15 big changes to your finances in April

- Published

1 April brings changes to some important rates and taxes

Household budgets are likely to be further stretched in the first week of April, as dozens of items including water bills, council tax, NHS charges, and some broadband and energy charges all rise.

Those on welfare will feel the squeeze especially, as payment rates are frozen for the second year in succession, and the generosity of some benefits are reduced.

However, those in work are likely to become better off, as tax rates become more generous, and the National Living Wage also rises.

Some of these changes will occur on 1 April, at the start of the government's financial year, while others occur on 6 April, the start of the tax year.

Taxes and Wages

1. Income tax

From 6 April the personal allowance - the annual amount you can earn before paying tax - rises from £11,000 to £11,500. This should save over 20 million people £100 a year, and take thousands out of tax altogether.

At the same time the starting point for paying the higher, or 40%, rate of tax will move from £43,000 to £45,000. This will save higher rate taxpayers a further £400 a year.

However, in Scotland the higher rate threshold has been frozen at £43,000, so better-off taxpayers north of the border will see no benefit.

2. National Living Wage

Millions of people over the age of 25 will receive a 4% pay rise from 1 April, as the National Living Wage (NLW) increases from £7.20 an hour to £7.50.

However, those between the ages of 21 and 24, who receive the National Minimum Wage (NMW), will get a rise of only 1.4% - well below the current 2.3% CPI inflation rate.

The new wage rates are:

NLW (25+): £7.50

NMW (21-24): £7.05

NMW (18-20): £5.60

NMW (under 18): £4.05

NMW apprentice: £3.50

3. Lifetime Isa

Savers can apply to open a new Lifetime Isa (Lisa) from 6 April. The government will add a 25% bonus to your savings after a year, up to a maximum of £1,000. The Lisa is designed for people who want to buy a property, or need a retirement income.

Anyone nearing the age of 40 is advised to consider opening a Lisa soon, as those over that age cannot start an account.

More details about the Lisa here.

4. Isa

The allowance for saving into an ordinary Individual Savings Account (Isa) goes up from £15,250 to £20,000 from 6 April.

The money can be invested in a cash Isa, or in stocks and shares.

There is no tax to pay on income from an Isa, or on any capital gain.

5. Car tax (Vehicle Excise Duty)

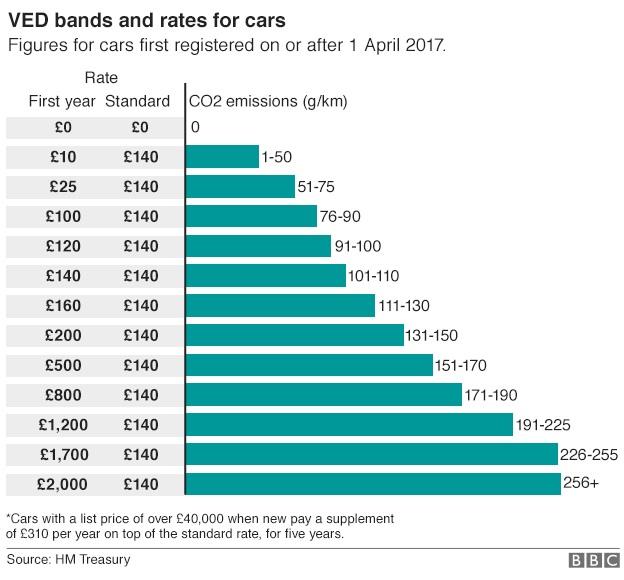

Anyone buying a new car from 1 April will pay a different rate of Vehicle Excise Duty (VED).

This is because car emissions have got so much cleaner that most of them would no longer qualify for VED at all.

New buyers will pay a special rate in the first year, depending on engine emissions, followed by a fixed rate in one of three categories thereafter: zero emission, standard or premium.

The standard rate will be £140. Luxury cars, costing more than £40,000 will pay an extra £310.

Rates for existing car owners will not change.

6. Inheritance tax

Inheritance tax will become less onerous for people who want to leave property to their children.

