Self-employed 'now earning less than in 1995'

- Published

Self-employed workers such as hairdressers have seen their wages squeezed in recent years

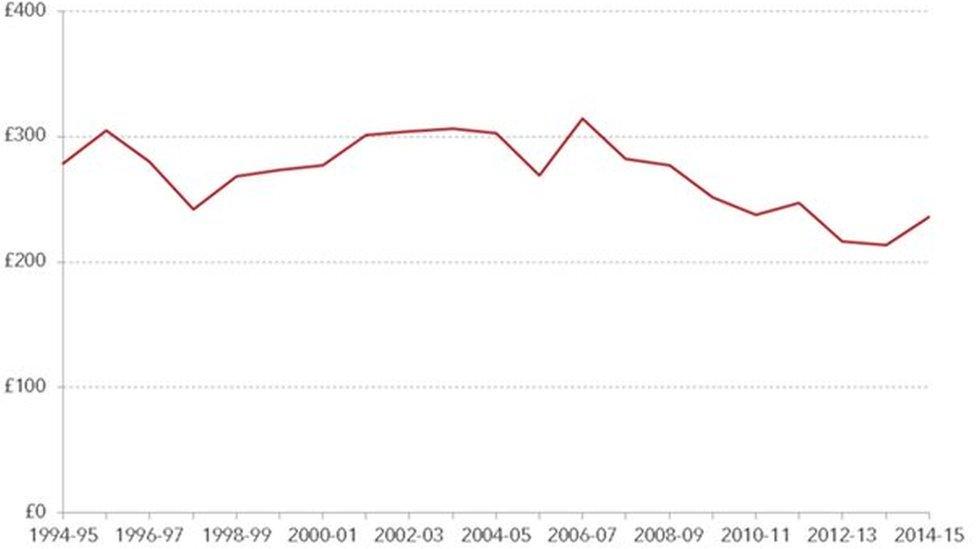

Average wages for self-employed workers are lower than in 1994-95, researchers say.

The Resolution Foundation said that while the UK's self-employed workforce had grown by 45% since 2001-02, their weekly earnings had fallen by £60.

It blamed the rise of lower paid jobs and the financial crisis, which had reduced pay rates.

The report comes as a ruling on a closely watched case on pay for self-employed drivers for Uber is expected.

Adam Corlett, economic analyst at the Resolution Foundation, said that almost five million UK workers were self-employed - about one in seven workers and a record high.

They included construction workers, hairdressers, taxi drivers, tutors and IT consultants, he said.

"But while the self-employed workforce is getting bigger, typical earnings are actually lower than they were 20 years ago," Mr Corlett said.

The Resolution Foundation says typical wages for the self-employed have tumbled since the financial crisis

According to the research, average self-employed wages were £240 a week in the 2014-15 financial year - the most recent period for which data is available - down from about £300 a week in 1994-95.

The Resolution Foundation - a think tank that aims to improve pay for families - partly blamed the changing nature of the self-employed workforce.

The foundation said that many more people had taken up lower-paid jobs in the so-called "gig economy", essentially self-employed workers taking on a variety of different roles, while the proportion of self-employed business owners with their own staff had fallen. The number of hours worked by the self-employed had also declined.

It said this had limited wage growth before the financial crash, but that pay had been "squeezed" in real terms after 2006-7, falling £100 a week by 2013-14.

"While returns may have increased slightly in 2014-15, many workers are still feeling the painful effects of the financial crisis," Mr Corlett said.

Uber has been accused by two drivers of not paying holiday or sick pay

"With so many self-employed workers earning so little, it is right the government investigate how public policy should catch up to meet the needs of these workers."

TUC general secretary Frances O'Grady said: "Britain's new generation of self-employed workers are not all the budding entrepreneurs ministers like to talk about.

"While some choose self-employment, many are forced into it because there is no alternative work. Self-employment today too often means low pay and fewer rights at work."

A Department for Business spokesperson said the government was "committed to building an economy that works for everyone".

"While the National Living Wage has given one million workers a pay rise, the Prime Minister has made clear the labour market must support and protect all workers," they said.

"That is why she has asked Matthew Taylor to lead a review of how changing employment practices affect job security, workplace rights and opportunities for progression."

Uber ruling

Some companies have recently been accused of taking advantage of self-employed staff.

Taxi app firm Uber is awaiting the outcome of a employment tribunal after two of its drivers claimed it was acting unlawfully by not paying holiday or sick pay.

Takeaway delivery firm Deliveroo faced protests in August after saying it would pay drivers per delivery, rather than per hour

The US company says it has 40,000 drivers in the UK, so the result could have a significant impact on its costs.

Meanwhile, takeaway delivery firm Deliveroo faced protests in August after saying it would pay its self-employed drivers per delivery, rather than on an hourly basis.

The firm, which was also criticised by the Department for Business, soon backtracked and made the scheme optional.

- Published28 October 2016

- Published14 August 2016

- Published20 July 2016