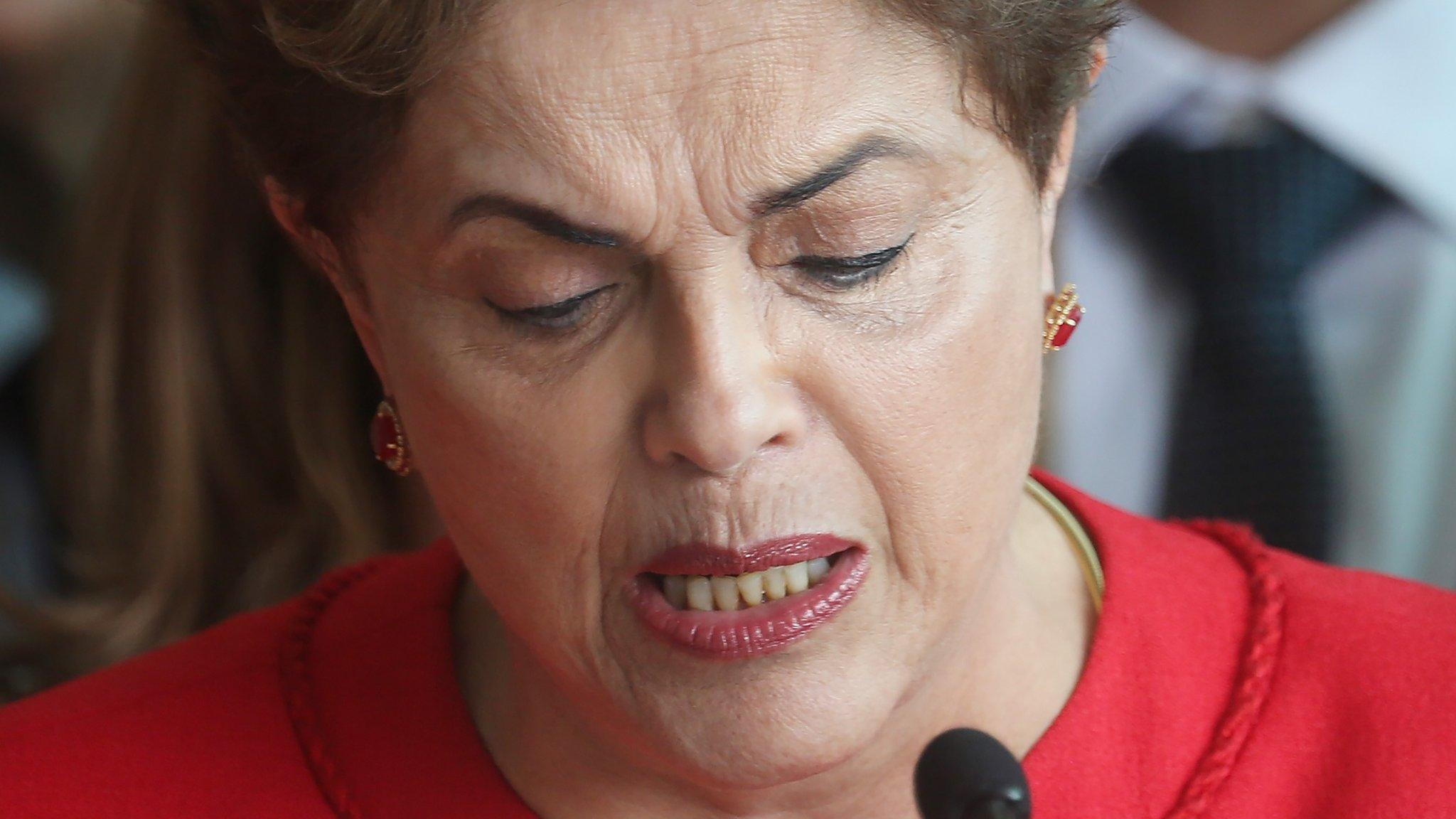

The main reason, according to him, is the impeachment of former President Dilma Rousseff.

"It is not just a change in government. It is the start of a new era, of a new project for Brazil," he says, as his company prepares to start expanding its network of shops next year.

Rocha believes Brazil's recession is V-shaped - with the steep downfall about to be followed by a sharp rebound.

Flavio Rocha believes it is "the start of a new era" for Brazil

"Up until now, the state was the protagonist of Brazilian growth. Now it is private investors who will lead the change, and the private sector is much quicker in reacting to changes."

