How an Icelandic firm became a global food giant

- Published

The cod father of the global food production

Hundreds of freshly caught cod are moving at pace down a conveyor belt, before automated paddles pop out to send the fish splashing, one by one, into storage tanks below.

From there the cod, pulled from the cold water of the North Atlantic just a few hours earlier, enter a machine where the two sides or fillets of the fish are quickly removed.

The raw fillets then go whizzing off on another conveyor belt, directed in places by 50 or so workers in white overalls and waterproof blue aprons, gloves and rubber boots.

Another machine then takes just 1.2 seconds to cut each fillet into neat portions, and a few minutes later the cod is boxed up on ice, ready to be flown to cities across Europe and North America to be eaten that same day.

This is the busy scene early one morning at a fish processing plant on the south coast of Iceland.

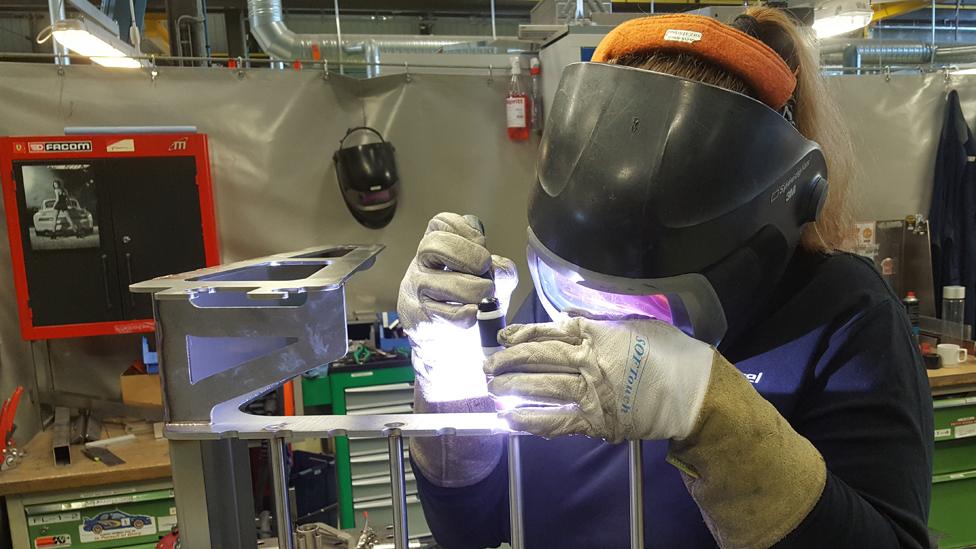

Marel works with Icelandic fish processing firms to test its latest equipment

We are there to see first hand the hi-tech assembly lines at work, which have been manufactured by an Icelandic company called Marel.

Marel is a name that few people outside of Iceland have heard about, but it is one of the world's largest manufacturers of food processing machinery.

Selling to food chain firms from Europe to China, and the US to Brazil, it has an annual turnover of $1bn (£760m).

But how has a company from an isolated island just south of the Arctic Circle, and with a population of only 335,000, managed to become such a global leader in its field?

The fishing sector accounts for almost a third of Iceland's economy

Marel's chief executive, Arni Oddur Thordarson, says that the business aims to ensure that its machinery and computerised systems are more technologically advanced than its rivals.

"We invest 6% of our revenues on innovation, meaning we invested $60m last year in innovation," he says.

The firm is also continuing with a policy of acquisitions around the world, buying up smaller rivals as a way to increase its market share.

Marel was founded as a private company back in 1983 following a project at the University of Iceland to devise ways to help the country's vital fisheries sector boost production and improve efficiency.

Arni Oddur Thordarson leads a global workforce of 5,000 people

As catching and processing fish accounts for almost a third of Iceland's economy, protecting and boosting the industry is a vital national concern.

So the idea behind Marel was to increase the mechanisation of the fish processing, so that the fish could be filleted and packed more quickly and efficiently - maximising the amount of meat that could be neatly removed from the cod, salmon and other species.

Like any Icelandic firm with ambitions to grow, Marel realised it had to quickly expand overseas because its home market is so small. Within two years it was selling its equipment to Canada and a year later to the then USSR, today's Russia.

By the 1990s Marel (the name comes from a combination of "marine" and "electronic") was selling to a growing number of countries around the world.

Marel's machines enable fish processing firms to box up neat fillets in just minutes

Thorgeir Palsson, from Reykjavik University's School of Business, says that Marel has successfully followed the "export or die" route of all large Icelandic firms.

"Iceland is obviously a very small country, so the home market quickly becomes mature or saturated," says Mr Palsson.

He adds that like other Icelandic firms who enjoy strong overseas sales, Marel has always realised that it cannot compete on cost.

Given the high labour costs in Iceland compared with, for example, China, Marel has instead focused on technological advancement - offering hi-tech solutions that while more expensive, do a better and more reliable job.

The equipment is made in Iceland, then exported around the world

One example of this is Marel's computerised "flexicut" machine, which uses x-rays, high pressure jets of water, and spinning blades to automatically portion out fish fillets.

Able to process 50 fillets every minute, or one every 1.2 seconds, the x-rays determine how to cut up each fillet according to its thickness and length, before the water jets push out any remaining bones, and then the blades cut the fish.

The company has similar technology for dealing with poultry and fish, but as Mr Thordarson admits, sometimes the company needs to read up on the culinary preferences of certain export markets.

A good example is China, where he says that Marel initially made the mistake of trying "to bring a European solution to the Chinese market".

So while Marel's machines were all about neatly removing the chicken breasts, as this is the meat most in demand in Europe, the Chinese focus is instead on the chicken legs, which were getting damaged.

This is the sixth story in a new series called Connected Commerce, which every week highlights companies around the world that are successfully exporting, and trading beyond their home market.

"So we were literally breaking a leg when we entered the Chinese market 15-20 years ago," says Mr Thordarson.

Marel soon adapted its machines in China to solve the problem.

Mr Thordarson adds that since its acquisitions strategy first started to gather pace in the early 1990s it has learned that the firms it buys should be integrated into Marel as soon as possible, to ensure their smooth running following the takeover.

Having seen its revenues grow by more than 20% every year since 1992, Marel now employs 5,000 globally, and its overseas operations account for 99% of its earnings.

To remove fish bones a Marel machine uses water at such a high pressure that it would cut through a human hand

The firm's business model sees it make 60% of its income from sales, and 40% from after sales servicing and maintenance.

With the global food processing machinery market, external for fish, meat and poultry, expected to expand to $7.9bn by 2021, up from $5.8bn last year, Marel intents to just keep on growing.

Mr Thordarson says: "Today our markets are growing fast in South America, Asia, Africa and the Middle East.

"If you really want to change things, you have to become global and serve all markets."