Autumn Statement 2016: Lettings agent fees will be banned

- Published

- comments

Lettings agents in England will be banned from charging fees to tenants "as soon as possible" under plans announced in the Autumn Statement.

Tenants can be charged fees for a range of administration, including reference, credit and immigration checks.

Chancellor Philip Hammond said shifting the cost to landlords will save 4.3 million households hundreds of pounds.

The move could spur competition as landlords, unlike tenants, can shop around for the cheapest agent.

In Scotland, lettings agency fees to tenants have already been banned.

In England and Wales since last year, lettings and managing agents have been legally obliged to clearly publicise their fees.

Fees vary widely, with costs in some big cities much higher than elsewhere.

Tenants face charges when agents draw up tenancy agreements along with the possibility of a non-refundable holding deposit paid before signing up to the deal.

'It is incredibly expensive'

Natalie Lightman is delighted to have found a flat but unhappy with the fees

Natalie Lightman says it is "incredibly hard" to find a place to live in London, but eventually she found a "cosy but expensive" flat.

"Then I paid £150 just for the privilege of putting down a deposit," she says.

In total, she paid upfront costs of £2,000 before setting foot in the flat, of which the letting fees were a part.

"Banning fees is a good idea as it will drive up competition," she says. "A lot of people cannot afford these costs."

But Julie Turner, who is a landlord, says the extra costs faced by landlords will lead to higher rents.

"We do not make a profit on our property we rent out because there is the service charge and insurance and mortgage, and there is a new tax law coming in," she says.

"If the administration fees come back to the landlord the rent will have to increase. It is not being greedy, it is just we need to cover our costs."

Choice

Charities have said that these primarily upfront fees have risen in recent years.

The latest English Housing Survey shows fees typically cost £223. However, Shelter research in 2012 found that one in seven tenants pays more than £500.

The charity said renters had no choice over the agent they dealt with after finding a house or flat. Landlords, on the other hand, were able to choose between agencies to act for them when renting out their property.

Many tenants are angry that, with more competition for decent places, they are forced to pay to guarantee somewhere to live. Some argue that the fee for drawing up a tenancy agreement far outweighs the actual cost to the agent.

Overall, along with rent in advance and a deposit, the average upfront costs faced by renters using a letting agency are more than £1,000 nationally and over £2,000 in London, according to Shelter.

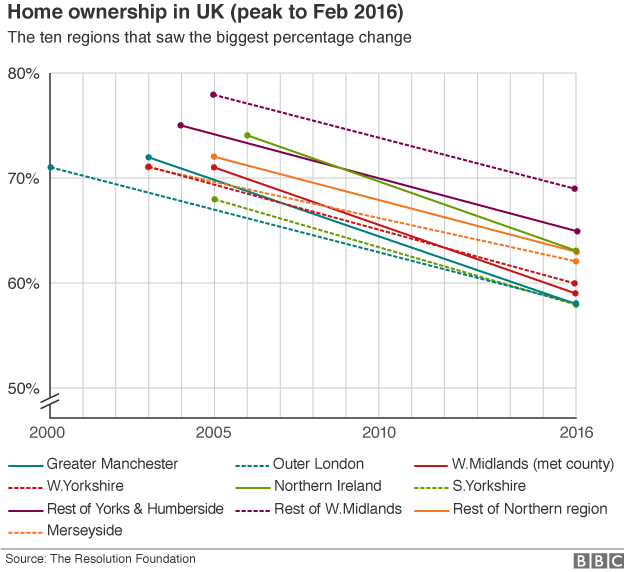

The rental market has become more significant owing to falling home ownership

The industry has argued that administration has a cost and has argued for stronger consumer protection through regulation of the sector, rather than a ban.

David Cox, managing director of the Association of Residential Letting Agents (Arla), said: "A ban on letting agent fees is a draconian measure, and will have a profoundly negative impact on the rental market.

"It will be the fourth assault on the sector in just over a year, and do little to help cash-poor renters save enough to get on the housing ladder. This decision is a crowd-pleaser, which will not help renters in the long-term. All of the implications need to be taken into account.

"Most letting agents do not profit from fees."

Agents saw some of the biggest falls in company share prices in early trading, with Foxtons down 11%, Countrywide down nearly 6%, and Savills also falling slightly.

Fees compared

Two agents based in Rugby have the following upfront fees:

Archer Bassett: First person application and referencing charge - £200; additional applicants - £150 each; tenancy agreement charge - £100 per property; guarantor application and referencing charge - £150 per guarantor; same day bank transfer refunds (where agreed) - £30

Brown and Cockerill: Sole tenant set-up fee - £180; additional tenant - £120 per tenant; guarantor fee - £96; tenancy agreement fee - £75; pet deposit - £300

The ban on fees in Scotland was tightened from 2012.

A report by Shelter assessing the effect of the change in Scotland suggested that:

Rises in rent had been "small and short-lived" despite expectations that rents would increase to cover the greater burden on landlords

Landlords in Scotland were no more likely to have increased rents since 2012 than landlords elsewhere in the UK

About 10% of the lettings agent market in Scotland fail to comply with the law, some of whom exploit loopholes in the law

Campbell Robb, Shelter's chief executive, said banning them elsewhere was welcome.

"Millions of renters in England have felt the financial strain of unfair letting agent fees for far too long, so we are delighted with the government's decision to ban them. We have long been campaigning on this issue and it is great to see that the government has taken note," he said.

Housing moves

Mr Hammond also announced plans to increase the construction of affordable homes.

It is estimated that at least four million people of working age in England would need affordable housing by 2024, according to the Local Government Association.

The average first time buyer paid just under £30,000 for their new home in the 1980s compared with more than £150,000 now, according to the Resolution Foundation.

Between the late 1940s and late 1950s councils built more homes than the private sector.

Local authorities were building 100,000 homes a year up to the late 1970s, but the election of Margaret Thatcher's Conservatives in 1979 led to a fall in house building by local authorities.

In the year to the end of June, local authorities built 1,500 homes in England out of a total of 131,370 - that is just over 1%.

- Published23 November 2016

- Published9 July 2020

- Published19 September 2016

- Published18 November 2016

- Published7 September 2016