Premium Bonds: Ernie celebrates his diamond anniversary

- Published

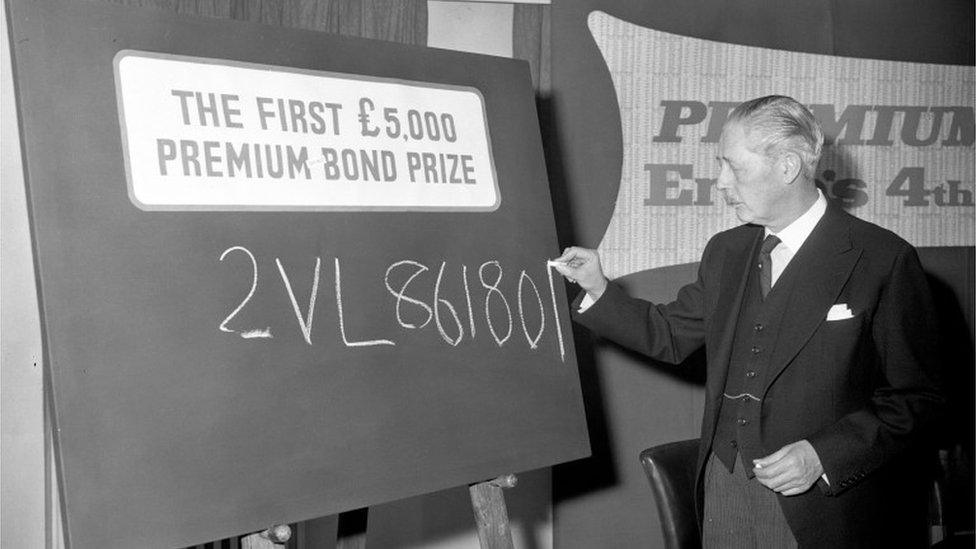

Prime Minister Harold Macmillan writing the number of a £5,000 Premium Bond draw

It was an initiative to encourage post-World War Two Britons to save more. And, 60 years on, the idea remains essentially the same.

The Premium Bond celebrated its diamond anniversary on Tuesday.

Amid countless savings and investment schemes that have come and gone, the state-backed scheme remains hugely popular - especially in this era of low interest rates, when returns are small.

With savings accounts paying so little, Premium Bonds at least offer a little excitement that you could win something, says Danny Cox, a financial expert at Hargreaves Lansdown. And the prizes are tax-free.

That said, critics argue that as most people win nothing, they are a poor investment.

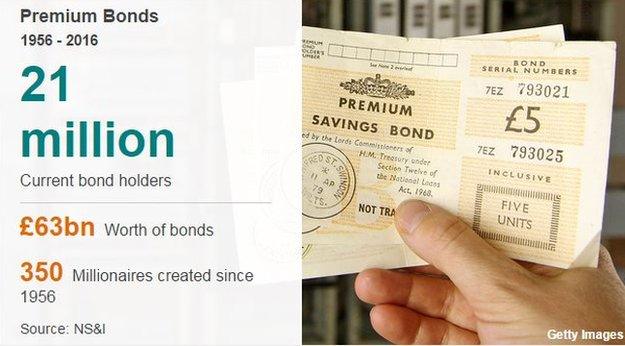

But the statistics point to a lasting popularity. Today, more than 21 million customers hold more than £63bn worth of Premium Bonds.

