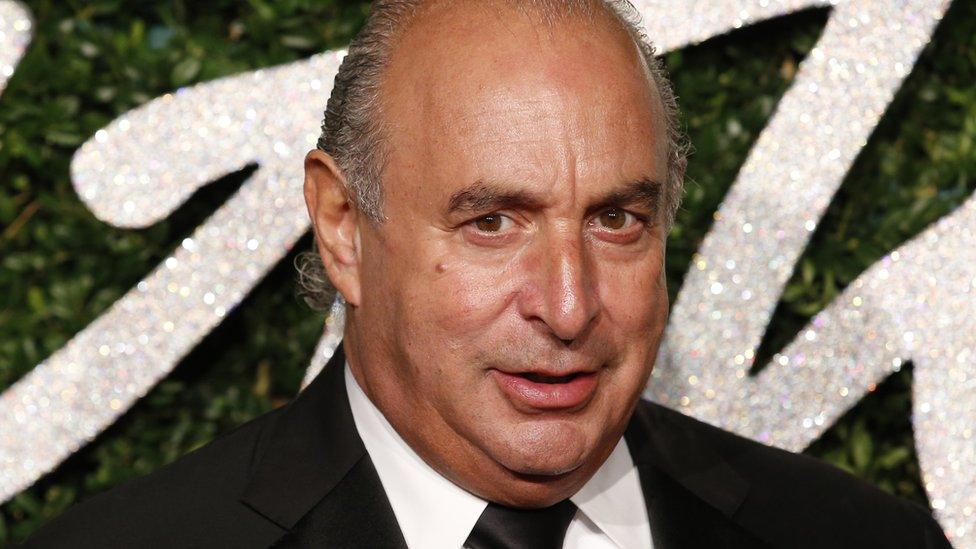

Philip Green's plan for BHS pension falls short by £100m

- Published

Sir Philip Green is offering £100m less than the Pension Regulator is seeking to plug a gap in the BHS pension scheme.

The BBC understands that the regulator wants £350m in redress from Sir Philip, who is offering £250m.

The regulator launched enforcement action against Sir Philip and other former owners of BHS after failing to agree a deal over pensions.

Sir Philip says he had presented "a credible and substantial proposal".

The regulator is looking for redress for BHS's 20,000 pension scheme members following an investigation into the matter.

It has sent warning notices to Sir Philip, his retail group, and Dominic Chappell, who was the owner when the department store chain collapsed.

The 300-page notices could see the billionaire being ordered to pay more towards the pension shortfall, which had swollen to nearly £600m by the time BHS went out of business.

"I have read the statement from the Pensions Regulator this evening and noted its contents," Sir Philip said.

His new proposal had evidence of "cash availability", could take the scheme out of the lifeboat Pension Protection Fund (PPF), and "achieve a better outcome for the BHS pensioners", he said.

"I have also spoken to the chairman of the [BHS pension] trustees who is supportive of the proposal on the basis that it provides members with better benefits than they would receive from the PPF," Sir Philip added.

'Lost patience'

MPs last month backed a call to strip Sir Philip of his knighthood for his role in the collapse of BHS, which closed just over a year after he sold it for £1 to Mr Chappell, a former racing car driver. The decision on his knighthood would have to be taken by the Honours Forfeiture Committee.

During months of talks Sir Philip has declined to publicly put a number on the level of financial support he would be willing to give the pension schemes.

Analysis: Simon Jack, BBC business editor

Four and a half months after Sir Philip Green said he'd "sort" the BHS pension deficit, the regulator has seemingly lost patience.

It has warned Sir Philip and brief owner Dominic Chappell it thinks there is a strong case for them to be forced to help plug the £600m hole in the scheme.

Sir Philip hit back saying he had tabled a substantial proposal that would provide a better result for the 20,000 members than the reduced benefits offered by the pensions lifeboat scheme and one that had the backing of the chairman of the BHS pension trustees.

The regulator said the door remained open for an improved offer but failing that, an independent panel would decide whether the evidence against Sir Philip and others is strong enough to force them to pay up and determine how much.

That panel will meet sometime next year. Any decision can be appealed against and even if Sir Philip is eventually forced to pay, it is likely any money will go to soften the hit to the Pension Protection Fund rather than directly to the BHS pensioners.

Lesley Titcomb, chief executive of the Pensions Regulator, said: "Our decision to launch enforcement action is an important milestone in our work to attain redress for the thousands of members of BHS schemes who have been placed in this position through no fault of their own."

Frank Field, who co-chaired a parliamentary inquiry into the collapse of BHS, said: "We are not surprised that the Pensions Regulator has, like all the rest of us, lost patience with Sir Philip Green's excuses and empty promises."

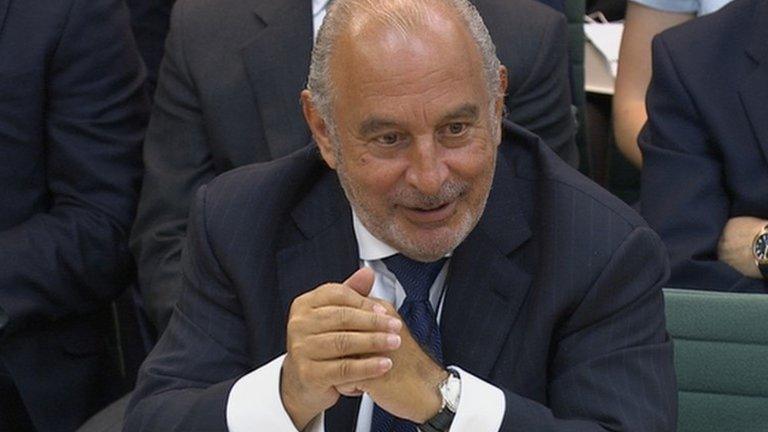

Iain Wright, the other chairman of the inquiry, said that five months after Sir Philip told MPs he would "sort out the pensions mess" he has put "no credible plan or cash on the table".

"We have seen stalling for time, lack of real progress in the negotiations and that's why the regulator has to do what it has done - understandable, regrettable, but I can perfectly understand what's been going on," he told the BBC.

Mr Wright also pointed out that while BHS stores have been closing, staff have been losing their jobs and worrying about their pensions "he takes ownership of his third yacht and spends his summer in the Med. That level of inequality really rankles with people".

'Enforcement action'

The Pensions Regulator opened an investigation into the BHS pension situation in March 2015.

It said it has now launched enforcement action after reviewing almost 100,000 documents and holding talks with various BHS stakeholders.

Sir Philip and the other recipients of the notices will have an opportunity to reply.

It could then be sent to an independent determinations panel, which can impose a financial order that the regulator and former owners must then agree.

Independent pensions expert John Ralfe said it was likely to be a very long process that could end up being dragged through the highest courts.

A separate case has been stuck at stage one - the enforcement notice - for three years, he told the BBC.

- Published3 November 2016

- Published20 October 2016

- Published18 October 2016