Merkel rejects Trump adviser euro claim

- Published

Mrs Merkel said Germany "will not influence the behaviour of the ECB"

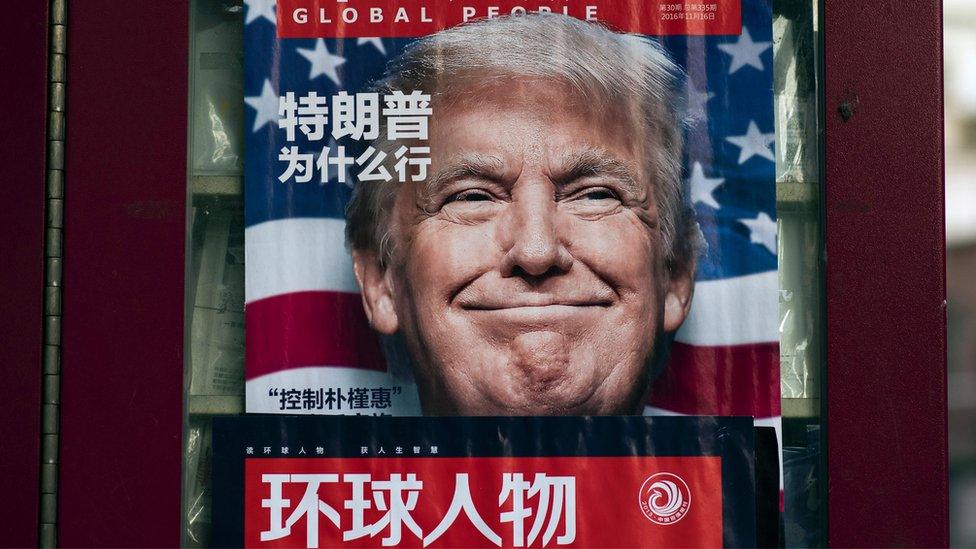

The German Chancellor has rejected comments made by a Trump adviser that Germany uses an undervalued euro to exploit trading partners.

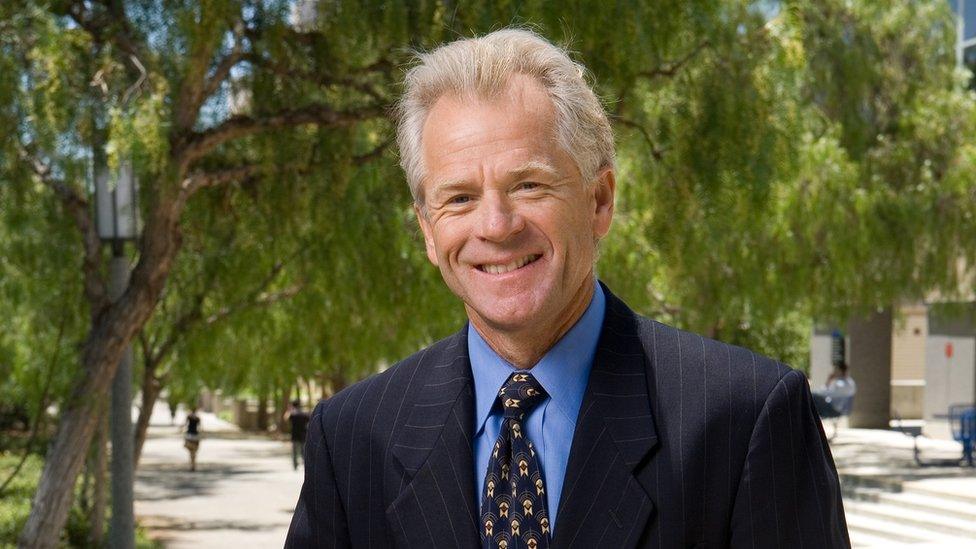

Peter Navarro, the head of Mr Trump's National Trade Council, told the Financial Times, external that the euro is a German currency in disguise.

But Mrs Merkel said Germany "has always called for the European Central Bank to pursue an independent policy".

She added that Germany "will not influence the behaviour of the ECB".

'Imbalance'

Mr Navarro also told the Financial Times that talks over the Transatlantic Trade and Investment Partnership (TTIP) between the EU and the US were dead.

"A big obstacle to viewing TTIP as a bilateral deal is Germany, which continues to exploit other countries in the EU as well as the US with an 'implicit Deutsche Mark' that is grossly undervalued," he told the Financial Times.

He added that there was a "structural imbalance" in trade.

Bloomberg News said, external the euro is trading "well below its fair value" according to OECD measures.

Those who argue the euro is undervalued often blame the ECB's monetary policy, including trillions of euros of asset purchases, aimed at stimulating inflation and growth in the eurozone, parts of which, notably Greece, are economically weak and need support.

The ECB, like the Bank of England and the US Federal Reserve, is independent.

A low currency makes goods cheaper to sell abroad. The US regularly tells China its currency is too cheap and gives its products an advantage in world markets.

'Independent'

Germany - which is the biggest economy in the 19-country bloc - differs from much of the rest by selling far more goods abroad than it imports, giving it a large trade surplus.

According to official figures from Destatis, external, in November 2016 Germany exported goods worth 108.5bn euros and imported goods to the value of 85.8bn euros - the highest monthly figures ever calculated both for exports and imports.

Analysis: Andrew Walker, economics correspondent

Has Germany done well out of the euro? The case that it has is about trade.

The argument is that the euro has been weaker than the Deutsche Mark would have been, and that has supported German exports.

Germany now has very large surplus in its international trade; the current account surplus (which includes some financial flows as well as goods and services) is 8% of the size of the country's economy.

It's another question whether having a large surplus is a good thing or not.

In any event, there's another side to Germany's competitiveness.

Wages rose very slowly in the years after the launch of the euro.

The country's unit labour costs , external(which allow for improvements in efficiency) actually fell in the euro's first decade.

And Germany is paying something for keeping the eurozone whole. For sure, the bailouts are loans. But the interest rates are so low and the repayment terms have been extended so much (this is especially true of Greece) that there is a cost for the lenders, the largest of which is Germany.

In response to Mr Navarro's comments, Mrs Merkel said: "Germany is a country that has always called for the European Central Bank to pursue an independent policy, just as the Bundesbank did that before the euro existed."

"Because of that we will not influence the behaviour of the ECB. And as a result, I cannot and do not want to change the situation as it is," she added.

Mr Navarro is also an economics professor at the University of California, Irvine

Mr Trump has made trade one of the central planks of a proposed radical overhaul of the way the US interacts with the rest of the world.

He has outlined a number of protectionist trade policies with the stated intention of creating more US jobs, including threatening to scrap a number of existing free trade agreements.

He has suggested withdrawing the US from the World Trade Organization, and in his first week on the job scrapped the Trans-Pacific Partnership.

China has also been singled out, and Mr Navarro has been a fierce critic of China.

- Published26 January 2017

- Published24 January 2017

- Published22 December 2016