RBS to close one in four branches and shed 680 jobs

- Published

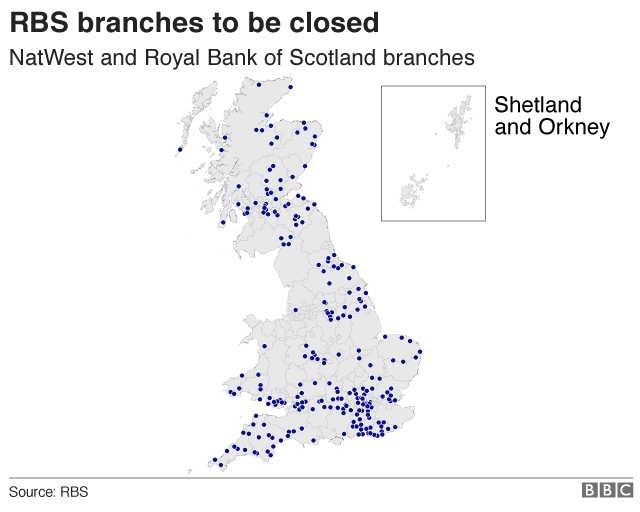

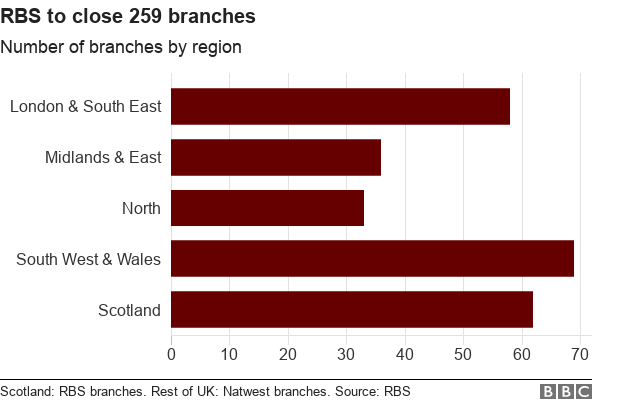

RBS is closing 259 branches - one in four of its outlets - and cutting 680 jobs as more customers bank online.

The closures involve 62 Royal Bank of Scotland and 197 NatWest branches.

RBS, which is 71%-owned by the taxpayer, said it would try to ensure compulsory redundancies were "kept to an absolute minimum".

The bank said use of its branches by customers had fallen 40% since 2014, but the Unite union, which represents bank staff, called the cuts "savage".

Following the closures, the RBS group will be left with 744 branches.

RBS's branch closure announcement is the third such this week, following Lloyds, which on Wednesday said it would close 49 branches, and Yorkshire Building Society, which said it would close 13 branches.

An RBS spokesperson said: "More and more of our customers are choosing to do their everyday banking online or on mobile.

"Since 2014 the number of customers using our branches across the UK has fallen by 40% and mobile transactions have increased by 73% over the same period. Over 5 million customers now use our mobile banking app and one in five only bank with us digitally.

"We realise this is difficult news for our colleagues and we are doing everything we can to support those affected."

Unite said serious questions needed to be asked about whether the closures marked the end of branch network banking.

Rob MacGregor, Unite national officer, said: "This announcement will forever change the face of banking in this country resulting in over a thousand staff losing their jobs and hundreds of High Streets without any banking facilities.

"The closure of another 259 branches is savage. Why is the government signing off this alarming branch closure programme?"

Analysis: Kevin Peachey, personal finance reporter

RBS, like many of its competitors, says that branch use has dropped dramatically as people bank on the go.

Industry analysts CACI forecasts that typical consumers will only visit a bank branch four times a year by 2022, as virtually all transactions or paperwork can be done online, or by letter or at a post office.

Yet visiting a branch remains a way of life for many people - older people and small businesses particularly. A report into branch closures by Professor Russel Griggs likened losing a local branch to a "bereavement" for some people.

So what is being done for them?

The major banks have signed up to a protocol that ensures specially trained staff are in place to help customers find alternatives when a local branch is closing, such as using the Post Office.

They must work more proactively to support elderly and vulnerable customers, and tell communities as quickly as possible after the decision has been made.

Rural impact

Paul Wheelhouse, Scottish Government Minister for Business, Innovation and Energy, said: "The news of further branch closures from RBS will be hugely concerning to many people in Scotland as it now not only affects, potentially, staff at RBS but also leaves large areas of Scotland, particularly rural areas, with limited branch coverage.

"While recognising that footfall in branches is falling, due to online banking, RBS, and other banks, must take into account the needs of all customers - not just those who can access and use digital services."

The news comes as RBS continues its rehabilitation from its state-backed bailout in 2008, prompted by the financial crisis.

On Thursday, it said it had closed its so-called "bad bank", which was set up to handle toxic assets stemming from the crisis.

Earlier this week, RBS passed the Bank of England stress tests, having failed in 2016.

In last week's Budget, the government revived plans to sell down its stake in the bank, aiming to sell £15bn of its shares by 2023.

- Published1 December 2017

- Published28 November 2017

- Published30 November 2017

- Published1 December 2017