Personal borrowing stalls in December

- Published

The growth of personal borrowing in the UK stalled slightly in December, the latest Bank of England figures show.

Outstanding personal debt rose by just £1bn that month, the smallest monthly increase since May 2015, to £193bn.

That left the annual growth rate of the UK's personal debt mountain, which covers credit cards and other non-mortgage loans, steady at 10.6% a year.

The Governor of the Bank of England, Mark Carney, recently warned that personal borrowing was rising too fast.

In November he said: "We are going to remain vigilant around the issue, because we have seen this shift [in borrowing]".

The amount of outstanding personal debt, excluding mortgages, rose that month to £192bn, which was the highest level since December 2008.

Of the Bank's latest figures, external, Martin Beck, senior economic advisor to the Ernst & Young ITEM Club, said: "We think it unlikely that this represents the start of a steep downturn, although demand for unsecured lending is likely to ebb this year, as household finances come under increasing pressure."

Other new Bank data suggests that the UK property market will be steady in the coming months.

The number of new mortgages approved for home buyers, but not yet lent, was steady in December at just under 68,000.

That was the highest monthly figure since March last year.

Company borrowing

Meanwhile the recovery of corporate borrowing in the UK appears to have stalled.

The amount of money owed by non-financial businesses to their lenders fell slightly in December, for the second month in a row, to £449bn.

The contraction of this sort of borrowing after the 2008 financial crisis was one factor which prompted the Bank of England to launch its policy of quantitative easing, external in 2009, to encourage companies to borrow and spend and to help bring the economy out of recession.

With commercial banks forced by the authorities at the same time to restrain their lending and clean up huge bad debts, it took a long time for corporate borrowing in the UK to recover.

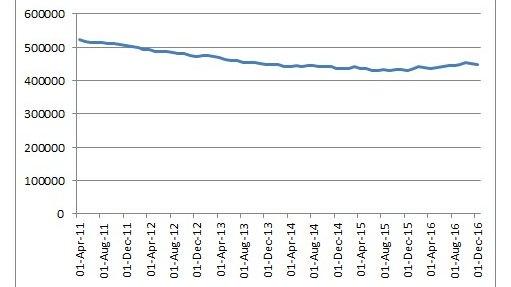

The Bank's figures show that the outstanding debt owed by non-financial businesses fell steadily, from £522bn in April 2011 to £428bn just over four years later in June 2015.

It then revived in 2016, rising to £453bn last October - the highest such figure for three years - before falling back again in November and then December.

The stock of outstanding borrowing by non-financial businesses (millions of pounds) in the UK, 2011 to 2016

- Published4 January 2017

- Published30 November 2016

- Published1 November 2022