Budget 2017 Reality Check: Do National Insurance changes break pledge?

- Published

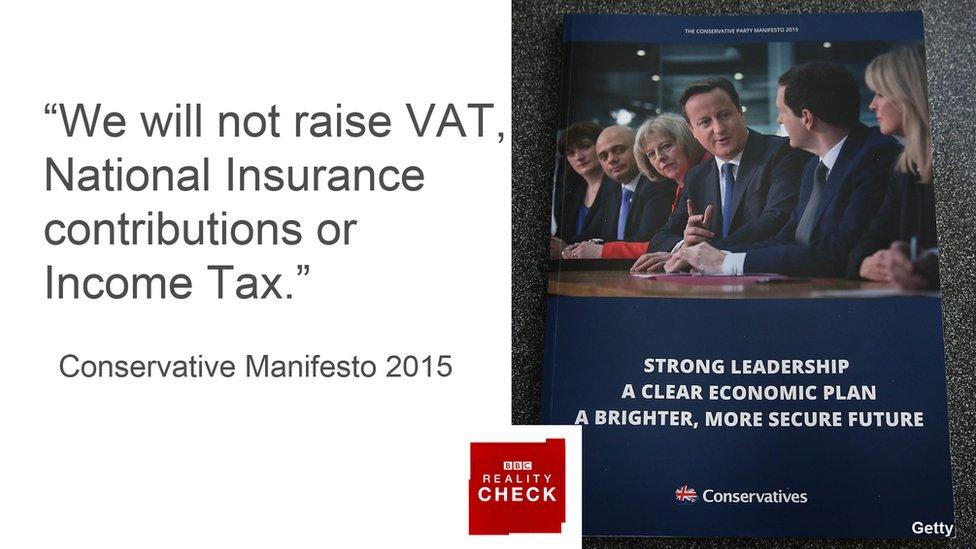

The claim: The government's increase in National Insurance contributions is a breach of its 2015 manifesto.

Reality Check verdict: The government did promise in its manifesto not to raise National Insurance contributions, and this is an increase, so it has broken that pledge. It has not broken the law that enshrined its pledge as this applies to employees only, not the self-employed.

Chancellor Philip Hammond has announced increases in the rate of National Insurance paid by self-employed workers.

But in the Conservative Party's manifesto, external for the 2015 general election, it promised: "We will not raise VAT, National Insurance contributions or income tax".

Currently, self-employed people pay two types of National Insurance: Class 2 and Class 4.

Class 2 contributions are a flat rate paid by self-employed workers making a profit of more than £5,965 a year

Class 4 contributions are a proportion of profits, paid when making a profit of more than £8,060 a year

George Osborne announced in 2016 that Class 2 contributions would be abolished from April 2018.

Philip Hammond has now announced that at that point, Class 4 contributions will increase from 9% to 10%, going up to 11% the following year.

Above profits of £43,000 a year, Class 4 contributions will still stand at 2%.

The overall effect of abolishing Class 2 and raising Class 4 will be to raise an extra £145m per year by 2021-22, so it clearly is a tax rise.

The government did pass an act of Parliament in 2015, called the National Insurance (Rate Ceilings) Act, external, which prevented it from raising National Insurance rates, although that will not be breached because it referred to Class 1 National Insurance only, which is paid by employees, not by the self-employed.

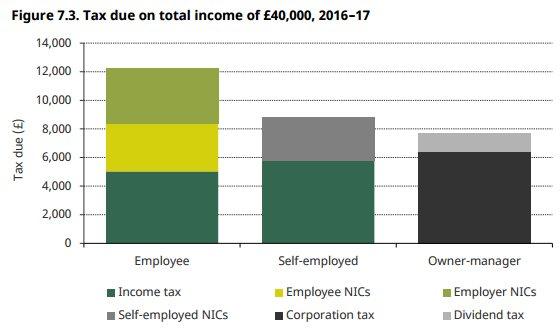

The Institute for Fiscal Studies argued before the Budget that the fact more tax was paid on the earnings of employees than those of the self-employed was not justified.

And the chancellor argued that the "dramatically different treatment of two people earning essentially the same undermines the fairness of our tax system".

- Published8 March 2017

- Published8 March 2017