Merlin Entertainments shares rise on talk of SeaWorld deal

- Published

Shares in the UK-based entertainment giant Merlin are up almost 3% on reports the Madame Tussauds and London Eye owner has held talks to take over parts of US theme park giant SeaWorld.

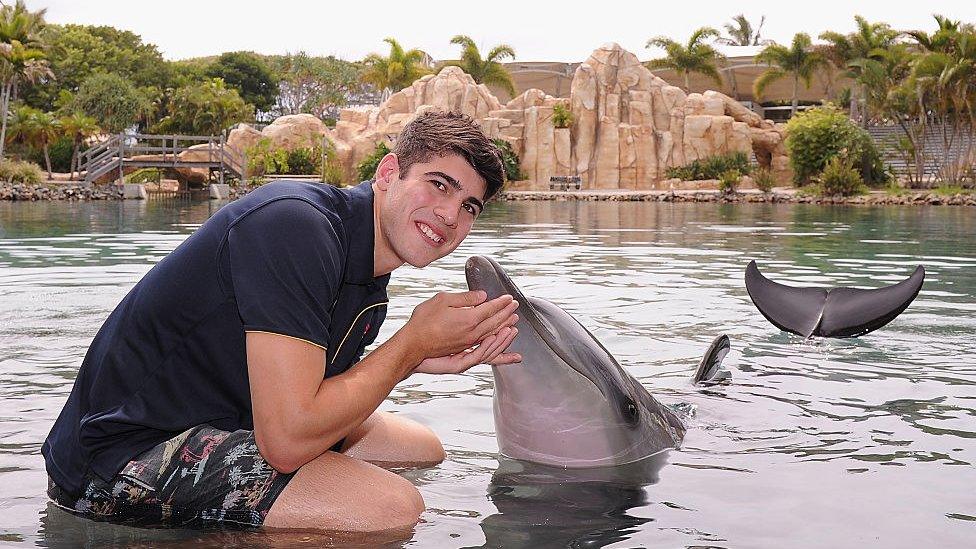

SeaWorld, which is based in Orlando, Florida, specialises in marine parks.

Its shares rose 5% on Wednesday on speculation a deal was in sight, but were 3% lower in Thursday trading.

Merlin, which also runs Legoland theme parks worldwide, is understood to be interested in only part of SeaWorld.

Merlin is already the world's largest aquarium operator. In August, at the time of its interim results, it said it might only be interested in SeaWorld's Busch Gardens assets.

Busch Gardens is a Florida theme park with an African flavour.

Killer whales

SeaWorld's shares have lost a quarter of their value this year, hitting an all-time low in August of just over $11.

Their all-time high of just short of $40 was reached in 2013, but later that year the company came under fire in a documentary which criticised how it looked after its whales.

The company defended its animal husbandry but the documentary hit attendance figures. Earlier this year SeaWorld said it would end one of its shows which featured killer whales.

Merlin will not have whales or dolphins in its parks as it believes such creatures need to live in the wild.

In August, the company's chief financial officer, Anne-Francoise Nesmes, said: "It takes two parties to do a deal so we do not know what SeaWorld's intentions are but we do believe that those assets [Busch Gardens] are interesting."

- Published13 June 2017