Who's afraid of the falling pound?

- Published

The pound has fallen dramatically since the Brexit vote at the end of June.

OK, investors have been known to overreact to dramatic events and sell too hard and too fast but regardless, the lower level of sterling is having a widespread impact across many aspects of our lives - and it looks like it's here to stay.

Get used to the new low.

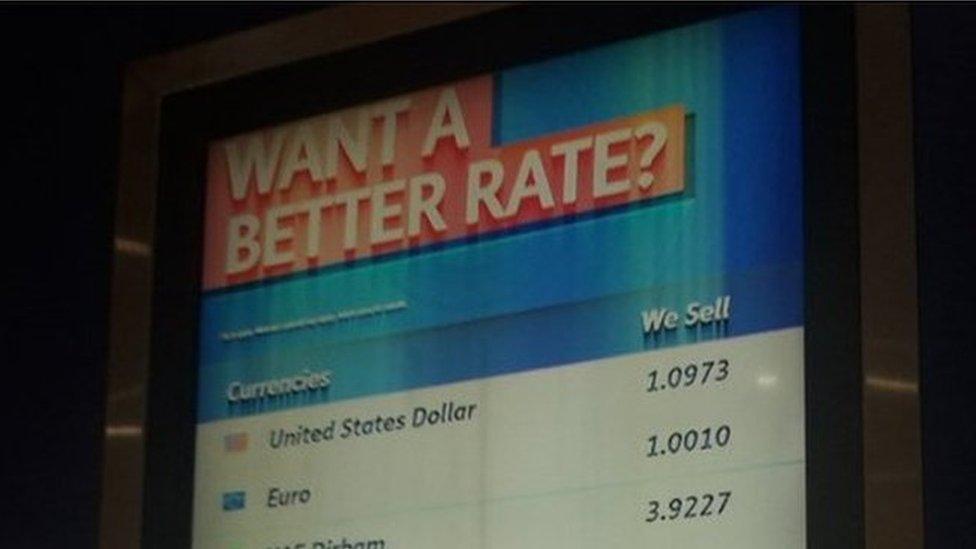

I was reading that the pound now buys less than €1 in some places, last year I was getting €1.35. If I don't eat out on holiday, will I avoid the worst effects?

If you're holidaying in Europe, you will see just about everything rise in price. Hotel, apartment and even Airbnb owners all price in euros, and it takes 25% more of your pound now to buy a euro or anything priced in euros, so the roof over your head will cost more. You could camp, but unless you're wild camping, you will have to pay more in pounds for your campsite fees.

And whether you eat in expensive restaurants or picnic, you'll pay more for your food. Going to the US? That's not as bad, but you'll still feel a hit. The pound has lost about 15% against the dollar since last year, so you'll only be paying 15% more for everything.

I'm not going abroad on holiday, I'm having a staycation - what does it mean for me?

Filling up is getting more expensive

Good for you. You won't be facing such a shock every time you work out what a bill costs in "real" money.

But if you're driving, the price of petrol is already creeping up, because oil is priced in dollars, and as the pound is at its lowest level in 31 years against the dollar, more of your pounds are needed to buy each dollar than before Brexit. The Petrol Retailers' Association says it is expecting a litre of fuel to cost 5p more by the end of the month. And as for food...

In that case, I'll just take a short drive to the shops. Is that safe?

A fiver is still a fiver - although since this new one was issued it has lost value on the international markets

Retailers have been flat-out in competition for many years - particularly the supermarkets. That's hardly likely to change. But we do buy a lot of our foodstuffs from abroad, meaning our pound will go less far in that area as well.

Same but more so for clothing, where almost all of what we buy is produced overseas. Indeed, Sports Direct, for one, has already warned that its profits will be dented by £15m to account for the fall in the pound alone, as its goods are more expensive to buy. That could lead it to raise its prices to rebuild its profits. And household goods, such as washing machines, are already up in price.

If it's more expensive for us to go abroad, it must be cheaper for foreign visitors to come here - will tourism in the UK get a boost?

It's all cheaper for foreign visitors now - including investors

I'm reminded of the Sex Pistols here, "Cheap holidays in other people's misery". The answer is yes. Numbers visiting the UK and the amount they spend has already risen. After all, if it's 25% more expensive for us to visit them, we're 20% cheaper. Bargain. Anything made in this country, including holidays, is now cheaper. Expect exports to increase, too, while the pound stays low.

Share prices have hit record highs, so it looks like a low pound is good for companies in general. Is that right?

Shares in UK companies priced in pounds are now cheaper on the international market, in a sense. Many of the major 100 companies earn most of their money overseas, in foreign currency. That gets translated back into pounds.

The stronger dollar, say, buys more pounds than last year so profits are suddenly higher, and the share price rises to match those prospects. As a result, the FTSE 100 has hit a new intraday record high.

That's great if you hold UK shares and want to spend that money in the UK. As long as it stays in the country, its value is as good as it was.

Economists are saying the pound was overvalued anyway, so did Brexit just give the market a wake-up call?

There are economists who point out that the UK was running a deficit - a gap between imports and exports - of 7% of gross domestic product. Some say this is because an overvalued pound allowed us to buy more than we as a country should be able to afford.

The upside of a weaker pound is not only that it makes our products cheaper abroad: just as for tourists coming here, business investors could also find bargains and want to invest.

Of course, set against that is the fact that the rules that will govern business post-Brexit are utterly unclear. Will we have tariff-free access to the EU? Will we use World Trade Organization tariffs? And will we abide by EU law-governing regulations? No-one knows, and business may like to know before committing precious funds.

- Published10 October 2016

- Published5 October 2016

- Published4 October 2016

- Published8 October 2016

- Published3 October 2016