UK inflation rate at highest level since September 2013

- Published

- comments

The challenge of coping with rising costs

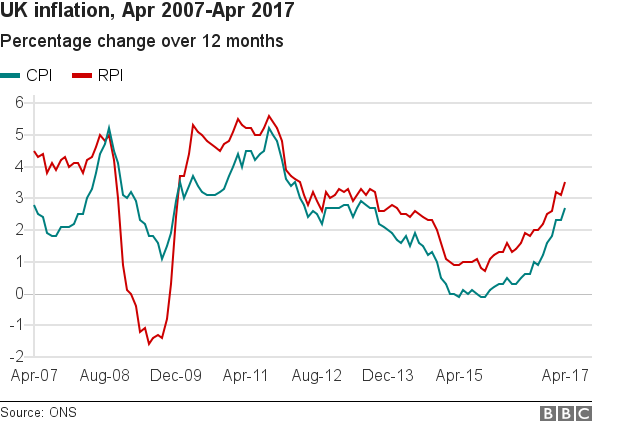

The UK's inflation rate rose last month to its highest since September 2013, official figures show.

Inflation now stands at 2.7% - up from 2.3% in March - and above the Bank of England's 2% target.

The main reason was higher air fares, which rose because of the later date of Easter this year compared with 2016.

Rising prices for clothing, vehicle excise duty and electricity also played a part, but a fall in the price of petrol and diesel slightly offset this.

Last week, the Bank of England warned that inflation as measured by the Consumer Prices Index (CPI) would peak at just below 3%, external this year.

It also warned that 2017 would be "a more challenging time for British households" with inflation rising and real wages falling - leading to a consumer spending squeeze.

Pay including bonuses rose at an annual rate of 2.3% in the three months to February, according to the ONS. The latest figures on earnings growth are due out on Wednesday.

Cheaper fuel

The Office for National Statistics (ONS) said, external the cost of air travel went up by 18.6% from the month before, with Easter falling on 16 April this year compared with 27 March last year.

The price of clothes jumped to the highest level for six years, with a rise of 1.1% between March and April.

Electricity and food prices also went up, but there were falls in the cost of gas, petrol and diesel.

The Retail Prices Index (RPI), a separate measure of inflation which includes council tax and mortgage interest payments, reached 3.5% last month, up from 3.1% in March.

The ONS's new preferred inflation measure of CPIH, which contains a measure of housing costs, rose to 2.6% from 2.3% in March.

Chris Williamson, chief business economist at analysts IHS Markit, said: "The timing of Easter looks to have played an important role in pushing inflation higher in year-on-year terms.

"But sterling's depreciation since the referendum last June is also clearly a significant factor, lifting prices for imports and likely to pile further upward pressure on consumer prices in coming months.

"There are nevertheless signs that inflation could perhaps rise less than many had been fearing.

"Survey data are already showing companies' costs are rising at a slower rate than earlier in the year, and recent weeks have seen some easing in global commodity prices, notably oil."

'Transitory' effect

Suren Thiru, head of economics at the British Chambers of Commerce, said: "Businesses continue to report that the substantial increases in the cost of raw materials and other overheads over the past year are still filtering through the supply chain, and are therefore likely to lift consumer prices higher in the coming months

"However, it remains probable that the current period of above target inflation is transitory in nature, with little evidence that higher price growth is becoming entrenched in higher pay growth.

"This should give the Bank of England sufficient scope to keep interest rates on hold for some time yet, despite their recent warning."

- Published11 May 2017