Budget 2017: £2bn for social care and tax rise for self-employed

- Published

- comments

The changes are expected to raise £145m a year by 2021-22

Chancellor Philip Hammond has increased National Insurance bills for self-employed people in his first Budget - leading to accusations he has broken a manifesto pledge not to raise taxes.

There was also £2bn for social care services in England, and help for firms hit by business rate rises.

On the economy he said growth was expected to be higher - and borrowing lower - than forecast in November.

Labour leader Jeremy Corbyn said it was "a Budget of utter complacency".

Mr Hammond said there had been a "dramatic increase" in the number of people working as self-employed - and that the reason for doing so should not be "differences in tax treatment".

The disparity between the rates paid by the self-employed and employees "undermines the fairness of our tax system", he said.

Class 4 National Insurance contributions will go up to 10% from 9% and to 11% in April 2019, Mr Hammond told MPs.

Chief Secretary to the Treasury tells The World at One the "majority" of the self-employed will see a tax reduction

On its own, the change announced in the Budget would affect 2.5 million people.

But a separate category of National Insurance payments, Class 2, are already due to be abolished from 2018, and Mr Hammond said that taken together the two changes meant NI payments for a self-employed person would be on average 60p a week higher.

The Treasury later said that 1.6 million people would, on average, pay £240 more a year and no-one earning less than £16,250 would be worse off.

Mr Hammond said the different National Insurance rates had traditionally reflected a disparity in pension and benefit entitlement between self-employed people and those in employment.

But he said these had now been "very substantially reduced", and that the government would also consult on addressing disparities in relation to parental benefits.

Shadow Chief Secretary to the Treasury Peter Dowd says the government has their priorities "absolutely wrong"

The government immediately faced accusations of breaking a Conservative manifesto pledge not to increase VAT, National Insurance contributions or income tax.

Ministers said this promise related to the class of National Insurance paid by employees, not the self-employed.

Some Conservative MPs also raised concerns. "I don't think we should be going out of our way to tax work, growth and enterprise and success," said former Tory minister John Redwood. Read more - Reality check: Has manifesto pledge been broken?

Cash for social care

The government has been under pressure to offer more resources for social care budgets, with council leaders warning the entire system stands on the "brink of collapse" without an immediate cash injection and a commitment to a long-term solution.

Mr Hammond acknowledged the system was under pressure with an ageing population, and said the new £2bn for services in England over the next three years would allow councils to "act now to commission new care packages".

He also said the government would set out the options for long-term funding of the social care system later in the year - although these would not include a "death tax". Read more - Will the extra money plug gap?

Economy 'confounding commentators'

Opening his statement, Mr Hammond said the UK economy "continued to confound the commentators with robust growth", and promised his Budget would provide a "strong and stable platform" for the Brexit negotiations to come.

As predicted, there were improved economic forecasts via the Office for Budget Responsibility (OBR).

The OBR has revised up its growth forecast from 1.4% to 2% for 2017, predicting it will slow to 1.6% in 2018 before returning to 2% in 2021.

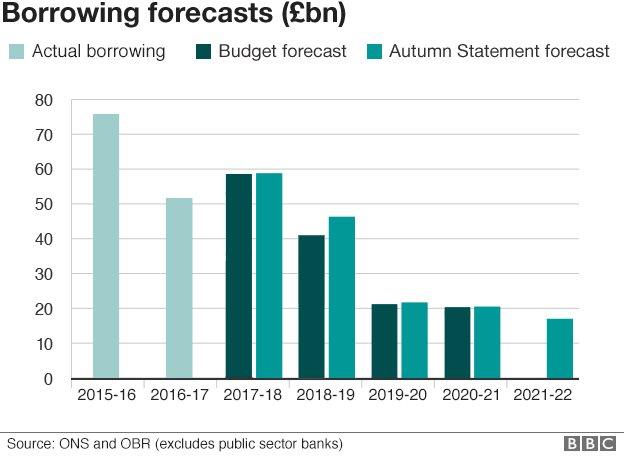

Due to "a number of one-off factors", borrowing was predicted to be £16.8bn lower than previously forecast, the chancellor said.

However, as the UK prepares for Brexit, Mr Hammond said there was "no room for complacency", and that the UK's deficit was still high, and productivity "stubbornly low". Read more - Focus on revised UK economy forecasts.

Date for balancing the UK's books delayed again...

According to the OBR's analysis, external, the government "does not appear to be on track" to meet one of its key fiscal targets.

Mr Hammond told MPs the deficit, the difference between what the government spends and what it receives, was "down by over two thirds".

In 2010 the Conservatives' original target was to eliminate the deficit by 2015. That has since slipped year-by-year and in November's Autumn Statement Mr Hammond pledged to eliminate it "as early as possible in the next Parliament".

But the OBR said: "The deficit falls little in 2020-21 and 2021-22, while the ageing population and cost pressures in health are likely to put upward pressure on the deficit in the next Parliament."

Tobacco and alcohol changes

There were no unexpected rises in the Budget, with the chancellor sticking to the previously pencilled-in rises.

So a packet of 20 cigarettes will cost 35p more from 18:00, while it will be 44p more for a 30g pack of hand rolled tobacco.

A pint of beer will cost 2p more from Monday, from when duty on a bottle of Whisky will rise 36p, with gin up 34p, cider 1p and a bottle of still wine 10p.

Business rates

The chancellor promised business rates help for firms including a discount for pubs

Mr Hammond has been facing a backlash, including from Conservative MPs, over businesses facing rates rises as a result of the revaluation of premises that is about to come into force.

