Tenants 'unfairly miss out on credit'

- Published

Tenants' regular rent payments should be recorded on their credit score and used as proof to lenders that mortgage demands can be met, MPs are to be told.

At present, mortgage applicants are unable to rely on rent payment history as proof that they would be safe to lend to when buying a home.

A debate is being held in Parliament on Monday following a petition which aimed to raise awareness of the issue.

The government has said that lenders should consider a range of factors.

The petition, signed by 147,307 people, argued that "paying rent on time [should] be recognised as evidence that mortgage repayments can be met".

Campaigners have argued that rent payment history should be included on a tenant's credit score, even though it is not strictly a form of credit.

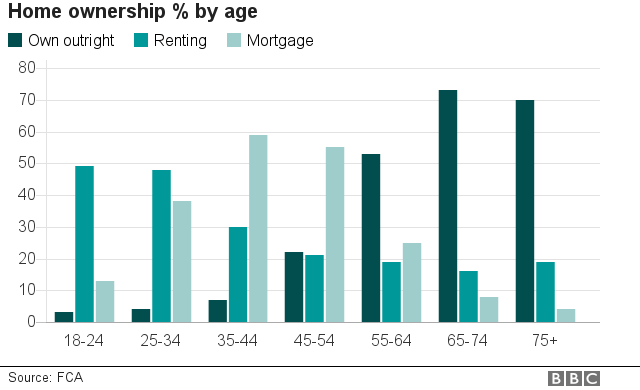

Steve Burrows, managing director of LateRent which offers a service to landlords, said: "It is no secret that owning a property has become a distant prospect for many and the private rental sector continues to grow as a result.

"It is therefore oddly out of step that tenants are unable to utilise rental payments as part of their credit profile - particularly as the government increasingly seeks to promote homeownership across the UK."

'Additional expenses'

Conservative MP Paul Scully, who will introduce and lead the debate on Monday, said that he was sympathetic to those who were paying more for credit, or being turned down, simply because they had been renting a home. This was particularly true when monthly rent was higher than typical monthly mortgage repayments.

"It is clear that in many cases if someone is renting, they can afford the equivalent mortgage," he said.

The petition was cut short owing to the general election being called earlier this year, but still garnered sufficient support for a debate to be called.

In its response to the petition, the government said regulators insisted that lots of financial information was needed to prove that an applicant could repay a mortgage, such as testing whether a borrower could cope were interest rates to rise.

"Lenders must consider a range of factors when assessing a mortgage application. Meeting rental payments is not sufficient in itself to demonstrate affordability over the lifetime of the loan," it said.

"It is important to be aware that home ownership brings a number of additional expenses that may not be incurred when renting, including maintenance costs and buildings insurance.

"Before extending a loan, lenders must satisfy themselves that a borrower will be able to meet these additional on-going costs when considering a mortgage application."

Where can you afford to live? Try our housing calculator to see where you could rent or buy

This interactive content requires an internet connection and a modern browser.

- Published9 July 2020

- Published18 October 2017

- Published17 October 2017

- Published29 September 2017