Outlook for City after Brexit 'has improved'

- Published

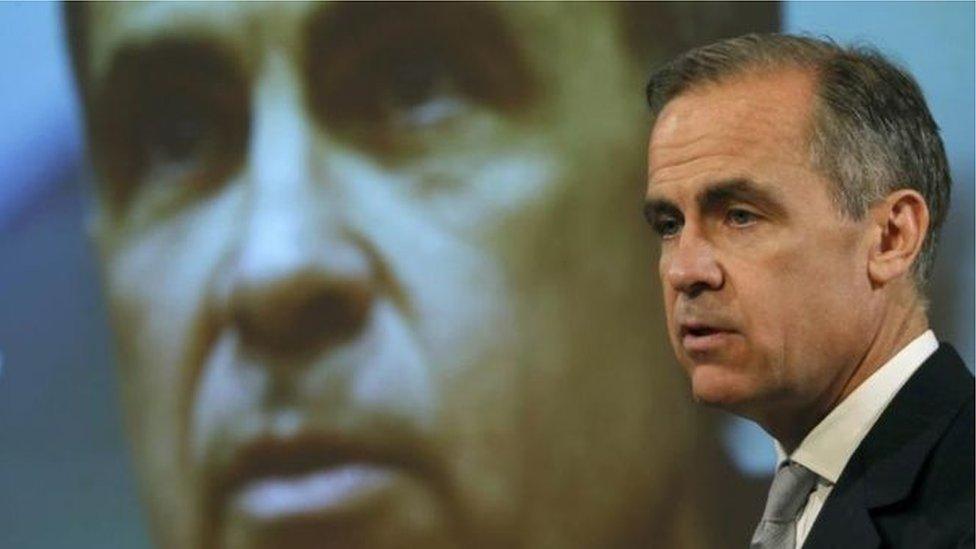

Mark Boleat said things were looking "rather better" for financial firms after Brexit

The outlook for the UK financial sector has improved since Brexit was triggered, the policy chief for the City of London Corporation has said.

Mark Boleat said London would remain a leading financial hub, with only a few banking jobs likely to move.

Urging speedy trade talks, he added: "We would hope that the negotiations go quickly and go well."

The triggering of Article 50 of the Lisbon Treaty last month began the two year countdown to the UK's EU exit.

Before the referendum, the financial services sector largely backed the Remain campaign, warning that quitting the bloc could spur an exodus of City jobs.

The City of London, the council that covers London's financial centre, itself backed EU membership.

Since then, banks including Goldman Sachs, HSBC and UBS have said they will move some jobs out of London as a result of Brexit.

The historic insurance market Lloyd's of London has announced plans to open a Brussels subsidiary in early 2019.

But in an interview with the AFP news agency, Mr Boleat said that while a few people would be moved, "no one is going to say 'we are closing down in London'".

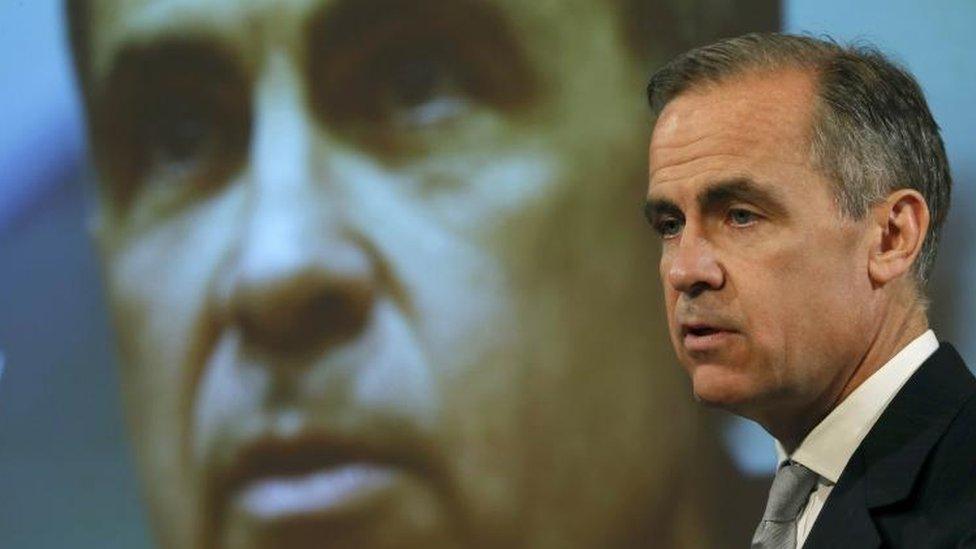

Mark Carney said the "vast majority" of City firms already had contingency plans

"Banks have had contingency plans since before the Brexit referendum in some cases," he said.

"They have known there is a possibility that Britain will not be in the single market - that has now been confirmed."

He said banks would need to "restructure what they are doing - perhaps cease doing a few things, in some cases build up business elsewhere in the European Union. They are getting on and doing that."

Mr Boleat also said it was important the UK reached an early agreement over the terms of its exit from the bloc and on the rights of EU nationals.

That would minimise disruption to "business and consumers in this country - and in Europe," he said.

On Friday, the Bank of England governor warned of sector-wide consequences if the UK left without a trade deal.

Mark Carney said the "vast majority" of City firms already had contingency plans in place.

However, he said some financial firms still needed to prepare in case of a "more extreme" outcome.

The Bank has written to the UK's biggest financial firms, urging them to plan for "all eventualities" from the UK leaving the bloc.

- Published7 April 2017

- Published27 February 2017

- Published18 January 2017