Fed boss says US rates may rise in March

- Published

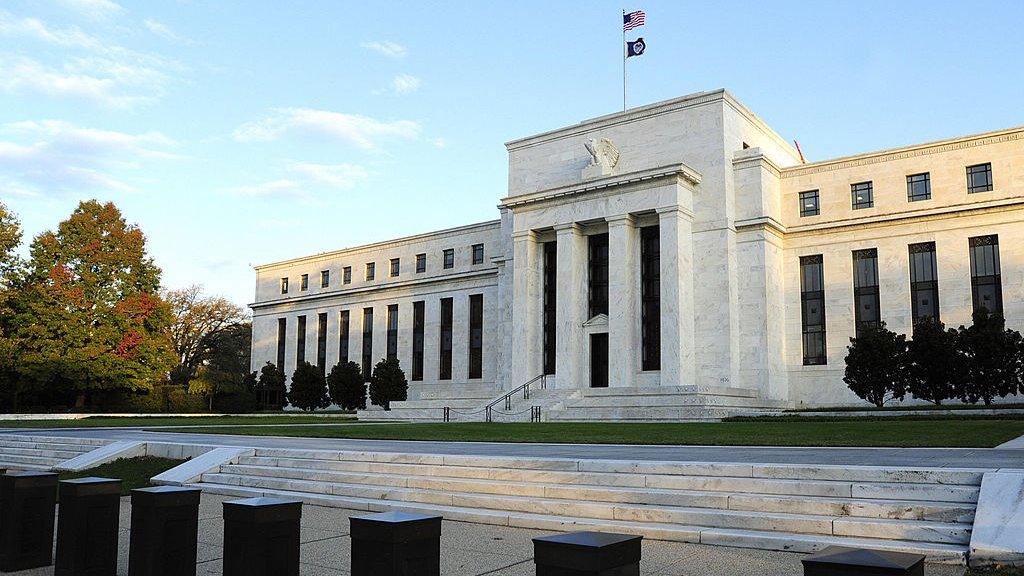

A rise in US interest rates could be "appropriate" as soon as this month, according to the chair of the US Federal Reserve.

Janet Yellen said rate setters will evaluate whether employment and inflation remain in line with expectations when they meet in March.

Ms Yellen also suggested the central bank was likely to raise rates more quickly than over the past two years.

Rates went up by 0.25% in December, only the second increase in a decade.

The benchmark interest rate, the Federal Funds rate, now stands at 0.5%-0.75%.

The Federal Open Market Committee (FOMC), which sets rates, has to ensure that the Federal Reserve achieves its goal of maximum employment and price stability.

Speaking to The Executives' Club of Chicago, external, Ms Yellen said the US economy had exhibited "remarkable resilience" in the face of adverse shocks in recent years" with the jobs market strengthening and inflation rising towards target.

She added: "We currently judge that it will be appropriate to gradually increase the Federal Funds rate if the economic data continue to come in about as we expect.

"Indeed, at our meeting later this month, the committee will evaluate whether employment and inflation are continuing to evolve in line with our expectations, in which case a further adjustment of the Federal Funds rate would likely be appropriate."

However, she added, it was not a "preset course" and FOMC "stands ready to adjust its assessment of the appropriate path for monetary policy if unanticipated developments materially change the economic outlook".

Economic outlook

Gennadiy Goldberg, interest rate strategist at TD Securities, said: "[Janet] Yellen has given us the strongest signal she could that a March rate hike is quite likely, without explicitly pre-committing. This is the firmest way that Yellen could have communicated that a March hike is likely."

In her speech Ms Yellen also said that waiting too long to raise rates "could potentially require us to raise rates rapidly sometime down the road, which in turn could risk disrupting financial markets and pushing the economy into recession".

She said she was confident that the "gradual" increase in rates was likely to be "appropriate".

However, she added that "unless unanticipated developments adversely affect the economic outlook", the increases in interest rates "likely will not be as slow as it was during the past couple of years".

The Fed expects to raise rates three times this year.

When it published its economic forecasts for the next three years, external in December it suggested that the Federal Funds rate may rise to 1.4% in 2017, 2.1% in 2018, and 2.9% in 2019.

- Published14 February 2017

- Published1 February 2017

- Published22 February 2017

- Published14 December 2016