Bank of England warns of consumer spending squeeze

- Published

- comments

Bank of England governor Mark Carney has warned of a consumer spending squeeze this year as inflation rises and real wages fall.

This year will be "a more challenging time for British households" and "wages won't keep up with prices", he said.

He was upbeat about wage growth beyond 2017 - but only if the government secures a "smooth" exit from the EU.

It came as the bank trimmed UK economic growth forecasts for 2017 from 2% to 1.9% and held interest rates at 0.25%.

The bank, unveiling its Quarterly Inflation Report, external, also raised its forecast for inflation this year to 2.8% from its February forecast of 2.4%.

Interest rates are set by the Bank's Monetary Policy Committee (MPC), which is tasked with keeping inflation at 2%.

Live: Bank of England inflation report - latest news and reaction

Kamal Ahmed: Short term negatives, long term positives

The Bank said the expected overshoot in inflation to 2.7% this year was "entirely" due to the impact of weak sterling and that raising interest rates would not be an effective way of tackling the increase in living costs.

Before last June's referendum the pound was trading at about $1.47. It is currently trading around $1.29 - some 12% lower.

The Bank also highlighted that its current forecasts were based on the assumption that "the adjustment to the United Kingdom's new relationship with the European Union is smooth".

Mr Carney characterised a "smooth" Brexit as the UK securing "an agreement about future trading arrangements and there will be a transition, or an implementation period, from the negotiation to that new agreement".

Lucy O'Carroll, chief economist at Aberdeen Asset Management, said: "The Bank of England is stuck between a rock and hard place. It has to base its forecasts on a view of the Brexit deal but, with so little to go on at present, it's not an easy judgement.

"To say that is far from certain is a huge understatement. Governor Carney acknowledges the risks, but the weight of uncertainty - and therefore frailty of the forecasts - does undermine the Bank's relatively positive message."

Mark Carney said wage growth should pick up beyond 2017

At the moment, Mr Carney said there was some evidence "that businesses are hesitating to bring in higher wage costs at a time of some uncertainty about market access and other costs that could be associated with the Brexit process, resulting in more modest wage settlements".

However, if business concerns ease over the process of exiting the EU, wage growth will accelerate.

Since the MPC's previous interest rate meeting in March, official figures have indicated that the economy is weakening. The economy grew by 0.3% in the first quarter of 2017, a sharp slowdown from the 0.7% growth rate in the final three months of 2016.

"The slowdown appears to be concentrated in consumer-facing sectors, partly reflecting the impact of sterling's past depreciation on household income and spending," the Bank said in its report.

It says that consumption growth will be "slower in the near-term than previously anticipated", but then forecasts that it will recover over the next two years as income growth picks up.

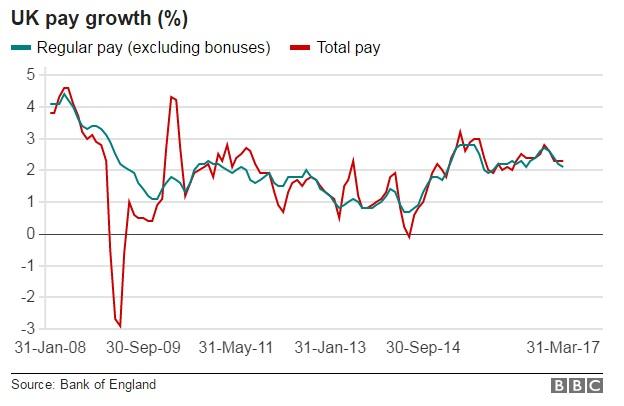

The Bank forecasts that average weekly earnings will grow at a rate of 2% this year, but rise to 3.75% by 2019.

Rate moves

If the UK economy follows the Bank's projections and begins to improve, it said monetary policy may need to be tightened.

At this month's meeting the Bank of England's Monetary Policy Committee (MPC) voted 7-1 to keep the interest rate on hold.

Ben Brettell, senior economist at Hargreaves Lansdown, said: "Unsurprisingly interest rates were left unchanged, with just Kristin Forbes voting for a 0.25% rise to 0.5%. However, the Bank also warned that rates may have to rise sooner and faster than the market currently expects.

"It might not take much positive economic data to persuade further MPC members to join Forbes and vote to hike rates, though it should be noted that she is due to leave the MPC at the end of June."

- Published28 April 2017

- Published11 April 2017

- Published12 April 2017