Bank of England sounds alarm on debt bubble risks

- Published

- comments

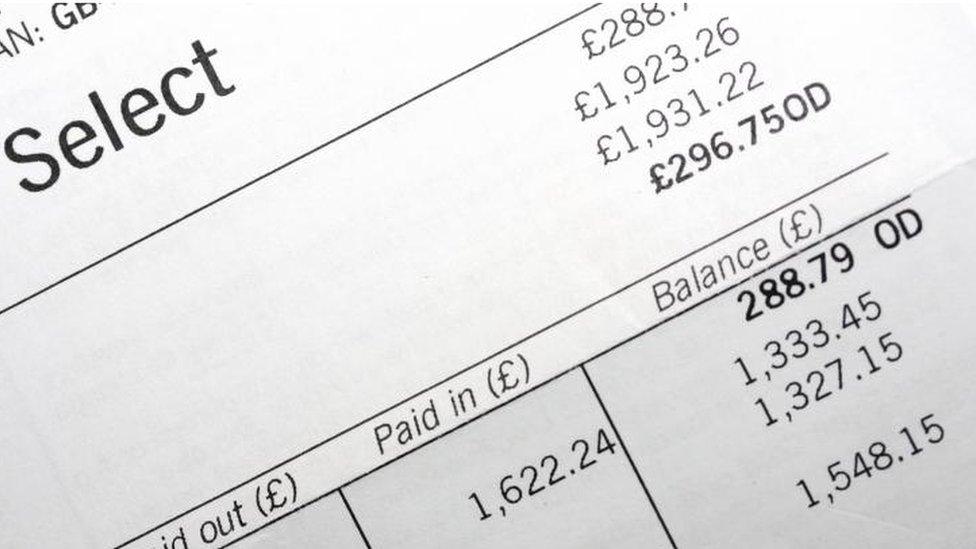

Lenders are underestimating the hit they would take from consumers defaulting on debt in a downturn, according to the Bank of England.

The Bank's Financial Policy Committee (FPC) said there were "pockets of risk" in the current level of lending on loans, overdrafts and credit cards.

It estimated that in a "severe downturn", UK banks could incur losses of £30bn.

That is the equivalent of 20% of UK consumer credit loans.

The conclusions were aired in a statement published on Monday following the FPC's meeting on Wednesday.

The Bank has consistently expressed the need for vigilance over growth in the consumer credit market during "benign" economic conditions.

This was repeated, although the FPC said it was relevant for the banks' resilience in an economic downturn, rather than a threat to the economy as a whole.

"This is not a material risk to economic growth, as consumer credit represents only 11% of overall household debt," the statement said.

Earlier this summer, another of the Bank's arms - the Prudential Regulation Authority - ordered banks to address specific concerns about their treatment of consumer credit. The Bank had also told lenders to beef up their finances against bad loans.

Credit card cap

Consumer credit, which also includes car finance, rose by 9.8% in the year to July, but has been at double-digit levels in recent times.

This has prompted fears from debt charities that families are relying on debt at a time of low wage growth, potentially storing up financial trouble for later.

"With levels of outstanding borrowing approaching levels not seen since the economic crisis and households are increasingly financially vulnerable, debt is an issue that needs to become a priority for policymakers now," said Mike O'Connor, chief executive of the StepChange debt charity.

"The way in which financial products are designed, especially credit cards, with low minimum repayments and high credit limits, can allow people to rapidly build up substantial debt levels and become trapped in spirals of unsustainable borrowing."

At its party conference, Labour pledged that it would introduce a law to limit the interest charged on credit card debt.

The City regulator, the Financial Conduct Authority, has said that more than three million people are in persistent debt, which it defines as having paid more in interest and charges than they have repaid of their borrowing over an 18-month period.

Labour said its "total cost cap" would help "tackle the persistent debt spiral", claiming growing consumer debt was becoming a "threat to our economy".

UK Finance, which represents the financial and banking industry, said: "The last thing the industry wants is to see those who are most vulnerable being pushed towards the hands of unscrupulous and unregulated lenders."

The Conservatives said action was already being taken.

- Published4 July 2017

- Published18 April 2017

- Published25 September 2017