Black Friday sales rush reported by retailers

- Published

UK shoppers have rushed to buy Black Friday bargains, as retailers and payment firms report strong sales activity for the annual discount event.

Barclaycard said it had seen a record number of transactions on Friday, while Argos, John Lewis and Currys PC World reported a surge in orders.

Online retailers said initial figures indicated Black Friday, now into its third year, had topped expectations.

Meanwhile, in the US, where it all started, websites saw heavy traffic.

The boss of department store Macy's said it had seen a strong start to the sales, although its website later suffered glitches.

Black Friday: Top tips to spot a bargain

Google aims to tackle Black Friday crush

Is Black Friday still a big deal?

Black Friday backlash getting bigger

In the UK, analysts expect sales on Friday to have topped last year's £1.9bn, with people hunting for discounts ahead of an expected rise in prices in 2017.

Barclaycard, which processes nearly half of the credit and debit card transactions in the UK, said payment transactions were 6% higher than last year's Black Friday.

Total spending was £2.9bn, although that also includes non-Black Friday specific purchases, a spokesman said. The firm processes payments for customers of Barclaycard, Barclays and several major retailers.

The Nationwide Building Society said purchases by its customers were up 13% on a year ago, while the discount retailing site TopCashback reported a 43% increase in spending over last year.

Many retailers are stretching the one-day shopping extravaganza over several days. Amazon and some supermarkets started their sales up to 10 days ago.

The total for the following four days is forecast to rise to more than £4bn once the weekend and Cyber-Monday - an online-only event - are included.

Experts say that the shopping cycle has changed in recent years, with Christmas consumer spending stretching for many weeks.

"The Black Friday promotions at the end of November are the start of a longer, more drawn-out peak season, which begins with most of the activity online and then moves in-store as we get closer and closer to Christmas day," said Richard Jenkings, data analyst at credit reference agency Experian.

Increasingly, Black Friday, which came to the UK in 2014, is becoming an internet bonanza. According to the online retailing association IMRG, well over half the spend will be done online.

Andy Mulcahy, editor at IMRG, which tracks online sales, said: "It seems a safe bet from what we've seen today that our forecast of £1.27bn will be met [for Friday's sales]".

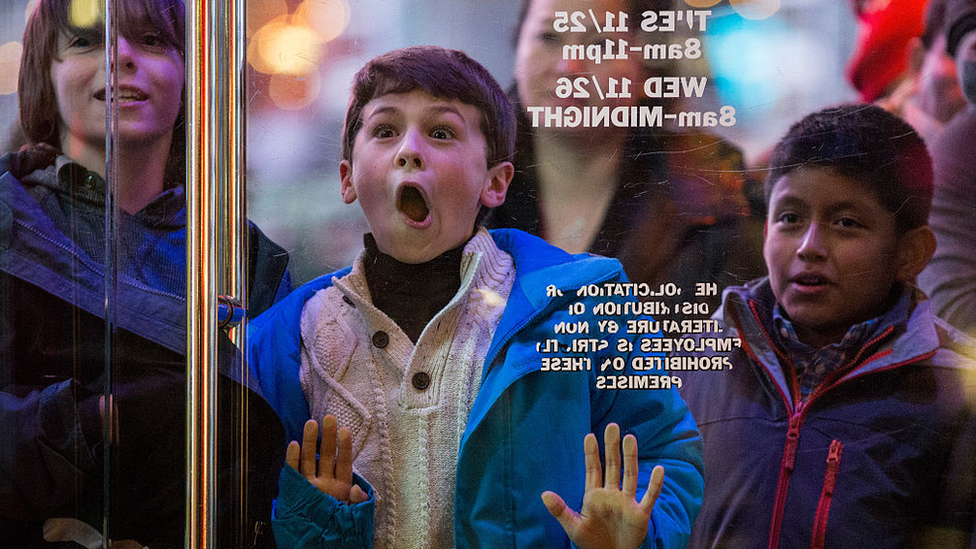

The trend for Black Friday sales started in the US

Warnings have been issued to shoppers over the dangers of getting carried along by Black Friday marketing.

"The key is to make sure you only buy items you were looking for anyway, and not because you fall for the marketing hype," said Gary Caffell, from Moneysavingexpert.

"There are some great deals out there but make sure you do your own price comparisons, as prices can fluctuate wildly from store to store - don't just take a retailer's word for it that something is a bargain."

He pointed to cut-price vacuum cleaners, which can already be bought cheaper online.

Andy Webb, of the Money Advice Service, said: "A third of people felt pressure to spend more than they could afford during the whole of Christmas. That leads into debt."

For some, this can have a serious impact on their wellbeing.

"Short-term discounts encourage consumers to purchase immediately, rather than reflecting on whether you really need to buy a product and if you can afford it," said Katie Evans, head of research and policy at the Money and Mental Health Policy Institute.

