Mnuchin promises to boost US growth as Treasury boss

- Published

Who is Trump's new Treasury secretary Steve Mnuchin?

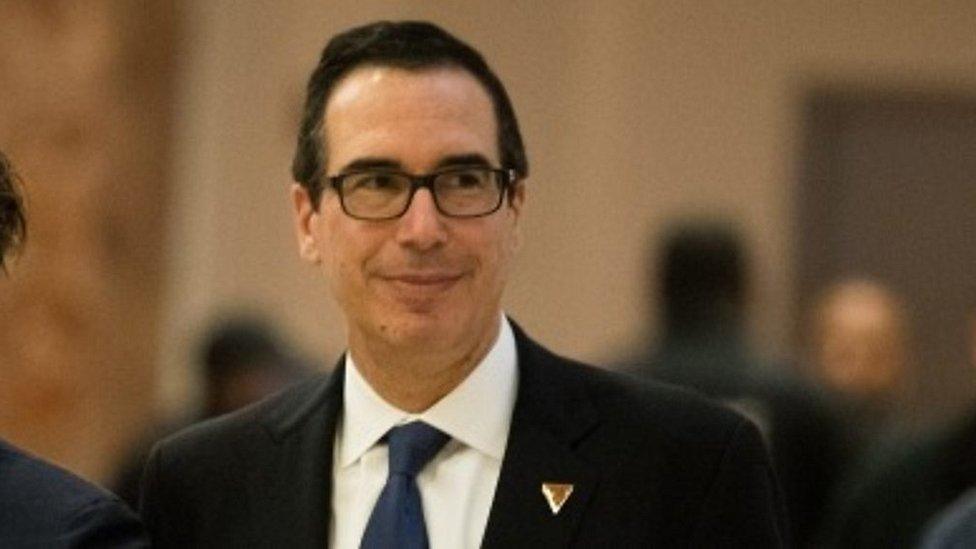

Ex-Goldman Sachs banker Steven Mnuchin has vowed a tax overhaul not seen in decades to boost the US economy.

Donald Trump's new Treasury secretary promised "the most significant middle income tax cut since [Ronald] Reagan".

The Wall Street veteran said in a CNBC interview that the new administration also planned to cut the corporate tax rate from 35% to 15%.

His appointment was announced alongside confirmation that Wilbur Ross will be the new Commerce Department head.

Mr Mnuchin said: "We think by cutting corporate taxes we'll create huge economic growth and we'll have huge personal income... Taxes are way too complicated and people spend way too much time worrying about ways to get them lower."

He said the US could "absolutely" achieve a 3%-4% growth rate, one of Donald Trump's key pledges.

Mr Mnuchin, 53, whose father also worked at Goldman Sachs, is relatively unknown as a public figure, despite building a career as a successful private equity investor and Hollywood financier.

He spent 17 years at the Wall Street bank before leaving in 2002 to set up an investment group which funded big movies such as "Avatar" and "Suicide Squad".

Mortgage controversy

More controversially, he persuaded billionaires George Soros and John Paulson to help him buy the failed bank IndyMac in 2009, which had collapsed under a portfolio of high-risk mortgage loans.

Rebranded as OneWest the bank grew to become one of California's largest lenders.

But it was also accused of driving homeowners into foreclosure to generate earnings - claims Mnuchin has denied.

