Car finance deals: Do they spell trouble?

- Published

A growing number of people get their new car via a personal contract purchase

Here is a fascinating conundrum: The price of new cars has gone up significantly in the last five years, yet they have become cheaper to drive.

How can that be?

The answer lies in the creative genius not of the car designers, but the financial engineers who invented a new way to borrow money.

The result has been a car-buying boom the likes of which the UK has never seen.

The Bank of England and the Financial Conduct Authority (FCA) are already concerned at the record £31.6bn we borrowed to buy cars last year.

But now it appears the FCA may also be worried about the finance deals themselves.

It is going to investigate what it calls "a lack of transparency, potential conflicts of interest and irresponsible lending" in the motor finance industry.

So should car buyers be concerned as well?

Renting

Until five years ago, most people would go to a bank to get a car loan, or else take out a Hire Purchase (HP) contract, paying for their car over several years.

But last year 82% of new car finance deals were defined as Personal Contract Purchase, or PCP.

Car sales have boomed in recent years

The idea - imported from the US - has revolutionised the way we borrow.

Instead of buying a car outright, a PCP allows you to rent the car over a three-year period.

The money you pay merely finances the depreciation in the car's value over that timeframe, meaning you pay substantially less than if you were buying it.

At the end of the three-year period you have three choices:

Buy the car for its residual value, after depreciation. This is known as a "balloon" payment

Hand the car back

Roll over the residual value of the car into a new PCP on a new vehicle

If you have ever wondered why there are so many new cars on the road, it is because most people choose the last option, driving out of the showroom in a shiny new model every three years.

'Like mobiles'

One reason PCPs have become so popular is that they price cars in monthly payments, rather than the full one-off amount.

Some people liken them to mobile phone contracts.

"Everybody's got used to paying a monthly payment for a mobile phone. At two years you get an upgrade," says Louise Wallis, head of business management at the Retail Motor Industry Federation.

"The same psyche is beginning to happen with cars. It's just on a bigger scale."

Another reason PCPs are so popular is that they are far cheaper than traditional ways of borrowing, like HP.

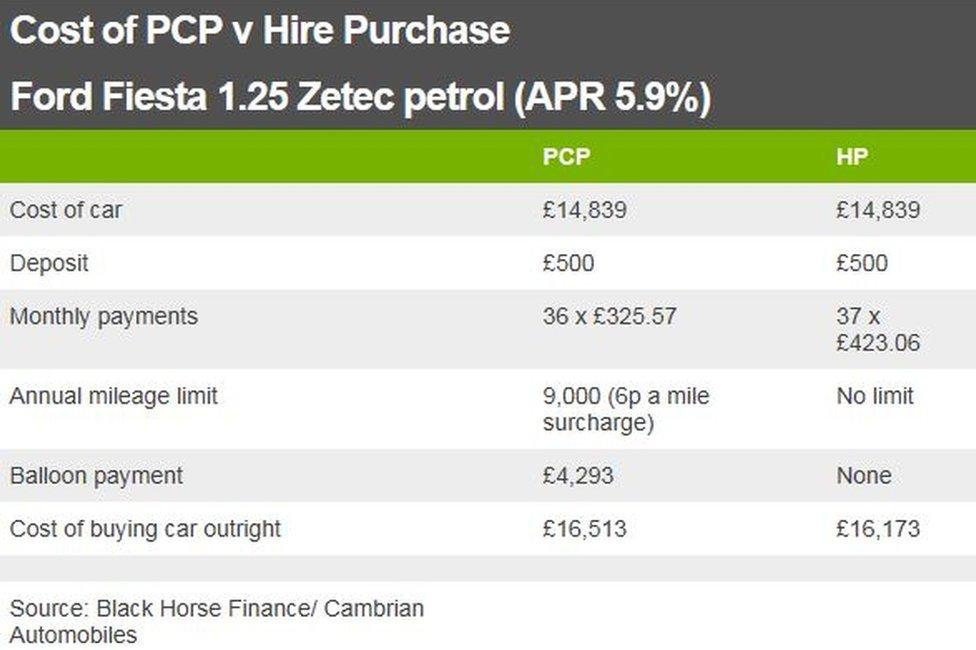

In the example above, driving a Ford Fiesta 1.25 Zetec would cost you £325 a month. The same car on HP would cost £423.

Unlike with a PCP, at the end of the HP contract you would own the car outright.

If you want to buy the car at the end of the PCP, you make the balloon payment.

But there are additional restrictions. There is usually an annual mileage limit, with in this case a penalty of 6p a mile if you go over it.

If you know you want to buy the car outright, HP is usually cheaper than PCP. In the example above it would save you £340.

'I couldn't get out of my PCP'

Jane Wells wanted to get out of a PCP contract

Jane Wells, from Essex, bought a Nissan Juke on a PCP three years ago. The car cost about £17,000.

But a year into the contract she bought a camper van, and decided she didn't need the Nissan any more.

The dealership told her she would have to pay the outstanding £15,000 to cancel the deal, which she couldn't afford.

"The bottom line is that you can't get out of it very easily," she told the BBC.

As a result she had to continue making the monthly payments.

"I could have been in the situation where I'd lost my job. Then where would I have been?"

As with any loan, the penalty for cancellation can be large, especially in the early stages.

Adrian Dally, head of motor finance at the Finance and Leasing Association (FLA), says it works in a similar way to a repayment mortgage.

"The earlier on in a deal you are, the more capital is outstanding. So you will have more to pay if you exit early."

Finance and Leasing Association: What is a PCP?, external

There is another feature of PCPs the FCA may be interested in examining.

Although motorists are free to walk away at the end of an agreement, in practice dealers ring up at least six months beforehand, offering an enticing new deal.

Jane Wells ended up having seven Nissans in a row: A black Note, a blue Note, a red Note, a white Note, a blue Micra, a black Micra Cabriolet and the Juke.

"Every time they phoned me and said would you like another car, I was silly enough to go 'alright then'. When you wanted to end that cycle of having a new car after new car, it was very difficult to get out of it."

The FCA may certainly question whether this is a market in which competition is working properly.

'Think carefully'

However since PCPs are regulated by the FCA, they do offer customers plenty of protection. If things go wrong, and a borrower cannot afford the repayments, they may also prove less costly than an HP agreement or a personal loan.

Mark Lavery says personal loans are more risky than PCPs

Mark Lavery, chief executive of Cambria Automobiles, says personal loans are much more risky.

"You're on the hook for that debt; the way PCPs work, you're not. If you take a personal loan or an overdraft, in my opinion that's where the risk is."

The Finance and Leasing Association is also insistent that dealers are lending responsibly.

However evidence gathered by the credit reference agency Experian suggests the biggest growth in applications for PCPs is coming from those whose finances are already stretched.

That may leave plenty for the Bank - and the regulator- to worry about.

But motorists too may want to think carefully about who's really in the driving seat when they exit the showroom.

- Published18 April 2017