Pound has best day's gain since 2008 after Brexit speech

- Published

- comments

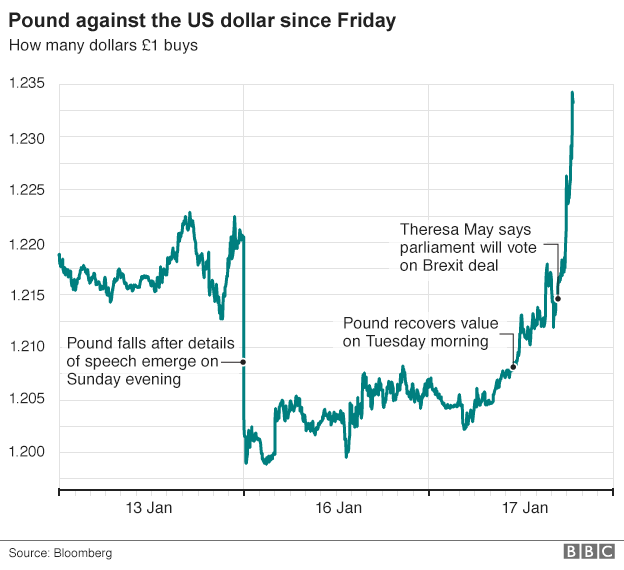

The pound saw its best day's gain in more than eight years against the dollar on Tuesday, helped by rising inflation and the Prime Minister Theresa May's major speech on Brexit.

Official figures showed inflation rose to 1.6%, a level that may usher in higher interest rates.

That boosted sterling and Mrs May's speech spurred on that rally.

Its best move was against the dollar, against which it closed in London trade up almost 3% at $1.2392.

Dealers said that rise, which was the best for the pound since October 2008, had been helped by a weakening dollar.

Open

Nevertheless the pound gained strongly against all major tradeable currencies, including notching up a 1.8% rise against the euro to reach 1.157 euros.

According to Thomson Reuters data, the pound had its best day's gain against a basket of major currencies since 1998.

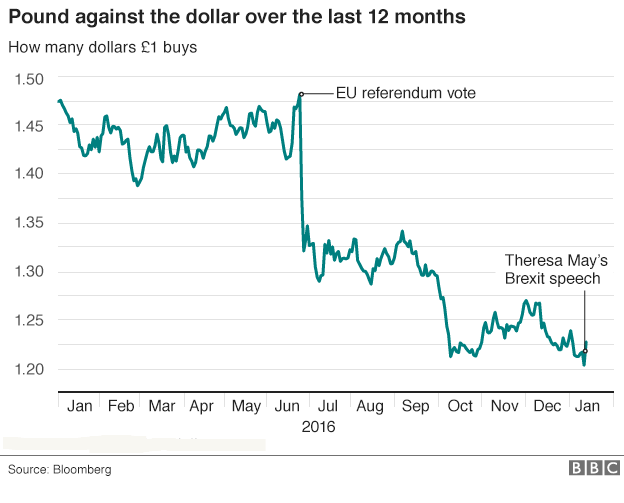

The pound has been hammered by dealers since the Brexit vote in June last year and remains 16% below its level of $1.47 the day before the referendum.

Also on Tuesday, the benchmark FTSE 100 share index, which was already in negative territory for the day, fell further to stand 1.46% lower at 7220.38.

In her speech, Mrs May said the UK would leave the EU's single market, but stressed that it would seek new international trade opportunities and be open to global trade.

The pound had already made gains in early trading on Tuesday, but surged as a result of the prime minister's speech.

"News that the Brexit deal will be put to a Parliamentary vote has seen sterling rocket, as have assurances from [Mrs] May of Britain's global intentions," said Dennis de Jong, managing director at online foreign exchange broker UFX.com.

"While the announcement that Britain will leave the single market isn't what traders wanted to hear, it doesn't come as a shock.

"With markets bracing themselves for a worst-case scenario, the better-than-expected news in [Mrs] May's speech should help to buoy the beleaguered currency - at least for the time being."

Laith Khalaf, a senior analyst at Hargreaves Lansdown, said the last time the pound was up so sharply against the dollar, it was also a "turbulent" time for the currency.

"If you look at both periods - October 2008 during the financial crisis, and today - there's a lot of volatility in the currency markets," he said.

The pound rose more sharply against the dollar than it did against the euro because the US currency had been weakened by remarks made by President-elect Donald Trump in the Wall Street Journal.

The dollar fell 1% against the euro and was down against most major currencies after Mr Trump said US firms could not compete with China "because our currency is too strong. And it's killing us".

- Published17 January 2017