India rupees: Chaos at banks after 'black money' ban

- Published

The police helped keep order at this State Bank of India branch in Mumbai

There have been chaotic scenes outside banks in India, two days after 500 ($7) and 1,000 rupee notes were withdrawn as part of anti-corruption measures.

Some banks ran out of cash. At others police were called in to manage queues of anxious customers hoping to change their savings for legal tender.

The surprise government move is aimed at tackling corruption and tax evasion.

But many low-income Indians, traders and ordinary savers who rely on the cash economy have been badly hit.

Banks were shut on Wednesday to allow them enough time to stock new notes following Tuesday night's announcement. There are also limits on cash withdrawals from ATMs.

The two notes accounted for about 85% of the cash in circulation.

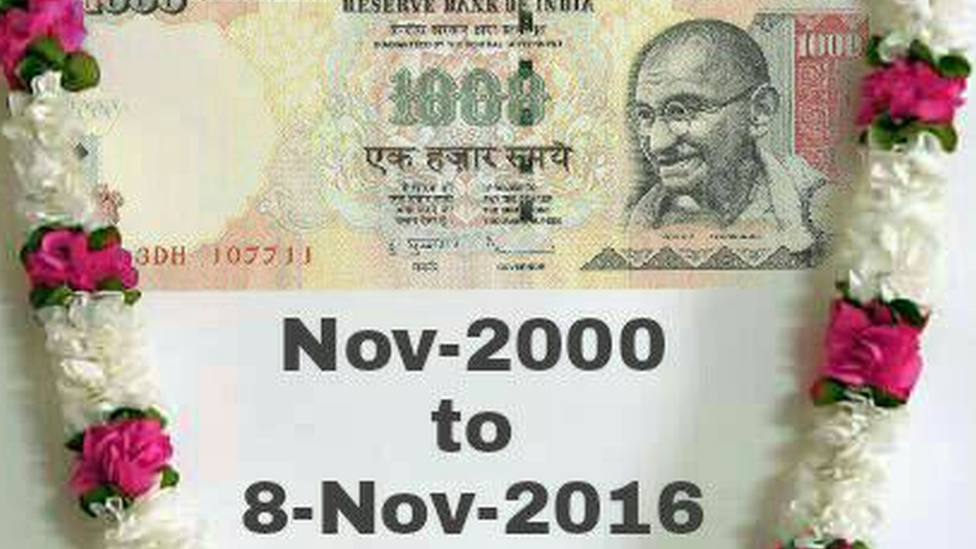

Old 500 and 1,000 rupee notes are no longer in circulation

The BBC's Geeta Pandey in Delhi says some banks extended working hours to deal with the rush on Thursday, and hired extra temporary staff.

Bank officials told the BBC that they had also brought in extra cash to deal with the situation - things had generally gone smoothly apart from the police having to deal with sporadic fights that broke out among customers.

"I went home for Diwali and my parents gave me money as a gift," Vijay Karan Sharma from Chhattisgarh, a student at Delhi University, told the BBC. He said he had been standing in line since morning.

"I wish they had a simpler system for students. I desperately need cash to pay my rent and buy books and food."

There were queues across India - here people wait in line outside a bank in Kolkata

How long have people got to change their old notes?

The 500 ($7; £6) and 1,000 ($15; £12) rupee notes are the highest denomination notes in the country and are extremely common in India. Airports, railway stations, hospitals and fuel stations will only accept them until 11 November.

People will be able to exchange their money at banks between 10 November and 30 December.

How much 'black money' is there in circulation?

The actual figure is unclear but correspondents say the issue of "black money" - which may have been acquired corruptly, or is being withheld from the tax authorities - is a huge problem. India's government hopes to flush out tax evaders and make money that is unaccounted for visible for tax purposes. There have been reports of tax raids, external in many parts of India.

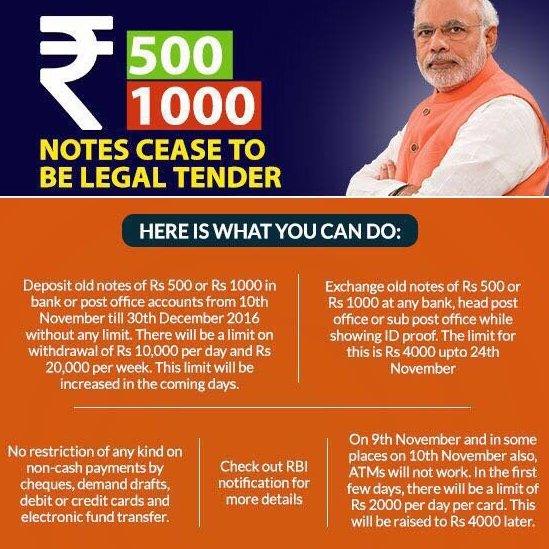

The government has issued flyers explaining the changes

Is there a limit on the amount an individual or household can cash in?

