UK inflation rate jumps to 1.6%

- Published

- comments

Rising air fares and food prices helped to push up UK inflation to its highest rate since July 2014 in December.

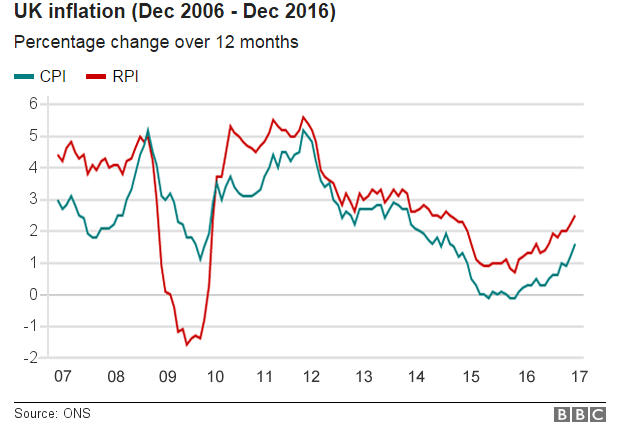

The annual rate of Consumer Prices Index (CPI) inflation rose to 1.6% last month, up from 1.2% in November, the Office for National Statistics said, external.

And higher costs for imported materials and fuels pushed up producer prices, external.

The fall in the pound since the Brexit vote was starting to feed into the economy, said the BBC's economics editor, Kamal Ahmed.

ONS head of inflation Mike Prestwood said: "This is the highest CPI has been for over two years, though the annual rate remains below the Bank of England's target and low by historical standards.

"Rising air fares and food prices, along with petrol prices falling less than last December, all helped to push up the rate of inflation.

"Rising raw material costs also continued to push up the prices of goods leaving factories."

Inflation means inflation, but who wins?

Separate producer price inflation figures showed that the price of goods bought from factories rose 2.7% in December compared with a year ago, as manufacturers started to pass on the higher input costs they are facing following the fall in the pound.

The prices paid by factories for raw materials and energy jumped by 15.8% over the year, the largest increase since September 2011.

Consumer inflation as measured by the Retail Prices Index (RPI), which includes housing costs, rose to 2.5% in December from 2.2% the previous month.

Analysis: Simon Gompertz, BBC personal finance correspondent

Air carriers usually push up their fares in December in advance of Christmas and the New Year, so the overall 49% take off in the price of flights this time isn't a big surprise to statisticians.

They track dozens of fares - short-haul, long-haul and domestic - and create a mini-index for each category.

And what they tend to detect every year is that discounts creep in in the early months, then prices gain altitude for Easter and the summer before dropping again in the autumn.

More ominous is that years of falling food prices appear to be coming to an end.

Also worrying is that UK manufacturers are having to pay 16% more for raw materials and fuel, the result of the drop in the pound.

Inflation's back. If it continues to be higher than expected, month by month, there is bound to be talk about the Bank of England's Monetary Policy Committee reconsidering its policy of keeping interest rates ultra-low.

But we are at the very early stages of the pick-up. Don't expect much change to savings and mortgage rates for now.

Brexit effect

Tom Stevenson, an investment director at Fidelity International, said: "Inflation is back with a vengeance.

"We could see sterling fall even further in the lead-up to the prime minister pulling the trigger on Article 50. This will translate into further inflation in the short term."

After the Brexit vote, sterling fell sharply against many currencies and is about down about 20% against the dollar and 13% against the euro since the June referendum.

In a speech on Brexit on Tuesday, Prime Minister Theresa May said the UK would leave the single market, although the pound rose sharply following her speech.

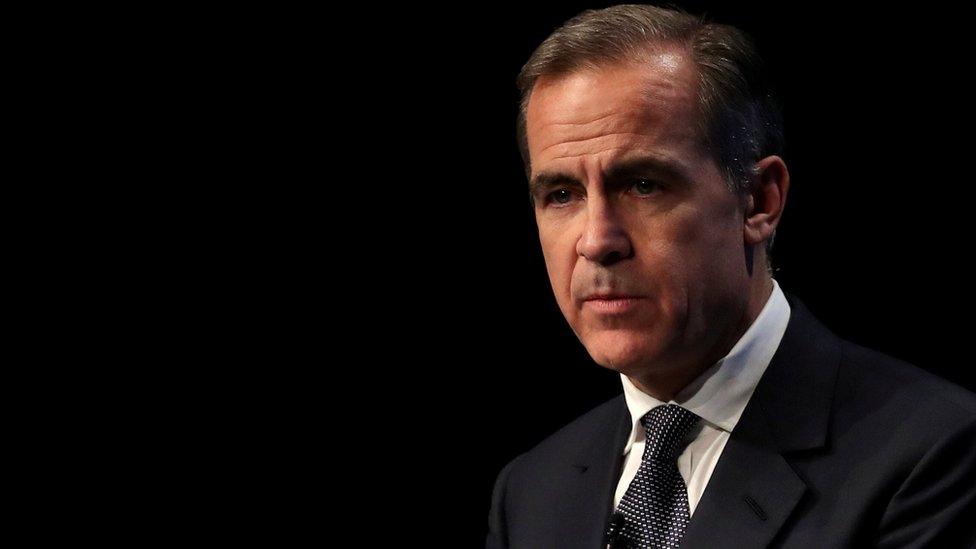

On Monday, Bank of England governor Mark Carney said that UK consumers faced headwinds this year as spending could be hit by rising prices from the weaker pound.

He said the UK's recovery was increasingly reliant on consumers, making it vulnerable to the risk of a fall in spending power.

- Published17 January 2017

- Published16 January 2017

- Published16 January 2017