Bank sees sharp rise in inflation in 2017

- Published

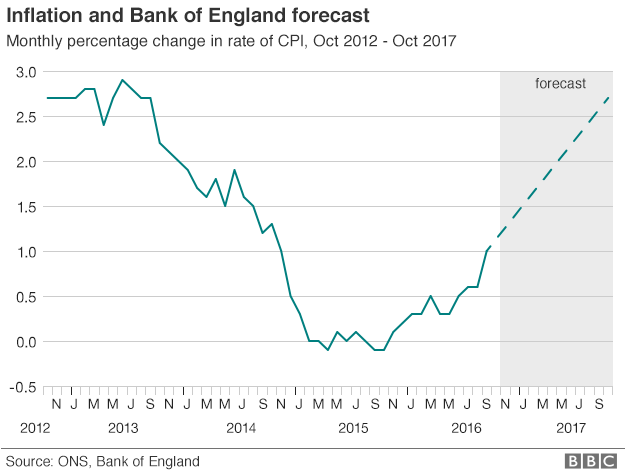

The Bank of England has made a dramatic rise to its inflation forecast for next year, predicting that the rate will almost triple.

The Bank now expects inflation to hit 2.7% next year, up from the current rate of 1%.

It also raised its forecast, external for economic growth next year to 1.4% from 0.8%, but cut expectations for 2018 to 1.5% from 1.8%.

An interest rate cut this year was no longer an option, the Bank indicated.

"In light of the developments of the past three months, all MPC [Monetary Policy Committee] members agreed that the guidance it had issued following its August meeting regarding the likelihood of a further cut in [the] bank rate had expired," the Bank said.

The sharp rise in inflation expectations was blamed on the slide in the pound since the referendum, which is driving up prices of imported goods.

The Bank does not expect inflation, external to return to its 2% target until 2020.

The revisions to growth indicate that the Bank now thinks the impact of the Brexit vote will be felt later than expected.

Analysis: Kamal Ahmed, economics editor

Inflation is an approaching risk and the economy is facing difficult times ahead, according to the Bank.

Yes, it has upgraded its growth forecasts markedly for this year and next.

But it has downgraded growth for 2018 as business investment and trading relationship uncertainty start to feed through to economic output.

That downgrade is so substantial that at the end of 2018, the Bank believes the economy will be on aggregate more than 2.5% smaller than expected before the Brexit referendum vote.

That's a bigger relative decrease in output than the Bank predicted earlier this year.

This is economic pain delayed, not cancelled.

Other forecasters see an even more dramatic rise in inflation. This week the National Institute for Economic and Social Research said it expected inflation to quadruple to about 4% in the second half of next year.

The think tank also warned that prices would "accelerate rapidly" during 2017 as the fall in sterling is passed on to consumers.

Households hit

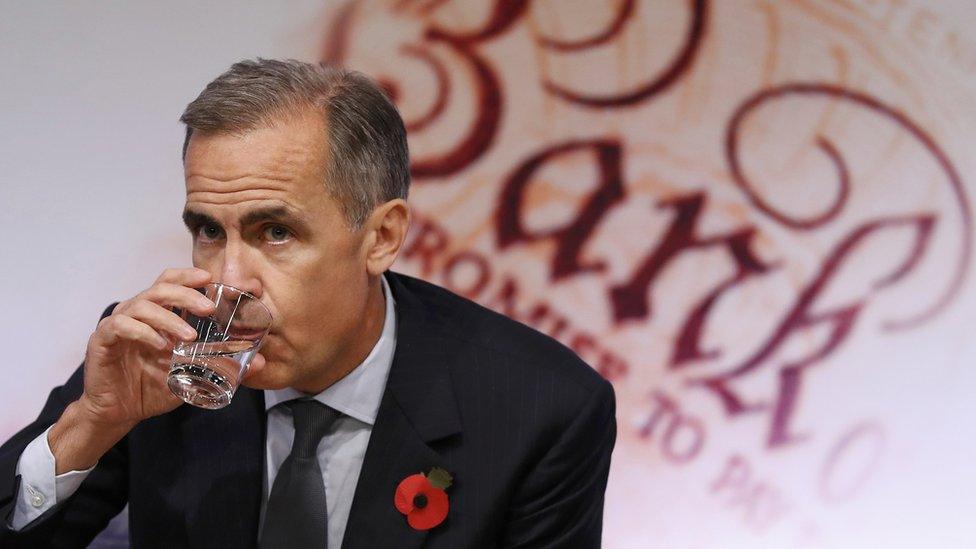

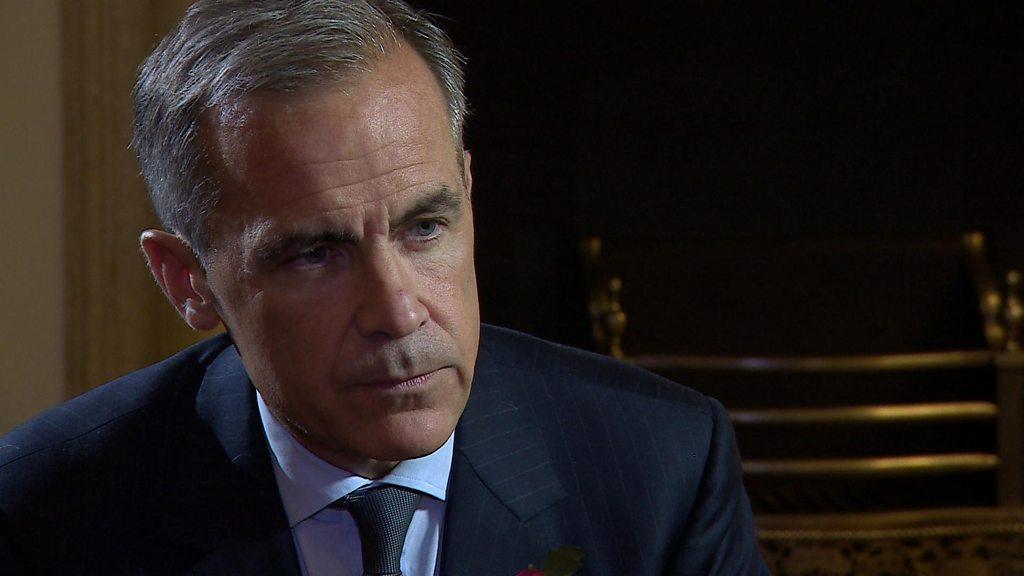

Explaining the raised growth forecasts for this year and next, Bank governor Mark Carney said that, since the vote to leave the EU, household spending had held up better than expected.

"For households, the signs of an economic slowdown are notable by their absence," he said.

But he warned that households would see "very modest" growth in their incomes over the coming years.

The Bank of England argues that food and energy prices have stopped falling and an increase in the price of imported goods will weigh on household budgets.

The Bank also warned that Britain's access to EU markets could be "materially reduced" following Brexit, which would hit economic growth over a "protracted period".

Carney: Brexit ruling part of uncertainty

The pound jumped higher against the dollar and euro - to $1.24 and €1.12 - following the Bank's move away from a rate cut and the High Court's ruling that parliament must vote on the start of the Brexit process.

Mr Carney said the court defeat for the government was "just one of many twists and turns that are likely to happen" as the UK leaves the European Union.

He told BBC economics editor Kamal Ahmed there was already economic uncertainty about Brexit, but that at the moment households were "looking through that uncertainty".

The Bank governor also reiterated he would leave his post in 2019, even if the court ruling means the Brexit process is delayed.

- Published3 November 2016

- Published3 November 2016

- Published3 November 2016