Dulux owner wins court victory in shareholder battle

- Published

Dulux paint owner Akzo Nobel has scored a court victory in its battle to fight off an unwanted takeover offer from US rival PPG Industries.

A Dutch court rejected attempts by a group of shareholders to force a special shareholder meeting aimed at ousting the company's chairman.

Antony Burgmans is seen as the main obstacle to the PPG takeover bid.

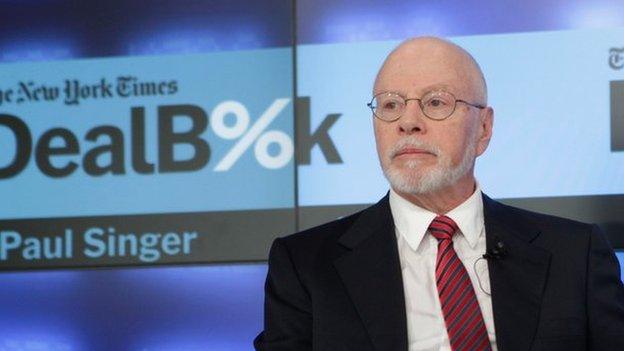

Hedge fund Elliott Advisors, which brought the case to court, has urged Akzo to "engage" with PPG.

But The Enterprise Chamber, a commercial court of the Netherlands, ruled that Akzo was not required to hold the special meeting or to include investors in its response to the PPG bid.

A spokesperson for Elliott Advisors said it was "disappointed".

"Elliott is considering the implications of this judgment for shareholder rights in the Netherlands and for its next steps in relation to Akzo Nobel," he added.

Akzo has rejected three successive takeover offers from PPG since March, saying the €26.9bn (£22.8bn) offer undervalued the firm and showed a "lack of cultural understanding of the brand".

The Dutch company, which claims its own plans for growth are superior, has also been urged to reject the merger by the Dutch government and its own workers.

PPG will now need to decide whether to walk away from Akzo Nobel, or go directly to shareholders with a hostile takeover offer.

The US firm suggested its third bid earlier this month was its last friendly attempt to merge with Akzo and indicated it had not ruled out putting the matter directly to shareholders.

Decision time

Under official takeover rules, the firm has until 1 June to decide.

After the court ruling, PPG said it "remains willing to meet with Akzo Nobel regarding a potential combination of the two companies".

"But without productive engagement, PPG will assess and decide whether or not to pursue an offer for Akzo Nobel," it said.

Akzo says its own plans for the firm - which involve spinning off its chemicals division into a separate business - would better serve shareholders.

It has promised to increase its dividend for 2017 by half and pay a €1bn special cash dividend in November.

- Published8 May 2017

- Published16 April 2018

- Published24 April 2017

- Published22 March 2017