Millions have less than £100 in savings, study finds

- Published

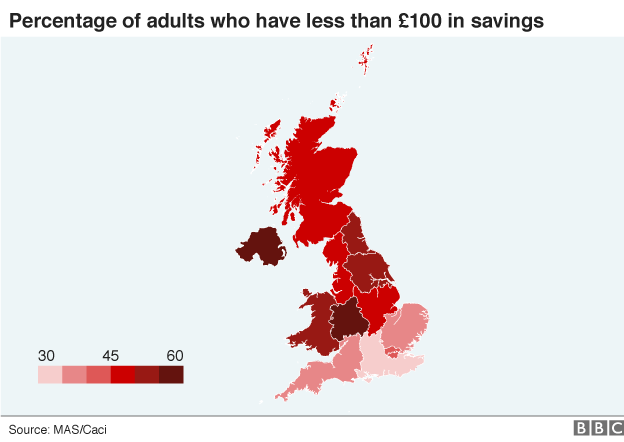

More than 16m people in the UK have savings of less than £100, a study by the Money Advice Service (MAS) has found.

In five areas of the country, more than half the adult population has savings below that level.

Those areas are Northern Ireland, the West Midlands, Yorkshire and Humber, North East England and Wales.

The MAS said the findings were worrying and presented a particular challenge for low earners.

"These figures show the millions put at risk by the saving gaps in the UK," said Nick Hill, money expert at the service.

"For some on low incomes, saving is a real challenge as they may simply lack the income needed to save at all."

The research was carried out for MAS by the consumer data company CACI which has a database of 48m UK adults.

However, the research also showed that some people on low incomes do save money.

Roughly a quarter of adults with household incomes below £13,500 have more than £1,000 in savings.

And 40% of people in that income bracket manage to save something every month.

Martyn Alonzo : How I learnt to save

Martyn Alonzo is 53 and from the West Midlands. He earns £13,000 a year delivering stationery and installing furniture.

Six months ago he was not managing to save anything.

"I just seemed to be working to eat and survive," he says. "I couldn't get any money behind me."

But after getting involved with a Money Advice Service project to learn about saving, he has now managed to save £800.

He and his in-laws now pool their shopping bills by cooking for four people rather than two.

"I'll buy a packet of mince for £3, and make two meals out of it: lasagne and spaghetti bolognaise. I'm totally de-stressed with it all."

The MAS says saving small amounts, external on a regular basis is achievable for most people.

"Regular saving is key to building up that buffer against those life surprises," said Mr Hill.

"If you earn enough to set even a little aside each month that's great - a direct debit into a savings account might be an easy way to do this, even if you start small and increase the amount with time."

Since April, basic-rate taxpayers have been allowed to earn up to £1,000 a year in a savings account, and pay no income tax.

The Personal Savings Allowance, external, as it is known, is £500 a year for higher-rate taxpayers, while there is no allowance for those paying the top rate of tax.