Currently, any estate worth more than £325,000 carries a tax liability of 40% on anything above that threshold.

But from 6 April there will be a new transferable main residence allowance on property within the estate, enabling individuals to pass on an extra £100,000 tax free.

Couples who are married, or in a civil partnership, will now be able to pass on £850,000 in total without paying tax, an amount that will rise to £1m by 2021.

7. Council tax

People living in England will see the steepest general rise in council tax. From 1 April the rise will average 4%, equating to £61 for a typical Band D property. The rise will be smaller in district councils, which do not have responsibility for social care, and up to 4.99% in those that do.

In Scotland the average rise is 3%, equating to about £32 for a Band D property. However, householders in the top four bands (E to H) will see extra increases, due to MSPs deciding to increase the "multiplyer". Those with properties in band E will see typical rises of £105 a year, while those in band H are likely to pay £517 more.

Council taxpayers in Wales will see a rise of 3.1% on average, equal to about £35 a year on a Band D property.

Rate-payers in Northern Ireland have still not been told what their bill will be, due to political issues.

Benefits

8. Child tax credit

From 6 April there will be cuts to future child tax credits. Where a first child is born after this date, claimants will no longer receive the family element of the payment, worth £545 a year.

Those whose first child was born before 6 April will see no change.

In addition, those who have a third or subsequent child after this date will no longer receive a payment for that child - limiting future tax credits to two children only.

The same will apply to people claiming universal credit. The Institute for Fiscal Studies, external (IFS) calculates that as a result of this change alone, 600,000 three-child families will on average be £2,500 worse off than under the old system.

But in practice no existing parent, and no existing claimant, will actually lose money.

9. Employment Support Allowance (ESA)

From Monday 3 April new claimants for the Work Related Activity Group (WRAG) of ESA will receive £29 a week less than existing claimants. These are people whom the government judges may be capable of working at some stage in the future.

They will receive £73 instead of £102, to bring them into line with claimants for Jobseeker's Allowance (JSA).

The IFS has estimated that half a million future claimants will receive £1,400 a year less than current claimants.

10. Freeze to benefits

April 2017 sees the start of the second year in which many state benefits will be frozen. This includes JSA, ESA, child benefit and some housing benefit payments.

Given that CPI inflation is currently running at 2.3%, this will amount to a real terms cut for tens of millions of people.

The freeze is due to last until March 2020.

11. Universal credit

From 10 April, those people who claim universal credit (UC) will be allowed to keep more of what they earn from a job before their benefits are reduced.

Previously those in work were allowed to keep 35p out of every pound they earned, before their UC payment was cut.

Now they will be allowed to keep 37p in every pound. This is as a result of the so-called taper rate being reduced from 65% to 63%.

Others:

12. NHS charges

The cost of an NHS prescription in England rises on 1 April from £8.40 to £8.60. However the cost of pre-payment cards has been frozen.

Dental charges in England are also rising. The cost of a check-up will go up by 90p to £20.60, the cost of a filling goes up by £2.40 to £56.30, and the most complex work will go up by £10 to £244.30.

13. Pre-payment meters

From 1 April, four million consumers who use pre-payment meters for their gas and electricity will see their charges capped. The regulator, Ofgem, says they should each save around £80 a year.

However, on average they were paying £220 more than other consumers, so they will still be paying a higher charge than others.

14. Water bills

Water and sewerage bills will go up on 1 April. The average rise in England and Wales is 2%, making a typical annual bill £395. In Scotland the rise will be 1.6%, or around £5 per household.

Residents of Northern Ireland pay for water through their rates bills.

15. Other bills

Some energy bills will rise significantly. SSE customers on standard tariffs will see electricity prices rise by 14.9% on 28 April. E.On will increase electricity prices by 13.8%, and gas prices by 3.8%, on 26 April. Most other suppliers increased their prices in March.

Several telecoms companies, including BT, EE and Vodafone are putting up prices. The cost of BT broadband, for example, will go up by £2.50 a month.

On 1 April the cost of a TV licence goes up by £1.50, to £147.