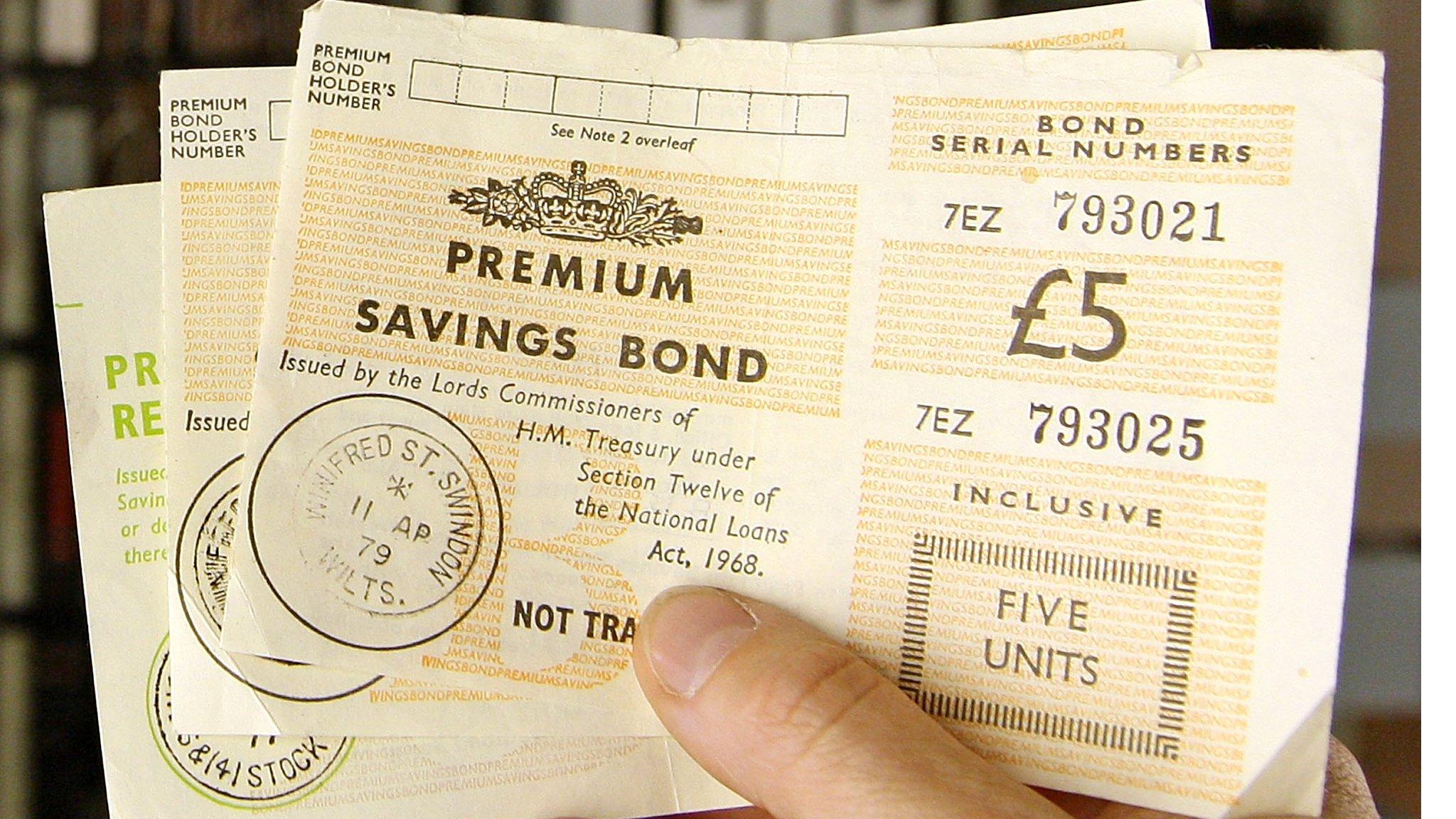

They are held on average for 25 years, and 41,000 bonds that were sold in November 1956 are still eligible for the monthly prize draw.

But there seem to be plenty of people who have lost or forgotten about them. Figures published on Tuesday by National Savings & Investments (NS&I) revealed that there are £54m worth of unclaimed prizes.

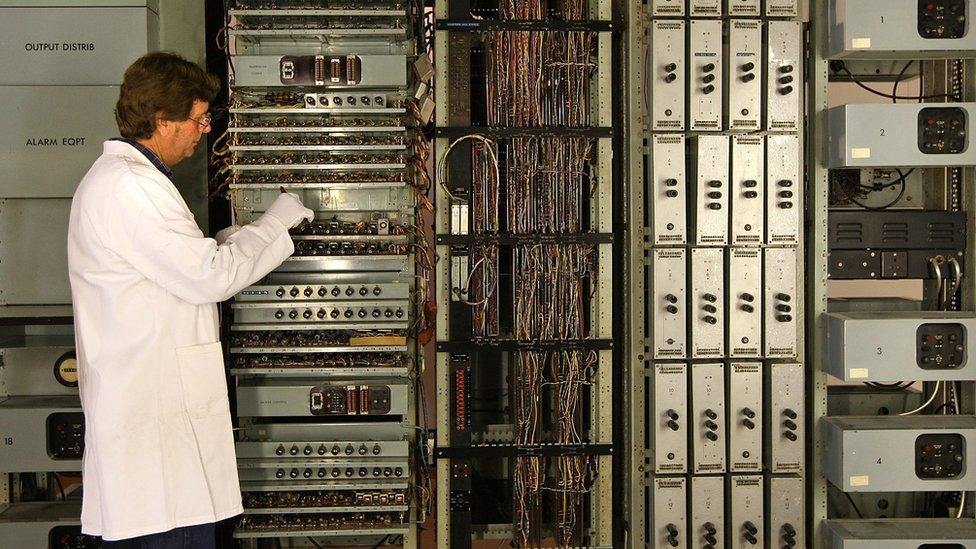

The first Premium Bond number generator, ERNIE 1, was invented by Cold War code breakers

The bonds now have a special place in British financial life, Jill Waters, director of retail at NS&I, told BBC Radio 5 live.

"Over the last 60 years, Premium Bonds have become a part of the fabric of British life, with almost a third of Britons now holding the product.

"When they were first introduced in 1956, they changed how the nation saved and, over time, have increasingly become a part of many savers' portfolio," she said.

The savings product was launched by Prime Minister Harold MacMillan on 17 April 1956 and first went on sale on 1 November 1956.