"This can be particularly difficult for people experiencing mental health problems, who sometimes find it harder to resist impulses and might find that shopping makes them feel better, at least for a short while."

The institute is calling for new rules to allow people to opt out of email marketing or to set a daily spending limit in online shops.

Prices to rise?

In the US, stores like Macy's, Walmart, and Target opened on Thursday evening to start the sales early amid hopes that more than 137 million shoppers will take part in the sales bonanza.

"I was here at the front door and there were 16,000 people that came through," Terry Lundgren, chairman and chief executive of Macy's, told the BBC. "They never stopped, the flow of traffic came from all three sides."

How Black Friday came to the UK and took off

But he said the firm has seen a big drop-off in UK shoppers since the fall in the value of the pound after the EU referendum in June. Sterling has dropped about 17% against the dollar since the Brexit vote.

Looking ahead, the cost of imported items in the UK is forecast to rise, as the weaker pound finally feeds through into retail prices.

AO World chief executive John Roberts said: "Obviously, with the Brexit currency movements, prices are going to go up in the first quarter of next year. The vast majority of all Black Friday offers were negotiated and in place before [the] Brexit [vote]."

Argos boss John Rogers said he "can't rule out price increases" next year because of the falling pound.

Fashion retailer Next said that it had managed its currency exposure so that it could keep prices down until January: "Although it is very early in the buying cycle, we currently estimate that cost prices in 2017/18 will rise by less than 5% on like-for-like products."

Consultancy group PwC estimated that one-in-four UK adults would spend on average £203 this Black Friday.

Black Friday 'questionable'

Even so, Paul Martin, KPMG's UK Head of Retail, said: "For retailers, it has always been questionable whether Black Friday really benefits them in the long-run, and in the current environment of rising costs and squeezed margins - perhaps it's even more so."

Asda opted out of Black Friday in 2015 and again this year following chaotic scenes among bargain-crazed customers in 2014. Next, Ikea and fashion chain Jigsaw have also declared themselves Black Friday refuseniks.

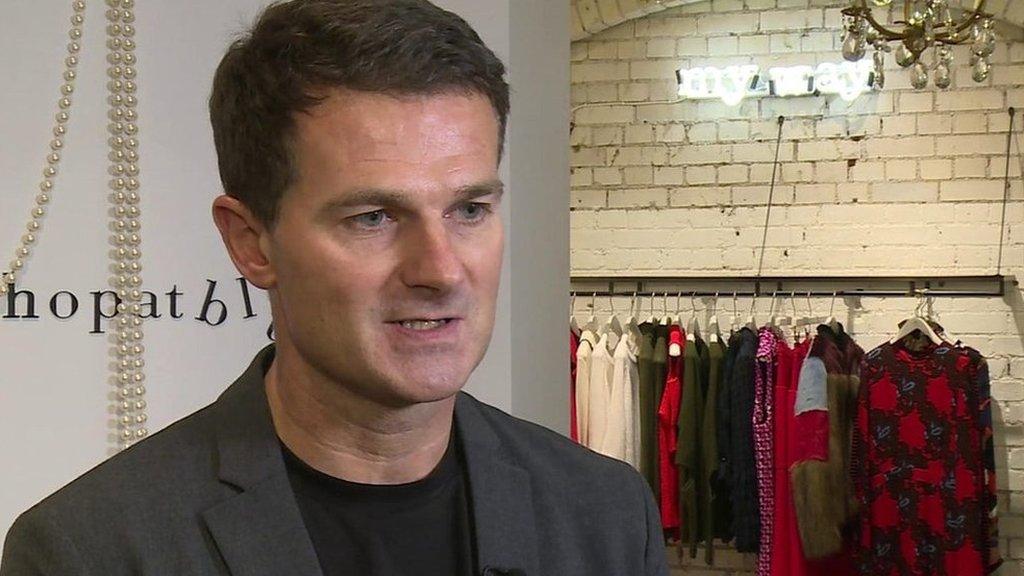

Jigsaw boss Peter Ruis: "Black Friday is a complete and utter deception"

Jigsaw chief executive Peter Ruis called it "a complete and utter deception". He said: "In fashion, over 50% to 60% of Black Friday purchases are returned. It stays in the supply chain two or three weeks, churns around and everyone's lost the chance to sell it, and it just goes straight into the sale at 50% to 60% off.

"It is a double whammy: loss of profit, loss of margin, and that product just sitting around in supply chains," he said.

Mr Mulcahy of IMRG, said it can work for companies to stay out of the discounting "if they play it well". He said: "Not everybody likes Black Friday. Some people absolutely hate it."

- Published25 November 2016

- Published24 November 2016

- Published25 November 2016

- Published24 November 2016

- Published23 November 2016

- Published15 September 2016

- Published24 November 2016