'Adrift'

Rocha is not the only one to believe this.

A few weeks before the impeachment trial, an industry survey of more than 3,000 leaders suggested that for the first time since March 2014 the majority of businesses had an optimistic view about the outlook for the Brazilian economy.

Markets have shown a similar reaction.

Since February, when Ms Rousseff's impeachment began to look more likely as she started losing a grip on her allies, Brazil's currency gained 24% in value and markets soared 37%.

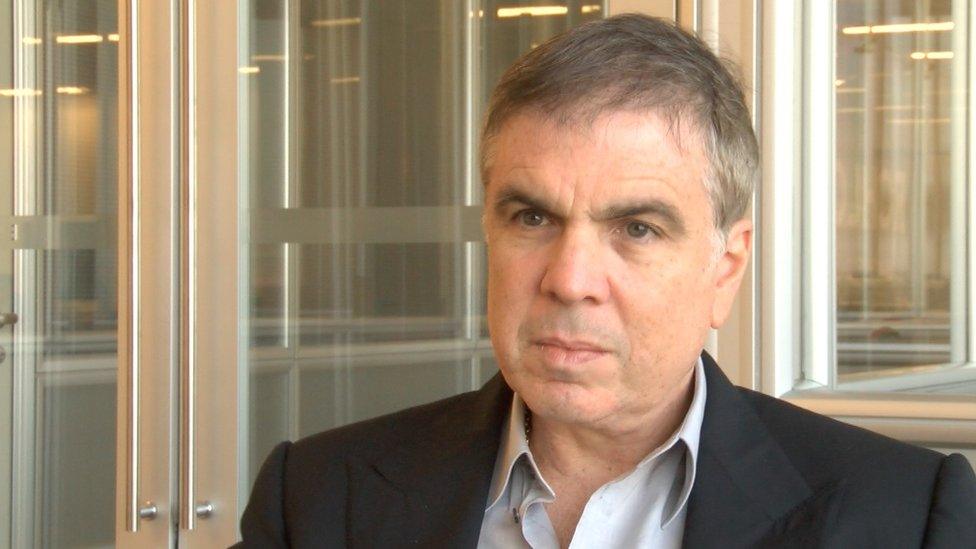

Paulo Skaf, the leader of Brazil's powerful industry association Fiesp, acknowledges that nothing has yet changed fundamentally in the economy, but he says a return of investment confidence is often the first sign of economic recovery.

Paulo Skaf has confidence in the potential of Brazil's economy

Since the beginning of the year, Fiesp - which represents 130,000 companies - has openly led a campaign defending the impeachment proceedings. Skaf is a member of PMDB, the party of Michel Temer, who came to power as a result of Ms Rousseff's impeachment.

"No-one has any doubts about the potential of the Brazilian economy. What was in doubt was the government's ability. President Rousseff had lost control of the economy and politics, and Brazil felt like a boat that was adrift," says Skaf.

Unimpressed

But despite some believing that the outlook will improve, many investors remain unimpressed, especially abroad.

The fundamental budget and debt problems that have undermined the economy are likely to continue next year, as Mr Temer - who has already been running the country for the past three months - is yet to approve any of the promised reforms.

One of the biggest criticisms levelled at the government is overspending - it spends 10% more money than it collects in taxes.

Businesses at home and international investors will be watching to see if Michel Temer can deliver his reforms

Politics may again delay some key decisions on reforms, as Brazil is about to hold local elections in 5,568 cities in October.

MPs and senators will not want to approve unpopular measures at the risk of their parties paying the price in the local elections.

Investors and businesses are looking at two major reforms that are likely to be voted on this year.

The first one limits Brazil's budget increases according to the inflation rate of the previous year. The second one is a pension reform that would increase the age of retirement.

Crunch time

Moody's, the last of the major credit ratings agency to downgrade Brazil's bonds to junk, says Ms Rousseff's impeachment removed an element of political uncertainty that had been weighing on the economy for months, but that her removal offers "no guarantees" that Mr Temer will be able to find a consensus in Congress to approve his reforms.

"While the proposals have had a positive impact on business confidence, a tangible improvement in Brazil's fiscal accounts has yet to materialise," says Moody's.

As one international investor put it, the honeymoon between Mr Temer and the markets was over as soon as he was confirmed as Brazil's president.

Now it is time for him to prove he can deliver on his promises

- Published8 April 2018

- Published31 August 2016