Italian bank shares tumble after vote

- Published

Shares in Italian banks have been hit following Prime Minister Matteo Renzi's heavy defeat in Sunday's referendum.

There are fears that a period of political uncertainty will hamper efforts by Italian banks to raise fresh finance.

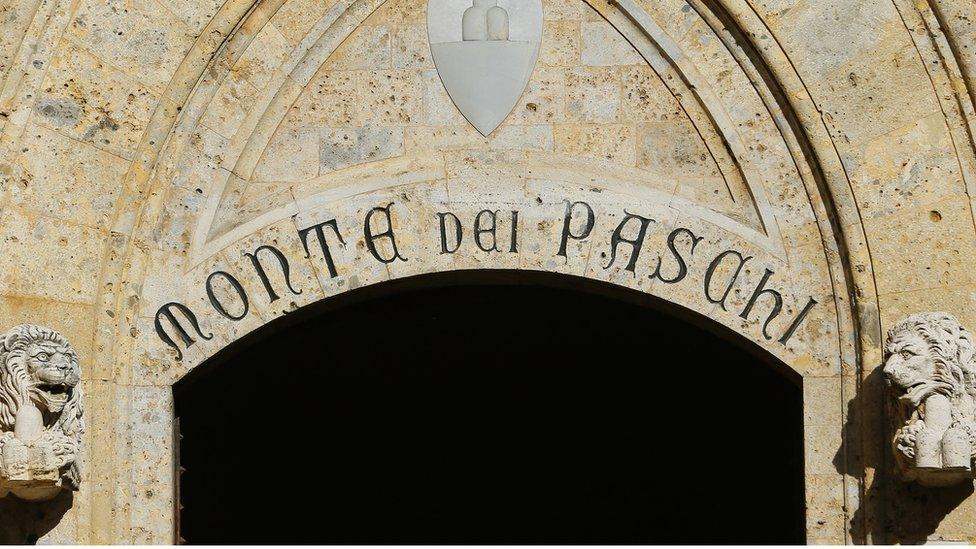

Shares in Monte dei Paschi, one of Italy's most troubled banks, fell 4% on fears that its rescue plan might fail.

Banca Popolare di Milano ended almost 8% lower and Banco Popolare Societa Cooperativa finished 7% lower.

Many Italian banks are struggling with a burden of bad debt and are in need of refinancing.

It was thought that a victory for the Yes camp in the referendum would have seen investors stepping in to help recapitalise the banks.

But given that the No voters won, analysts are now unsure about what sort of help will be forthcoming:

"The economy is gradually recovering but it is also being held back by the problems in the banking sector which haven't been addressed properly so far," said Lorenzo Codogno, former chief economist at the Italian Treasury and founder of LC Macro Advisors.

"So I think the combination of domestic and international factors plus the open issue of the banking sector are at the root of not particularly brilliant growth."

Poll defeat risks Italy political crisis

Italian banks including Monte dei Paschi di Siena have been under pressure

The euro was hit after Mr Renzi said he would resign.

At one stage it hit $1.0505, its lowest level against the dollar since March 2015.

But it recovered to trade 0.7% higher at $1.0737 by the close in Europe on Monday.

Kathleen Brooks, research director at City Index Direct, said there was caution among investors but not panic.

"While the markets are likely to remain nervous as we start a new week, they haven't fallen off a cliff, so far," she said.

"Either markets are becoming immune to political risk, or they are taking the view that the Italian issue will be a slow-burner, even if the president can't form a government, he still has 70 days to try, and that seems quite far away at this stage."

Analysis: Simon Jack, BBC business editor

If the consortium of investors does decide the plan to rescue Monte dei Paschi is now too risky, then the government may have no choice but to nationalise the bank.

That would trigger a so-called "bail in" which means people who lent the bank money would have to write it off.

Unfortunately, 65% of those creditors are ordinary retail investors so the damage would be widespread and politically toxic.

The size of Italy's government debt is also a concern.

Government borrowing, depending on which figures you look at, is one of the largest in the eurozone.

Italy's cost of borrowing rose on Monday.

The country's 10-year government bond yield was up from 1.896% at the end of last week to 2.034%.

Yields rise when the price of bonds falls.

Mr Renzi's defeat adds to pressure on the European Union following June's Brexit vote in the UK.

"It's not very hard to see a new election on the horizon, and it's not very hard to see the 5-Star Movement taking power with stated aims to either leave the EU, drop the euro, or both," said Mark Wills from State Street Global Advisors.

"For Italy, establishing stable governance and a plan to guide the nation is of critical importance given the fragility of the economy, challenging policies and the liquidity problems in the banking system."

- Published5 December 2016

- Published5 December 2016