Executive pay to be investigated by MPs

- Published

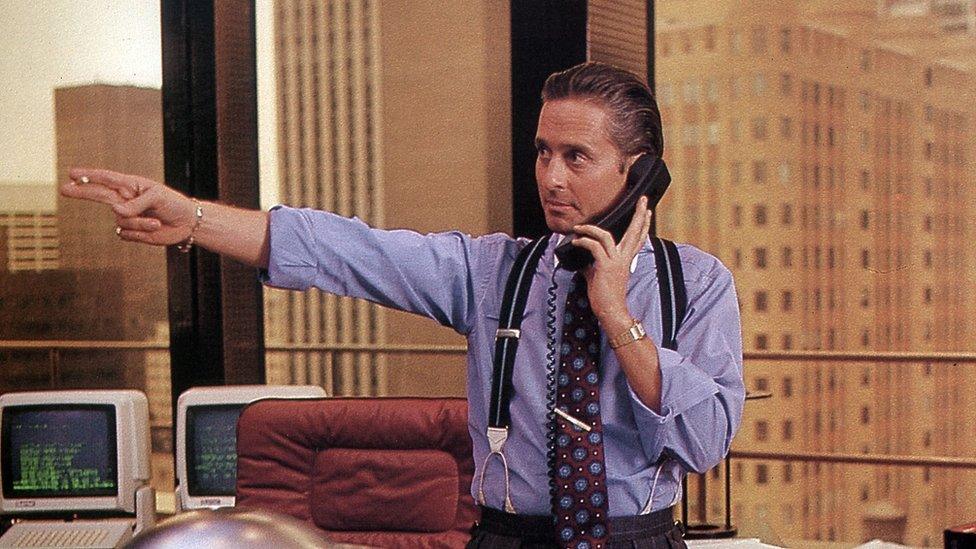

BP shareholders objected to chief executive Bob Dudley's pay packet earlier in the year

MPs have launched an inquiry into corporate governance, focusing on executive pay, worker representation in the boardroom and the lack of women in senior positions.

The Business, Innovation and Skills Committee has recently held inquiries into BHS and Sports Direct.

The investment arm of insurer Legal and General has also warned Britain's top companies to curb executive pay.

It said that significant shareholder opposition "should not be ignored".

Companies should take note if more than 20% of shareholders voted against a pay deal, Legal and General said.

It comes after the Prime Minister recently pledged to overhaul the way businesses are run.

Committee chair Iain Wright said the parliamentary inquiry needed to look "at the laws that govern business and how they are enforced".

Value for money

BP, WPP and Smith and Nephew have been among the big companies where investors have revolted against boardroom pay.

In April, 59% of BP shareholders voted against a 20% pay rise for chief executive Bob Dudley, worth £14m.

However, that vote was not binding and Mr Dudley received the rise despite BP's falling profits.

Under current rules shareholder votes are only binding every three years and, at BP, the next binding vote is in 2017.

Earlier this year, WPP chief executive Sir Martin Sorrell was forced to defend his pay package, worth up to £70m.

He said his pay was based on the performance of WPP, the world's largest advertising group.

Investors are increasingly unhappy over excessive pay

On Friday, Legal and General Investment Management, (LGIM) which manages £853bn in assets wrote to Britain's top 350 firms warning that they must take note of the increasing unease about large bonuses and pay.

LGIM wrote that it would like to "encourage" firms to reduce short-term annual bonuses.

It said they should consider the wider impact when awarding executive pay, including the effect on the workforce and public perception as well as taking into account the economic climate.

In 2013, amid growing investor unhappiness over excessive pay, the government gave shareholders a binding vote every three years on a firm's pay policy.

LGIM has timed its letter to influence firms as they plan new policies to run from 2017.

Greater control

MPs will look at the factors which have led to a steep rise in executive pay over the past 30 years in comparison with the salaries of more junior employees.

Mr Wright said: "We on the committee are also keen to explore the issue of ever growing pay increases to executives, especially when there often seems to be very little connection with company performance or any pay rises to the vast majority of employees.

"While there has been some recent shareholder actions against these ever larger pay packages, can we have any confidence that the current framework for controlling pay is working?

"As a committee, we will want to look at whether executive pay should take account of companies' long-term performance and whether the government should intervene further to control executive pay".

The High Pay Centre thinktank released a study in August which showed that on average chief executives were paid 140 times more than their employees.

It also found no women were in the top 10 highest paid chief executives.

The committee wants to hear what barriers are preventing women achieving senior executive positions.

Sports Direct founder Mike Ashley

Prime Minister Theresa May has said she wants shareholders to have the power to veto executive pay every year, and wants companies to publish figures showing the difference between the average worker's salary and that of the chief executive.

She also wants employees to sit on the committee that oversees how much bosses are paid.

The committee will look at how this would work and wants to consider how greater diversity of board membership could be achieved.

Last week, Sports Direct said it would put work representatives on the board after it came under fire for its treatment of its workers at its troubled Shirebrook warehouse.

TUC general secretary Frances O'Grady said: "Poor corporate governance contributes not only to high profile corporate disasters such as BHS, but also to short-termism and excessive executive pay across much of the private sector.

"This inquiry is important and timely and the TUC welcomes the opportunity to contribute to the committee's discussions."

- Published11 September 2016

- Published8 August 2016

- Published20 July 2016