Indian rupees: Holders of notes abroad face tough battle

- Published

People outside of India holding discontinued 500 and 1,000-rupee (£6; £12) notes face difficulties exchanging them, BBC research has found.

British banks are generally not accepting the notes and technically, they should not leave the country.

One of the clearest options for overseas Indians is to travel back to India to exchange the notes in person.

They stopped being legal tender at midnight on Tuesday as part of a government crackdown on corruption.

Indians will be able to exchange their old notes for new ones at the country's banks until 30 December.

The Reserve Bank of India, external (RBI) said Indians could deposit them in their non-resident ordinary rupee accounts, a type of bank account where people living abroad park income earned in India.

However, this has been complicated by many banks abroad not accepting the notes.

Foreign tourists have been advised by the Indian central bank they have until midnight on Friday to exchange the discontinued currency at airports.

Banks in India are seeing large queues to exchange the notes

Ankeet, a 40 year-old currency trader from London, told the BBC he had given 2,000 rupees of his old notes to a cousin flying to India.

"Normally the Bank of India should provide an option, but nothing has come out," he told the BBC's Asian Network.

"I'm very lucky that I have a relative who's flying tomorrow, so my only option would be essentially to give it to him and ask him to enjoy it," he said.

"I've got a friend in the US who has close to 50,000 rupees, which is about $1,000. He will probably write it off," he added.

'Not accepted'

The 22 billion banned currency notes represent 85% of the cash in circulation in India, which is an overwhelmingly cash-based economy.

Indian banks ICICI Bank, Punjab National Bank, State Bank of India and Baroda Bank have said they do not handle physical rupees in the UK.

Tourists with leftover notes can exchange up to 5,000 rupees' worth at airport exchange counters by the Friday deadline, according to the RBI guidance.

M&S Bank is advising customers: "Indian rupees cannot be taken in or out of India, therefore we wouldn't be able to accept them."

Travelex, a foreign exchange company, said on Wednesday that customers with a buyback guarantee from when they purchased the rupees would be able to swap them back.

How long have people got to change their old notes?

The 500 ($7; £6) and 1,000 ($15; £12) rupee notes are the highest denomination notes in the country and are extremely common in India. Airports, railway stations and hospitals will only accept them until 11 November.

People will be able to exchange their money at banks between 10 November and 30 December.

How much 'black money' is there in circulation?

The actual figure is unclear but correspondents say the issue of "black money" is a huge problem in India. The idea here is to lock out money that is unaccounted for and make it visible for tax purposes - banks will be happy to exchange a few thousand rupees, but will be asking questions of those who turn up with hundreds of thousands or millions in currency.

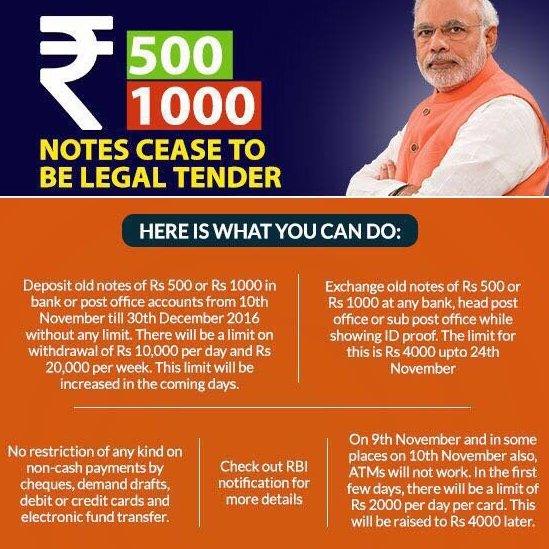

The government has issued flyers explaining the changes

Is there a limit on the amount an individual or household can cash in?

It seems not. An individual can put as much as he or she likes into the bank - but withdrawals are limited so the banking system may end up being flooded with cash.

Government guidelines say it is possible to exchange up to 4,000 rupees per day up to 24 November. People can also withdraw up to 10,000 rupees from a bank per day and a maximum of 20,000 rupees per week.

- Published10 November 2016

- Published8 November 2016

- Published9 November 2016