What sticking points remain on US tax plan?

- Published

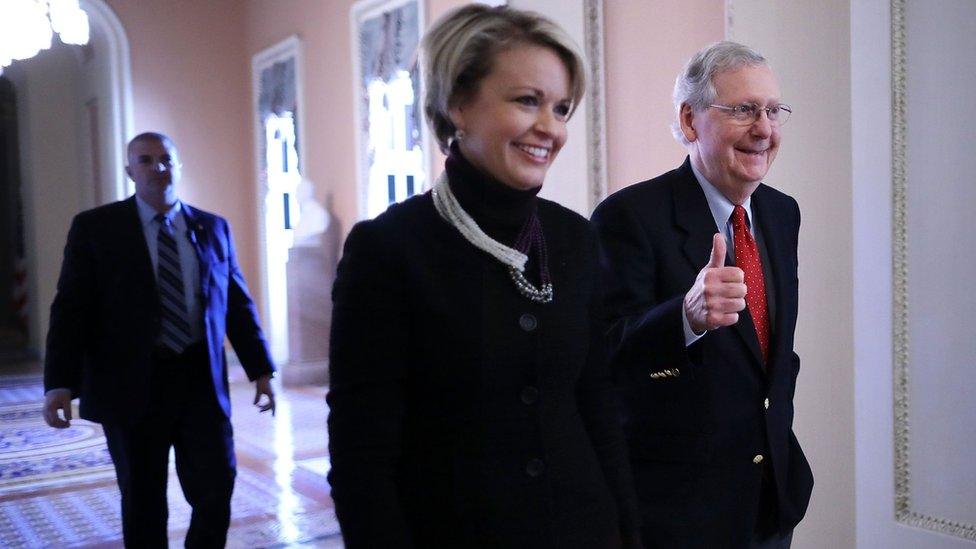

Republicans expect to complete a tax code rewrite by the end of the year

Republicans have started haggling on final details as they near completion of the most significant rewrite of the US tax code in decades.

The main thrust of the plan has been clear for months - a major reduction in the corporate tax rate, currently 35%.

But many parts of the overhaul remain in flux, as the House and Senate versions of the bill diverge on several key points.

The Senate bill, for example, would allow drilling in an Arctic refuge and eliminate a requirement that individuals have health insurance or pay a penalty.

Negotiations will be tricky, as lawmakers aim to keep the final cost of the bill within current estimates.

The Joint Committee on Taxation projects the Senate cuts will lead to $1tn less revenue over a decade, even after accounting for economic growth.

What's the same?

Both the House and the Senate would reduce the corporate tax rate from 35% to 20%.

Both bills also roughly double the amount of money individuals and couples can automatically deduct from their tax bills, to about $12,000 and $24,000 respectively.

And both allow people to deduct up to $10,000 in state and local property taxes.

But they diverge on other matters

1. Individual tax rates

Tax brackets

The House bill creates four tax brackets, with a top rate of 39.6%.

The Senate bill has seven tax brackets, like current law, but introduces lower rates, with a top rate of 38.5%.

Under the Senate bill, the rate reductions would expire after 2025.

Inheritance tax

The House bill roughly doubles the amount of money exempt from inheritance tax, raising it to $11m for an individual, and eventually eliminates it entirely.

The Senate bill also doubles the amount exempt from the tax, but that benefit expires in 2026.

Health care

Unlike the House, the Senate bill repeals a requirement that people carry health insurance or pay a penalty.

The provision would raise $318bn, since it is expected to lead to 13 million fewer people with insurance coverage.

Republicans in the House have tried to undo health care laws such as this one so it is likely to attract support.

Other deductions

The House bill is more aggressive about tackling a host of other individual tax benefits.

For example, the House limits the mortgage interest deduction to loans of up to $500,000 on a primary residence. The Senate maintains current law, which caps the deduction at $1m.

The House also repeals a deduction for medical expenses, while the Senate preserves the benefit - even expanding it for two years at the insistence of Senator Susan Collins.

For graduate students, the tuition waiver is also at stake. The Senate bill does not discuss the issue, but the House would treat waived tuition as income for tax purposes.

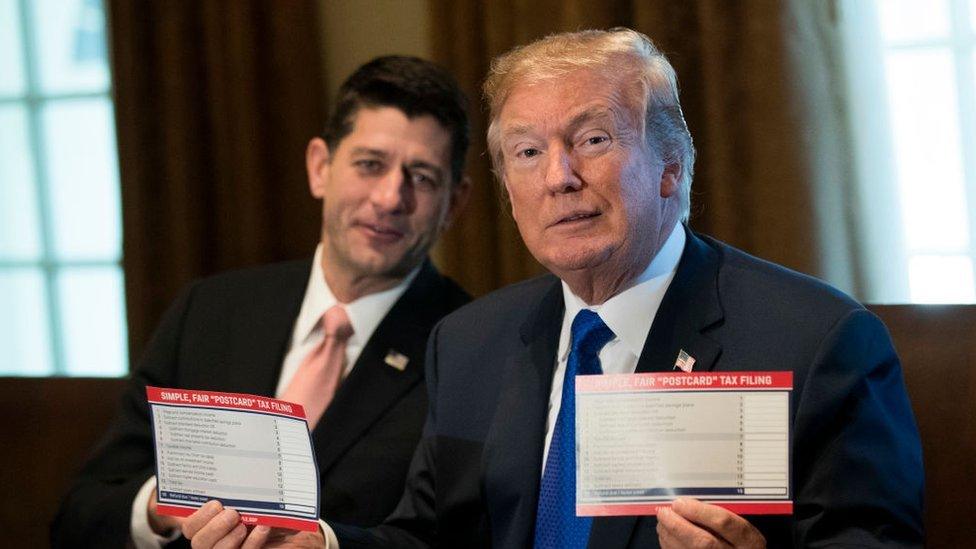

The tax bill has aroused opposition, since many of the benefits go to the wealthy and large corporations

2. Business taxes

Corporate tax rate

Under the Senate plan, however, the reduction in the corporate rate would be delayed for one year.

This weekend, President Donald Trump also raised the possibility that the rate could end up a bit higher - a major shift from earlier statements when he said he was not open to a higher corporate tax.

Alternative Minimum Tax for corporations

The House bill repealed this minimum 20% tax, which applies to larger firms and is designed to ensure that companies can't use tax credits and other benefits to completely avoid taxes.

At the last minute, the Senate reinserted the tax into its bill, a move that raised an estimated $40bn to pay for cuts elsewhere.

Companies are pushing back.

They say a code with a corporate tax rate of 20% and an alternative minimum tax rate of 20% will make important tax credits such as those designed to encourage research meaningless.

Pass through businesses

Both bills aim to lower taxes on businesses organised as pass through entities, such as real estate firms, where profits get taxed at the owner's individual rate.

They achieve the lower rates differently. In both cases, the provisions are already among the most highly contested parts of the bills.

Overseas profits

The Senate and House bills both overhaul the way that overseas profits get taxed, but the methods vary.

- Published2 December 2017

- Published30 September 2017

- Published1 December 2017