The chancellor defended the revaluation, although he said he said it "undoubtedly raised some hard cases".

He announced a £300m "discretionary fund" to be used by councils to help companies that are badly hit, and a £50-per-month cap on increases for firms facing the loss of small business relief.

In a further measure, he said 90% of pubs would be given a £1,000 business rates discount.

Read more - help for pubs in rates revamp

Share dividend tax change - and other announcements

The biggest money raising measure was a reduction in the total amount of dividends company directors and shareholders can receive from businesses without having to pay taxes, from £5,000 to £2,000.

Mr Hammond said the move was meant to "address the unfairness" around the dividend tax advantage, which he claimed was "an extremely generous tax break for investors with substantial share portfolios".

Other measures included:

£100m for new triages in English hospitals and an extra £325m for NHS reform programmes

Funding of £5m to support people returning to work after a career break

Transport spending of £90m for the north of England and £23m for the Midlands to address "pinch points" on roads

£20m to support the campaign against violence against women and girls

£270m for maintenance of existing schools

Extending free transport to all free school meals pupils who attend selective schools

No change to previously-planned upratings of duties on alcohol and tobacco

Additional funding of £350m for the Scottish government, £200m for the Welsh government and almost £120m for the Northern Ireland Executive

What the other parties said

Jeremy Corbyn attacks the government over Budget 'complacency'

Responding to Mr Hammond, Labour leader Jeremy Corbyn said the Budget ignored the "crisis facing our public services and the reality of daily life for millions of people in this country".

He accused the government of "cutting services and the living standards of the many, to continue to fund the tax cuts of the few".

He calculated there would be a £70bn tax giveaway for "those who need it the least".

As an example, he said that instead of using £10m to set up a children's funeral fund, the government was cutting support for bereaved families.

The SNP's Stewart Hosie: "Five years of Tory austerity failed"

For the SNP, Stewart Hosie said Brexit had barely been mentioned, despite the "momentous" challenge it posed.

The Liberal Democrats said the social care announcement "gives sticking plasters a bad name".

"It is a woefully inadequate response to the impossible pressure the NHS and care services are under," Norman Lamb, the party's health spokesman, said.

UKIP MP Douglas Carswell criticised what he called an "attack" on self-employed people through National Insurance rates, and said the Budget was not "fundamentally sorting out the biggest problem we face", the UK's debt.

BBC editors' analysis

The chancellor repeatedly emphasised that it is a government that says it is preoccupied by "fairness" with ministers oft-quoted promise of a "country that works for everyone". But does that stack up? The overall picture might be slightly healthier in the government's giant balance sheets but it is still extremely challenging - hardly a land of milk and honey. And that slightly cheerier fettle in the forecasts is very different to the public feeling any better off - Read political editor Laura Kuenssberg's full blog

Uber and Deliveroo - the Treasury is on your case. Philip Hammond regularly cites evidence that the growth of self-employment is undermining the tax base - by between £3.5bn and £5bn a year by 2020 potentially. Those who are self-employed point out that they are in a much more precarious employment and have often decided to take a risk as entrepreneurs. And they do not receive pension contributions and entitlements such as holiday pay, which are rights for those directly employed by companies - Read economic editor Kamal Ahmed's full blog

Jokes from 'Spreadsheet Phil'

The chancellor committed £20m to fight violence against woman and girls

It wasn't all dry economics and tax announcements - the chancellor, billed beforehand as "Spreadsheet Phil", also sprinkled some jokes into his 55-minute speech.

He played up to his nickname ("this is the spreadsheet bit, but bear with me because I have a reputation to defend") but also took aim at Jeremy Corbyn, sitting across the despatch box.

The Labour leader, he said, was "so far down a black hole that even Stephen Hawking has disowned him", in a reference to the scientist's criticism earlier in the week.

He didn't stop there, quipping later in the speech that "they don't call it the last Labour government for nothing".

He also faced some good-natured heckling from the PM, when he told MPs two of his planned announcements had already been revealed by Theresa May.

"It's international women's day", she reminded him.

What we already knew

The chancellor posed with his red box before leaving Downing Street to head to Parliament

Several spending announcements were made ahead of Mr Hammond's Commons statement.

These included:

A £5m fund to mark the centenary of female suffrage next year

An extra £500m for vocational and technical education in England

A one-off £320m for 140 new schools in England, which could include grammars

Measures to protect people who inadvertently end up subscribing for services after signing up for free trials

Plans aimed at helping the North sea oil and gas industry

£500m support for electric vehicles, robotics and artificial intelligence

Aside from the Budget, several previously-announced changes come into force in April, including an increase in the personal tax allowance to £11,500, a new inheritance tax allowance, a rise in the annual ISA limit to £20,000 and the introduction of a levy to fund apprenticeships.

How business reacted

The Federation of Small Businesses criticised the changes to National Insurance paid by self-employed people.

"This undermines the government's own mission for the UK to be the best place to start and grow a business, and it drives up the cost of doing business," said its chairman, Mike Cherry.

Mark Littlewood, of the Institute of Economic Affairs, said the chancellor "defused one bomb" by providing relief for business rate rises: "But he has definitely exploded another bomb with this rise in NICs [National Insurance Contributions] for the self-employed."

For the CBI, the "limited" help over business rates "falls short".

British Chambers of Commerce director general Adam Marshall said: "Businesses had been advised to expect minimal change, rather than a blockbuster Budget, and Philip Hammond did not disappoint."

- Published8 March 2017

- Published8 March 2017

- Published8 March 2017

- Published8 March 2017

- Published8 March 2017

- Published8 March 2017