Five things you need to know about Steve Mnuchin

- Published

Steve Mnuchin: Who is Trump's new treasury secretary?

President-elect Donald Trump swore he'd shake up Washington and he's wasting no time.

His latest pick is former Goldman Sachs banker Steven Mnuchin as his treasury secretary, where he will be responsible for government borrowing, assisting in the overhaul of the tax code and preparing financial sanctions against other countries.

The appointment still needs to be approved by the Senate. It's an unusual - and somewhat controversial - choice, given candidate Trump's criticism of Wall Street.

Here are five things you need to know about Steven Mnuchin.

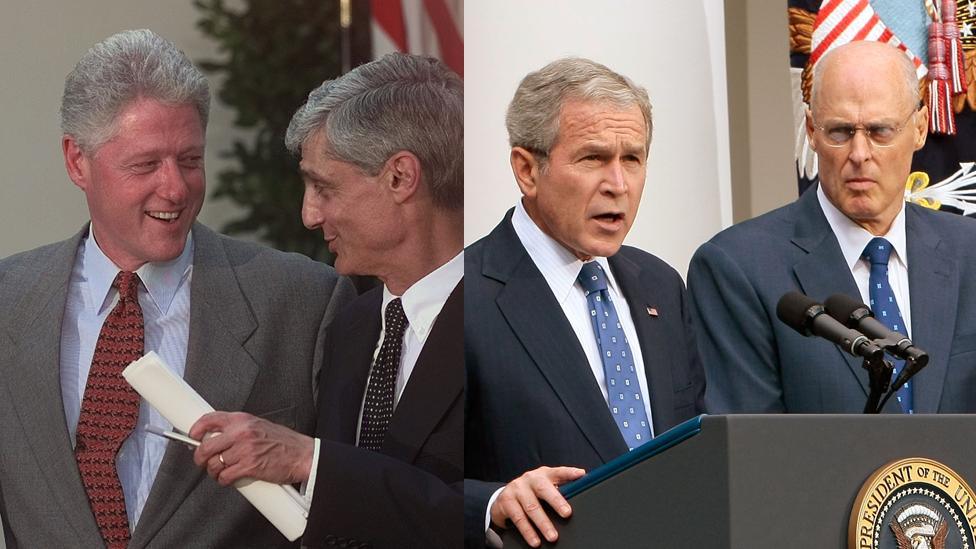

1. He will be the third Goldman Sachs veteran to hold the Treasury job in recent years

Steven Mnuchin will follow in the footsteps of fellow Goldman alumni Robert Rubin (under Bill Clinton) and Henry Paulson under (George W Bush) in the Treasury job. Mr Mnuchin spent 17 years early in his career at the investment bank, where he oversaw trading of mortgage-backed bonds and rose from partner to chief information officer. Goldman chief executive Lloyd Blankfein described Mr Mnuchin - who served as Mr Trump's national finance chairman - as "a very smart guy". "When I was running the fixed-income division, he was a high-flyer," Mr Blankfein said recently, external. Mr Mnuchin left Goldman in 2002 and two years later founded the hedge fund Dune Capital Management.

Mr Mnuchin follows in the footsteps of Robert Rubin and Henry Paulson

2. He's acted in a Hollywood film and produced several more

The future US treasury secretary coming to a screen near you? Yes, it's true. He plays a banker in Warren Beatty's new film Rules Don't Apply. Besides working in finance, Mr Mnuchin has longstanding ties to Hollywood. He teamed up with producer-director Brett Ratner and Australian businessman James Packer to form RatPac Dune Entertainment. Together they produced some of Hollywood's most successful movies, including Avatar and Mad Max: Fury Road. Recent projects include Sully and The Accountant. He was briefly co-chairman of Relativity Media before it went bankrupt.