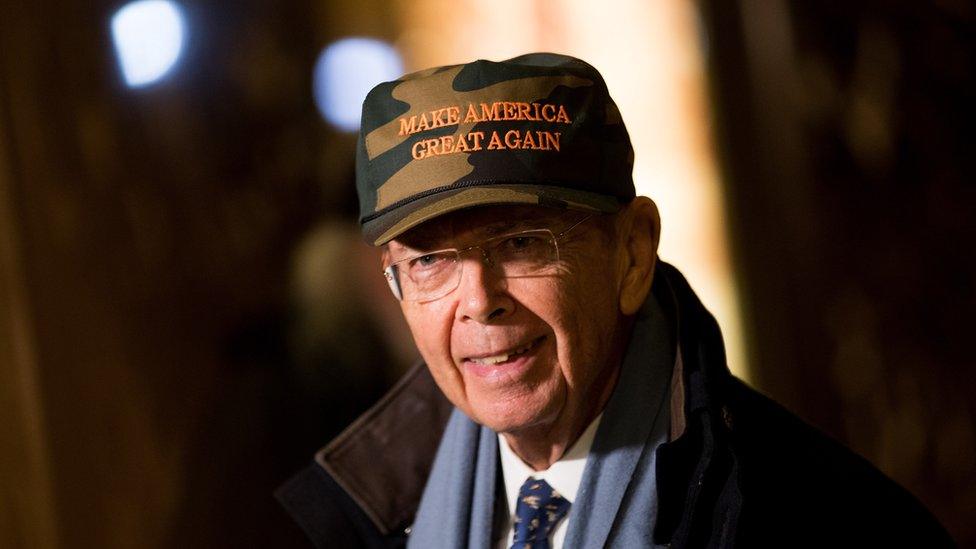

Wilbur Ross, the new head of the Commerce Department, made a fortune from turning around distressed businesses

As Treasury secretary, Mr Mnuchin would be the administration's chief economic spokesman, responsible for selling its economic programme to Congress.

He has been described as bipartisan, however he has known Donald Trump for 15 years and worked as his presidential campaign's finance chairman.

Like Mr Trump, he has also criticised the Dodd Frank act - brought in by the Obama administration to stabilise the banking system - saying it prevented banks lending to smaller businesses.

Five things about Trump's new treasury secretary

Analysis: Michelle Fleury, New York business correspondent

Will Donald Trump deliver on his promise of the biggest 'tax revolution' since Ronald Reagan? According to Steven Mnuchin, the man named for the role of treasury secretary, the answer is yes.

He confirmed that Mr Trump will push to cut the top corporate tax rate from 35% to 15%. The President-elect also wants to offer a tax holiday on overseas profits.

This has long been a sore point for congressional leaders who have gone after multinationals that are, in their opinion, not paying their fair share.

The most striking example is the technology giant Apple. Its chief executive Tim Cook has said in the past that he would "love to" repatriate Apple's foreign profits but that he can't because it would cost too much.

US firms are supposed to pay federal taxes on their global profits, but the tax on money made overseas is only due when it's brought back to the US.

American companies have an estimated $2.6 trillion in profits sitting untaxed overseas. By lowering the corporate tax rate, Donald Trump wants to give companies an incentive to bring that money back to US shores where it can be put to use to boost growth and create jobs.

But many economists argue that lowering the corporate tax rate to 25% would have the same effect without as much lost revenue.

And then there's the politics. Donald Trump's plan can only be enacted by changing the tax law.

And while Republicans maintain control of both chambers of Congress, their grip on the Senate is less firm. There, Republicans are likely to hold only 52 seats, leaving the door open for Democrats to obstruct or delay any tax reform and prevent them from reaching the 60 votes needed.

Mr Mnuchin also complimented Janet Yellen, chair of the Federal Reserve, saying she had done a good job, but declined to comment on whether she would serve the rest of her four-year term, which ends in early 2018.

"Eventually we are going to have higher interest rates and that's something that this country is going to need to deal with," he added.

Mr Mnuchin will be the third ex-Goldman Sachs banker to serve as Treasury secretary, but, with no prior government experience, some say he could struggle to navigate the world of Washington politics.

"People who come from Wall Street quickly find that they can't just make a decision and have it happen," said Stanley Collender, a communications expert who previously advised the House and Senate Budget Committees.

"It's not like being a CEO. There is a lot more compromise involved."

'King of bankruptcy'

As head of the Commerce Department, Wilbur Ross will be responsible for managing America's business and trade policies.

The 78-year-old financier has been called the "king of bankruptcy" for buying distressed companies and turning them around, and has personal wealth of about $2.9bn, according to Forbes magazine.

Mr Ross advised Mr Trump on the campaign trail, in particular helping him shape his protectionist trade policy positions.

Mr Ross has blamed the North American Free Trade Agreement with Canada and Mexico, and China's 2001 entry to the World Trade Organization, for causing huge US factory job losses.

In a statement announcing his choice, Trump said: "Wilbur Ross is a champion of American manufacturing and knows how to help companies succeed.

"Wilbur knows that cutting taxes for working families, reducing burdensome government regulations and unleashing America's energy resources will strengthen our economy at a time when our country needs to see significant growth."

- Published30 November 2016

- Published30 November 2016

- Published30 November 2016

- Published30 November 2016