It seems not. An individual can put as much as he or she likes into the bank - but withdrawals are limited so the banking system may end up being flooded with cash.

Government guidelines say it is possible to exchange up to 4,000 rupees per day up to 24 November - anything over this will be subject to tax laws. People can also withdraw up to 10,000 rupees from a bank per day and a maximum of 20,000 rupees per week.

Are the new notes safer?

New 2,000 and 500 rupee denomination notes with new security features are being given to people to replace those removed from circulation.

A new 1,000 rupee note "with a new dimension and design" will also be introduced in due course, a senior government official said on Thursday.

New 2,000 rupee denomination notes were introduced on Thursday

How will overseas Indians exchange banknotes?

Overseas Indians can deposit the banknotes in their non-resident rupee denominated accounts.

What will foreign tourists carrying the banknotes do?

They can purchase foreign exchange equivalent to 5,000 rupees using these bank notes at airport exchange counters until midnight on Friday.

What's been the reaction in India?

Indian social media has been talking of little else.

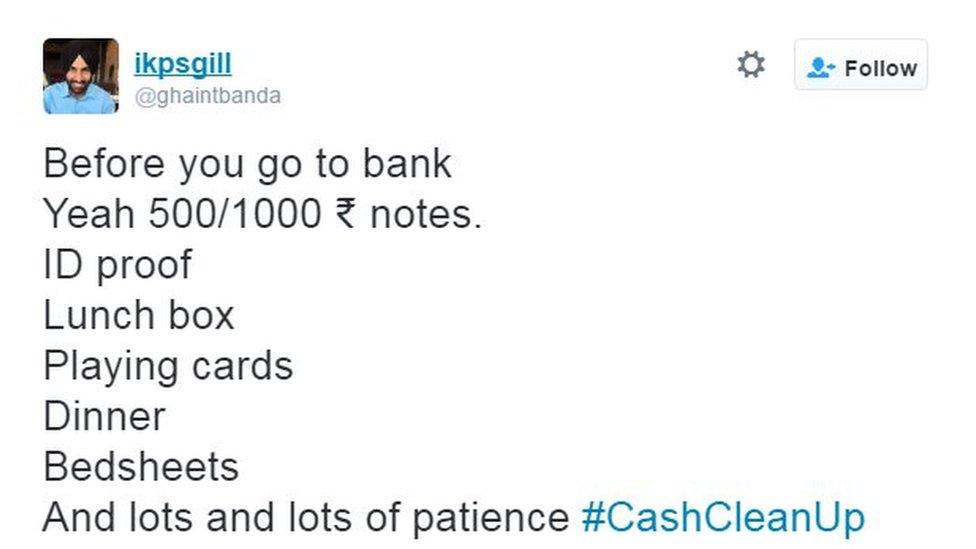

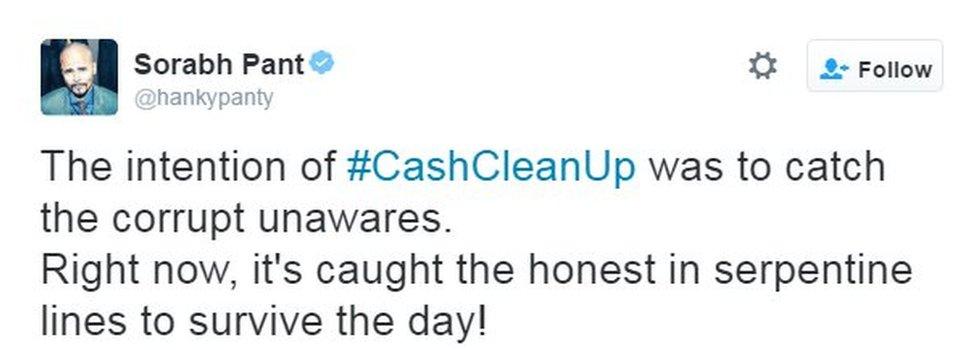

The top trend on Twitter India has been #CashCleanUp with tweets ranging from the frustrated to the humorous, as many Indians came to terms with the fact that much of their day would be spent in queues.

- Published8 November 2016

- Published9 November 2016