Rules Don't Apply: starring Warren Beatty... and Steve Mnuchin

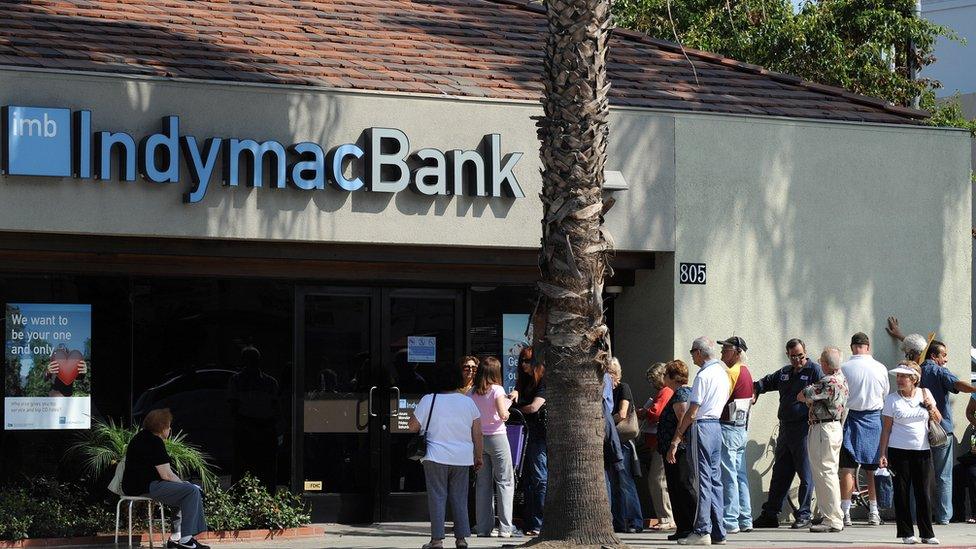

3. He bought a bank, whose behaviour was later described as 'repugnant'

Mr Mnuchin returned to banking during the financial crisis, gathering a group of investors including hedge fund bigwigs George Soros and John Paulson, private equity investor Christopher Flowers and computer mogul Michael Dell to buy failed mortgage lender IndyMac. The bank, renamed OneWest Bank, returned to financial health but it became known for quickly seizing the homes of borrowers who fell behind on their mortgage payments.

In 2009, a New York judge called OneWest's behaviour "harsh, repugnant, shocking and repulsive'', external in trying to foreclose on a New York family. OneWest said it "respectfully disagreed" with the court. Two years later, protesters marched on Mr Mnuchin's Los Angeles mansion accusing OneWest Bank of aggressive foreclosure practices. It was sold to CIT Group in 2015 in a lucrative deal.

Mr Mnuchin was part of the group that bought failed lender IndyMac and revived it as OneWest

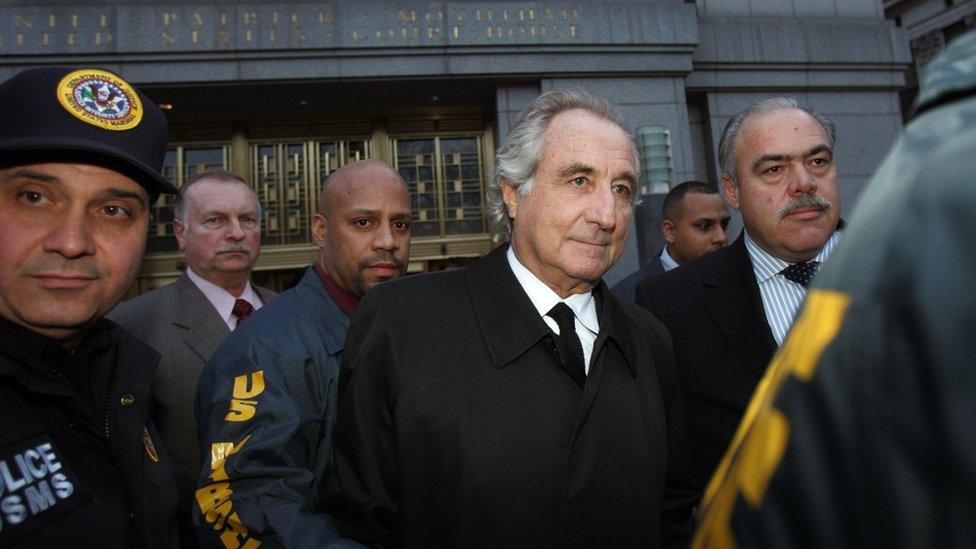

4. He was sued over Madoff fraud profit

Like his new boss, Steven Mnuchin grew up in a wealthy family. His father, Robert Mnuchin, was a banker-turned-upscale art dealer and his mother was a vice president of the International Directors' Council of the Solomon Guggenheim Museum. When she died in 2005, she made Steven and his brother Alan the beneficiaries and executors of her estate. Within a few months, they withdrew $3.2m from her account with Bernard Madoff Securities. Three years later Madoff was arrested and the two were sued by the trustee trying to recover money for victims of Madoff's Ponzi scheme. The suit was dropped because of time restrictions.

Bernard Madoff's arrest led to a lawsuit for Steve Mnuchin and his brother

5. He was once sued by Donald Trump

Donald Trump could soon be in a position of having sued his own treasury secretary. Mr Mnuchin's Dune Capital was among a group of lenders, including Deutsche Bank, who provided loans for the construction of a Trump skyscraper in Chicago. Mr Trump sued the lenders during the credit crunch to extend the terms of the loan. The suit was later settled. Mr Trump and Mr Mnuchin have also previously worked together on a hotel in Hawaii.