Why a $1.6bn car plant has been left to decay

- Published

The skeletal structure is all that remains of Ford's factory plans

Mexico is currently the world's fourth largest car exporter, but could US President Donald Trump's plans to renegotiate the North American Free Trade Agreement (Nafta) between the US, Canada and Mexico bring this to an end?

On the outskirts of the Mexican state of San Luis Potosi, the skeletal remains of the partially constructed Ford plant loom over the desert. To the residents of the small towns surrounding the site it's a constant reminder of a failed economic promise.

For Jose Puebla Ortiz, who sold his plot of land to Ford, it's still painful to think of the economic prosperity his family could have had.

Mr Puebla Ortiz used the proceeds from the sale to buy a truck. He expected to work as a private contractor during the plant's construction, but since the company cancelled its plans he has struggled to find regular high-paying work.

Jose Puebla Ortiz bought his truck with money from selling land to Ford

"When Ford arrived and we thought everything would be good... there was investment and there was money," he says.

Now that investment has dried up.

"[Ford] decided to pull out and overnight they told us, 'it's over, we're not continuing, we're leaving, this is cancelled.' And, well, there was nothing we could do."

More stories from the BBC's global trade series looking at trade from an international perspective:

'You don't have to be a squillionaire to buy art'

The slimming pills that put me in hospital

In January, Ford announced it was cancelling plans to spend $1.6bn (£1.2bn) building a factory in here in central Mexico. The company's chief executive at the time, Mark Fields, said the decision related to the declining sales of small cars the company was intending to build at the new plant.

But he also admitted that Donald Trump's presidential victory and the "improved business climate" the company expected as a result was a factor.

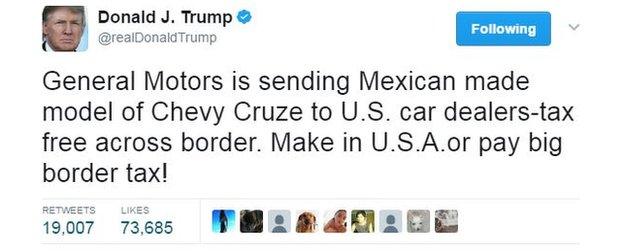

During the campaign and since assuming the presidency Mr Trump has expressed his anger at car companies such as GM and Toyota for using Mexican plants to build cars sold in the US.

He has called for the North American Free Trade Agreement (Nafta) to be renegotiated, blaming it for the loss of US jobs.

The agreement - which came into effect between the US, Canada and Mexico in 1994 - created one of the world's largest free trade zones by reducing or eliminating tariffs on most products.

Before taking office Donald Trump tweeted a threat targeting General Motors

It is that kind of executive pressure that has residents here worried.

"It's because of [Donald Trump] that the plant wasn't made here - he said if he became president he'd take it away. He became president and he followed through," says Fidel Ribera, who had been working on the construction of the Ford plant.

Fidel Rivera (second from left) and others who were construction workers on the Ford plant are now unemployed

For many in San Luis Potosi, Mr Trump's presidency is seen as a real threat. But most economists, politicians and industry observers think his calls to pull out of or rework Nafta are all talk.

"There's a learning curve," says Eduardo Soliz Sanchez, head of Mexico's car trade body AMIA.

He says the checks and balances in the US government, where the different branches of government hold equal authority and offset one another, and the interdependence of the car industry across the Nafta members will keep the deal alive.

"Someone should explain to Mr Trump," says Manuel Molano from the Mexican Competitiveness Institute. "Maybe you started with an oil molecule in Mexico. That becomes some plastic [part] and goes up north to the US, and becomes a more sophisticated part of a car. [Then the piece] goes back south and becomes a motor, and then goes back up and becomes a complete car."

President Bill Clinton signed Nafta in 1994

On average car parts made in North America cross the US border to Mexico or Canada eight times. And that could mean that restricting Nafta or imposing border taxes on car parts made in the US's neighbours could cost American jobs.

Mexican officials are betting the US won't shoot itself in the foot even as its new president tries to change his country's role in the global economy.

It's a bet they can't afford to lose.

The car sector makes up 6% of Mexico's gross domestic product and 25% of its exports. In just over 20 years Mexico has gone from a relatively insular economy to the fourth largest car exporter - behind Germany, South Korea and Japan.

GM's San Luis Potosi plant is just a few kilometres from where Ford started to build its factory

Economist Jonathan Heath says Nafta "cemented" the opening of Mexico's economy.

"That is when the auto industry started to flourish. Now almost every single carmaker in the world is present in Mexico," Mr Heath says.

It is not just Nafta that has attracted companies such as BMW, Nissan and General Motors. Mexico has trade deals with 45 countries and its position on the US border, with access to both the Atlantic and Pacific Oceans, makes it an ideal trading hub for carmakers.

Mexico is the fourth largest car exporter behind Germany, South Korea and Japan

But any changes to its deal with the US would still be a big blow. Mexico exported 77% of the cars it made to the US last year.

Still AMIA head Mr Soliz Sanchez admits that after 23 years Nafta would benefit from being updated. He says his group, which represents Mexico's car and car parts makers, would be okay with "deepening and modernising" the trade agreement.

Mexico's car industry has a lot to lose if trade with the US is damaged

But for Mexicans who have benefited from its influence, changes to the deal pose a risk.

"We have people from the community here working in BMW, in General Motors," says Mr Ortiz.

"That's what we imagined with Ford - that there'd be a lot of work so there'd be enough for all the boys. But there's nothing we can do, this was cancelled. Ford was cancelled."

Mr Ortiz's village is thousands of miles from Washington DC, but the decisions and the rhetoric coming from the US is having a direct impact on him and his neighbours. While the car industry as a whole may not be turning its back on Mexico, the uncertainty is casting a shadow over the livelihoods of Mexicans that rely on the sector.

- Published20 January 2017

- Published3 January 2017