Australia Kidman bid: Gina Rinehart and Shanghai CRED make new offer

- Published

Grass fattened cattle in Kidman's Naryilco property in Queensland

Australia's richest woman Gina Rinehart has teamed up with a Chinese company to bid for the country's largest private landholding, the Kidman estate.

The A$365m ($276.8m, £222.8m) offer would see Rinehart's Hancock Prospecting hold 67%, with the rest held by Chinese firm Shanghai CRED.

The bid hopes to overcome government concerns about foreign investment.

Previous Chinese-led bids were blocked by the government, which cited national security concerns.

Treasurer Scott Morrison said the sale of Kidman's vast holdings to Chinese buyers was not in the national interest., external

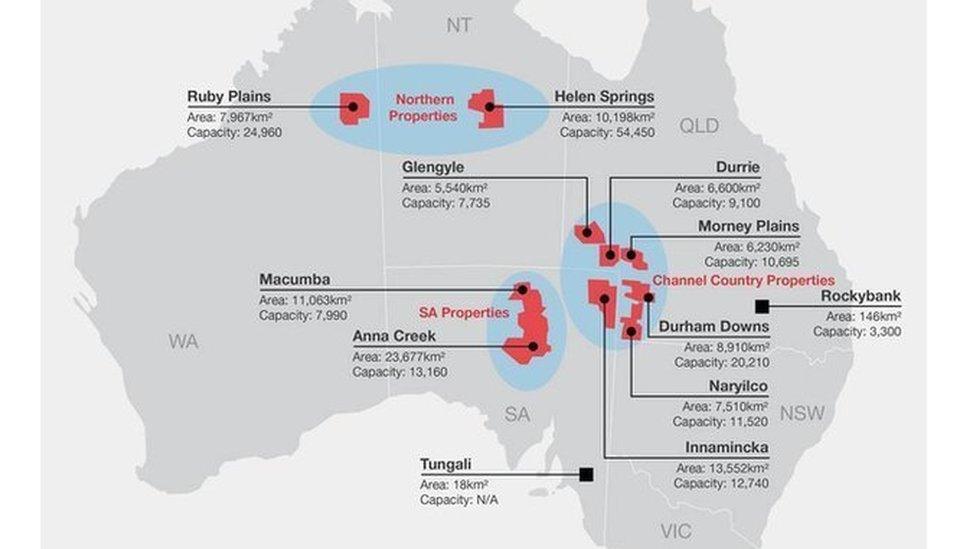

The landholding - with its 10 cattle ranches, a bull breeding stud and a feed lot covering 101,411 square kilometres (39,155 square miles) in four states - encompasses about 1.3% of the Australian continent, about the same size as South Korea.

The Anna Creek farm has been taken out of the sale

But it also contains the world's largest cattle station, Anna Creek. Australia's Foreign Investment Review Board said it was concerned part of that property was inside a military weapons testing range in South Australia.

Kidman has since taken Anna Creek farm out of the sale.

The new offer, led by Ms Rinehart, will also need regulatory approval.

Agriculture Minister Barnaby Joyce said he welcomed the interest by the Australia-led consortium.

"I'm always enthusiastic when ... a majority Australian company is buying Australian land," he old Australian Broadcasting Corporation.

"Most Australians prefer it if a large Australian asset is majority owned by Australians as opposed to majority owned by foreigners."

Kidman was founded in 1899 and with Anna Creek accounts for about 2.5% of the country's agricultural land. It is currently 33.9% foreign-owned.

The company's chairman John Crosby welcomed the "significant investment proposed in addition to the purchase price and (we) are confident that the Kidman business will be in good hands".

- Published19 August 2016

- Published20 November 2015

- Published19 November 2015