As well as providing an alternative way to save, the hope was that it would also help reduce inflation.

Sir Cuthbert Ackroyd, the Lord Mayor of London, bought the first one for £1. By the end of that first day, £5m worth had been sold.

Back then the biggest prize was £1,000. Now it is £1m, with the smallest prize £25.

Today, they remain the UK's single most popular savings product, and as of 1 November 2016, there have been 350 Premium Bond millionaires.

Anyone aged 16 or over can buy Premium Bonds, with a minimum investment of £100 and a maximum of £50,000.

The bonds don't pay interest, but you don't lose your investment and they can be sold at any time. NS&I's Electronic Random Number Indicator Equipment - or Ernie - is the computer that generates Premium Bond numbers.

Invented by the legendary code breakers at Bletchley Park, there have now been four generations of Ernie.

Premium Bonds numbers generator Ernie through the years

Each model has become smaller and faster over the years, and NS&I says that if Ernie 1 were still in use today, it would take more than 100 days to complete a draw. Ernie 4 can do it in five hours.

But its basic function has not changed since the original model: Ernie still generates numbers completely at random.

1956: An eventful year

British spies Guy Burgess and Donald Maclean resurface in the Soviet Union after being missing for five years

Double yellow lines to prohibit parking introduced in Slough

The Queen opens the world's first commercial nuclear power station at Calder Hall

Possession of heroin becomes fully criminalised

Egyptian leader Gamal Abdel Nasser announces the nationalisation of the Suez Canal

The RAF retires its last Lancaster bomber

PG Tips launches its long-running ITV advertising campaign using a chimpanzees' tea party

Every bond number, whether it has eight, nine, 10 or 11 digits, has a separate and equal chance of winning a prize.

And just to be sure, every month the Government Actuary's Department checks to ensure Ernie's output is indeed random.

The odds of winning for each £1 bond number are 30,000-1. The odds had been 26,000-1, but last June the NS&I cut the number of prizes.

Several myths surround Premium Bonds.

One is that Ernie is biased towards people in south-east England. But that is because there are more bonds bought there compared with the rest of the UK.

Another myth is that bonds with old numbers are left out. Not true. As more than 80% of bonds have been bought since 2000, newer numbers will inevitably have more chance of being chosen.

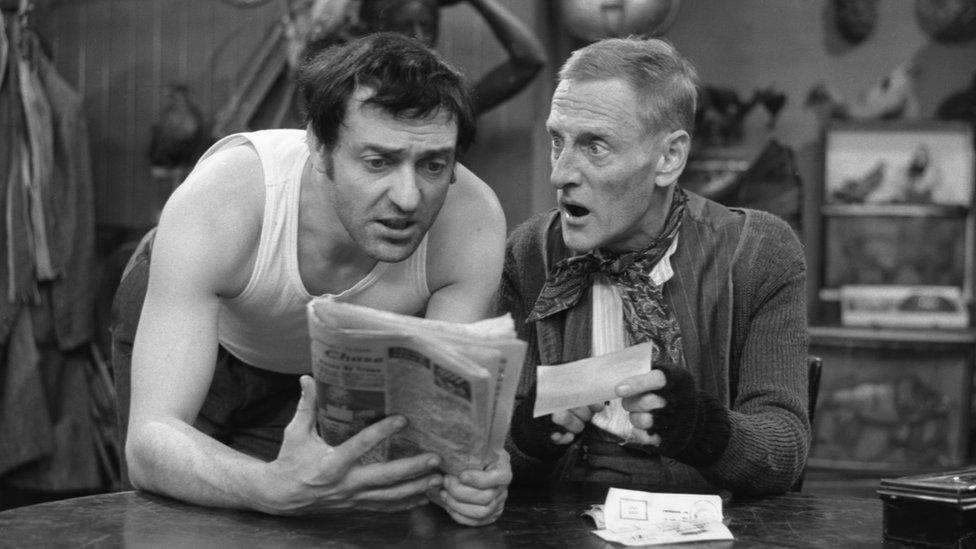

In the sitcom Steptoe & Son, Albert and his son Harold are divided over a £1,000 win

So are the bonds a wise investment for savers?

Axa Wealth investment adviser Adrian Lowcock told BBC Breakfast that he is sceptical. "Premium bonds are a poor investment, because the winnings are actually just skewed to a few individuals.

"The majority of people will win nothing, so the 1.25% average yield you get is actually not what people get - most people get nothing at all," he says.

But Hargreaves Lansdown's Danny Cox thinks they are a good choice for those not too concerned with making a return and beating inflation.

He says: "Premium Bonds are a national treasure. More people hold Premium Bonds than save into a cash Isa.

"With cash returns so poor, the potential for a tax-free prize compared to meagre or zero interest is more attractive - if your cash is paying nothing, at least with Premium Bonds you could win something."

Happy birthday Ernie. It looks like there will be plenty of anniversaries to come.

- Published1 November 2016