UK economy grows 0.5% in three months after Brexit vote

- Published

- comments

Phillip Hammond described the UK economy as "resilient"

The UK's service sector helped the economy to grow faster than expected in the three months after the Brexit vote, official figures have indicated.

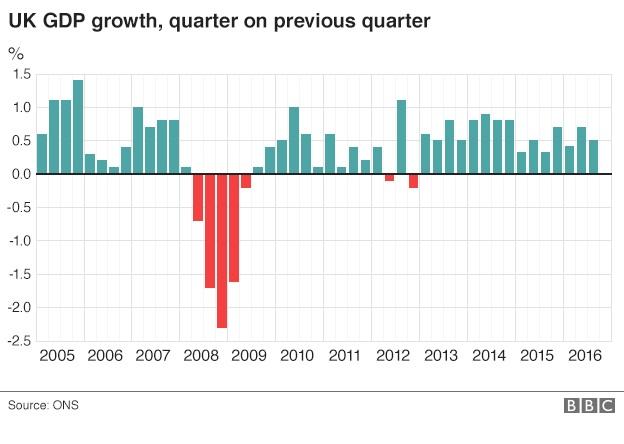

The economy expanded by 0.5% in the July-to-September period, according to the Office for National Statistics.

That was slower than the 0.7% rate in the previous quarter, but stronger than analysts' estimates of about 0.3%.

"There is little evidence of a pronounced effect in the immediate aftermath of the vote," the ONS said.

The stronger than expected growth will further dampen expectations that the Bank of England's Monetary Policy Committee will cut interest rates next week.

Analysis: Jonty Bloom, business correspondent

The economy has slowed slightly but by nothing like as much as feared and the Office for National Statistics says that "the pattern of growth continues to be broadly unaffected following the EU referendum".

That pattern is however a rather unbalanced one, the only sector of the economy that continued to grow was services up by 0.8%; agriculture, manufacturing production and construction all shrank.

Brexit supporters will take these figures as a sign that warnings about the economic costs of voting to leave the EU were nothing more than scaremongering. Remain supporters will argue that they were warning about potential damage over a period of several years. They say that only prompt action by the Bank of England saved deeper damage to the economy and that worse is to come.

Welcoming the figures, the Chancellor of the Exchequer, Phillip Hammond said: "The fundamentals of the UK economy are strong and today's data show that the economy is resilient."

However, Labour's Shadow Treasury Minister, Jonathan Reynolds said: "Continued disappointing, sluggish growth shows the failures of the Tories' economic approach after six years in power, especially for the manufacturing sector which shows little sign of benefiting from lower sterling.

Dominant services

The economy was boosted by a particularly strong performance from the services sector, which grew by 0.8% in the quarter.

Transport, storage and communication was the strongest part of the service sector, growing by 2.2%. That was the fastest pace since 2009 and was helped by a healthy quarter for the UK's film industry. The latest films in the Jason Bourne and Star Trek franchises were released in July along with other popular productions, lifting takings at box offices.

Ask Andy: What is GDP?

ONS chief economist Jo Grice said "A strong performance in the dominant services industries continued to offset further falls in construction, while manufacturing continued to be broadly flat."

This is the first estimate of economic growth for the period, using less than half the data that will be used for the final estimate.

While growth in the services sector was robust, the construction sector contracted by 1.4% and industrial production fell 0.4%, with manufacturing output down 1%.

"In manufacturing, the contraction in output should be attributed to some unwinding of the massive growth spike seen in the second quarter, rather than industry scaling back production for any referendum related reasons," said Lee Hopley, chief economist at the EEF, the manufacturers' organisation.

"In line with the raft of survey data the GDP estimates confirm that it has been more or less business as usual but it doesn't tell us, however, if this will continue for the foreseeable future."

'Resilient'

No in-depth breakdown of consumer spending was released in this set of figures, but Howard Archer, UK economist at IHS Global Insight, said: "It looks certain that third-quarter growth was also heavily dependent on consumers' willingness to keep spending, supported by still decent purchasing power and high employment.

"Consumer spending also clearly benefited from the weakened pound encouraging spending by overseas visitors to the UK. The weakened pound also supported foreign orders for UK goods and services."

However, the "resilient" post-referendum performance does not say anything about the UK's ability to perform outside of the EU, said Berenberg's senior UK economist, Kallum Pickering.

"Today's data does not alter our long-term view that Brexit will lower UK trend growth, to around 1.8% from 2.2% per year, via less trade, migration and investment with its major market, the EU," he added.

- Published28 October 2016

- Published27 October 2016