Janet Yellen: US Fed could raise interest rates 'soon'

- Published

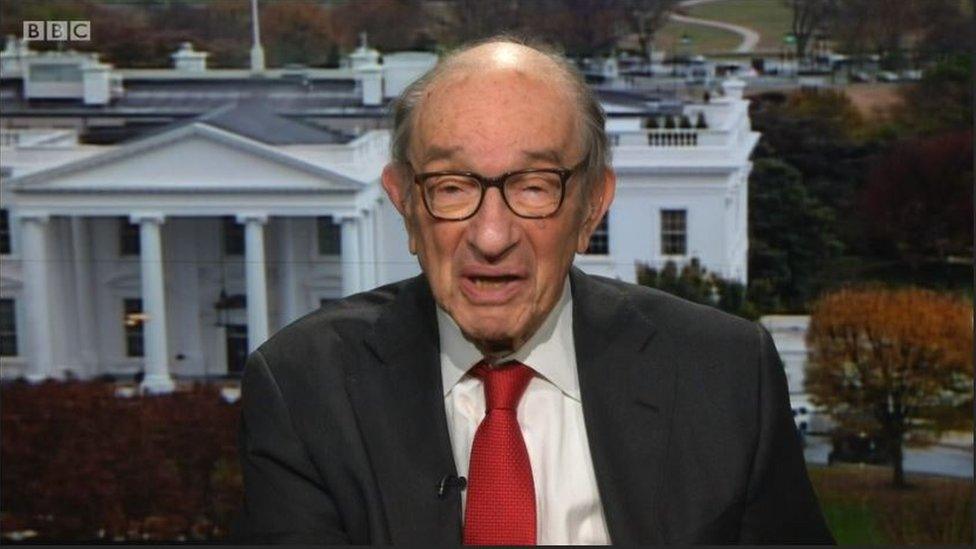

The chair of the US Federal Reserve, Janet Yellen, has indicated that it could raise interest rates "relatively soon".

She said the job market had made further improvements this year and that inflation, while still below the Fed's 2% target, had started to pick up.

Financial markets are expecting the Fed to take action at a meeting next month.

She also defended the independence of central banks after criticism of the Fed by President-elect Donald Trump.

Ms Yellen's comments came in an appearance before a Congressional Committee on Thursday.

It would be only the second rate rise since the bank pushed rates to a record low during the financial crisis.

In December last year, the Fed raised its benchmark rate for the first time in seven years, from near zero to its current level of between 0.25% and 0.5%.

Inflationary pressures

Ms Yellen said that further delaying a rate increase would present its own risks.

BBC economics correspondent Andrew Walker says indications that Mr Trump will cut taxes and spend heavily on infrastructure make it more likely that the Fed will want to raise rates to contain inflationary pressures.

The Fed does not know yet what will happen when the president-elect and a new Congress take office next year, Ms Yellen said.

But she added that the central bank would take into account decisions by the White House and Congress when setting its interest-rate policies.

She also said the US economy was "making very good progress", further strengthening analysts' expectations of a rate rise at the 14 December meeting.

"As a result of the testimony, we raised our subjective probability of a hike next month to 90% (from 85% previously)," Goldman Sachs said. Other analysts give a similar likelihood.

'Terrible' consequences

Turning to the independence of central banks, Ms Yellen said they need to be able to make long term decisions that are not always popular.

In countries where central banks are subject to political pressures, there have been "terrible" consequences, she said.

Ms Yellen also confirmed she planned to serve out her four-year term, which expires in January 2018.

During the election campaign, Mr Trump criticised both the Fed and Ms Yellen's handling of the economy.

The Bank of England (BoE) has faced similar pressure from senior Conservatives over the effects of ultra-low interest rates and quantitative easing since the financial crisis of 2008.

Former shadow chancellor Ed Balls on Thursday called for the BoE's independence to be curbed in response to growing "popular discontent".

In an academic paper, he said central banks could "sacrifice some political independence" without undermining their ability to do their job.

- Published10 November 2016

- Published2 November 2016

- Published28 October 2016