Sports Direct investors veto £11m payout to Ashley's brother

- Published

Sports Direct founder Mike Ashley wanted the company to give his brother £11m

Sports Direct shareholders have rejected a proposed £11m payment to the brother of its founder, Mike Ashley.

The tycoon, who abstained from voting, wanted to give John Ashley the cash as a back payment.

However, the vote was more than 70% against John Ashley receiving the sum.

Sports Direct said: "The board respects the views of the company's independent shareholders, and considers all these matters to be closed. We now intend to move on."

Investors such as Royal London Asset Management had said they would vote against the plan.

John Ashley, who is Mike's elder brother, stepped down as the retailer's IT chief in 2015.

An internal review by Sports Direct legal advisers RPC and accountants Smith & Williamson found that John Ashley had been underpaid since the company listed on the stock market in 2007, and was due £11m in bonuses and awards.

The findings were endorsed by Mike Ashley and the board, but were criticised before the vote by investors because of corporate governance issues.

Royal London Asset Management said in November that there should have been a clear process for paying John Ashley at the time.

Pay package

Sports Direct called a general meeting at its Shirebrook headquarters to ask independent shareholders to vote on the findings of the RPC investigation.

That probe found John Ashley had not been paid in line with other senior executives who helped build the company because of worries about how it would appear to the public.

Mike Ashley said in November he did not expect investors to approve the payment.

John Ashley had a salary of £150,000 a year after Sports Direct floated on the stock market, and got a bonus of £706,502 under a separate employee bonus scheme, RPC said.

The latest showdown between the retailer and its shareholders came after years of clashes.

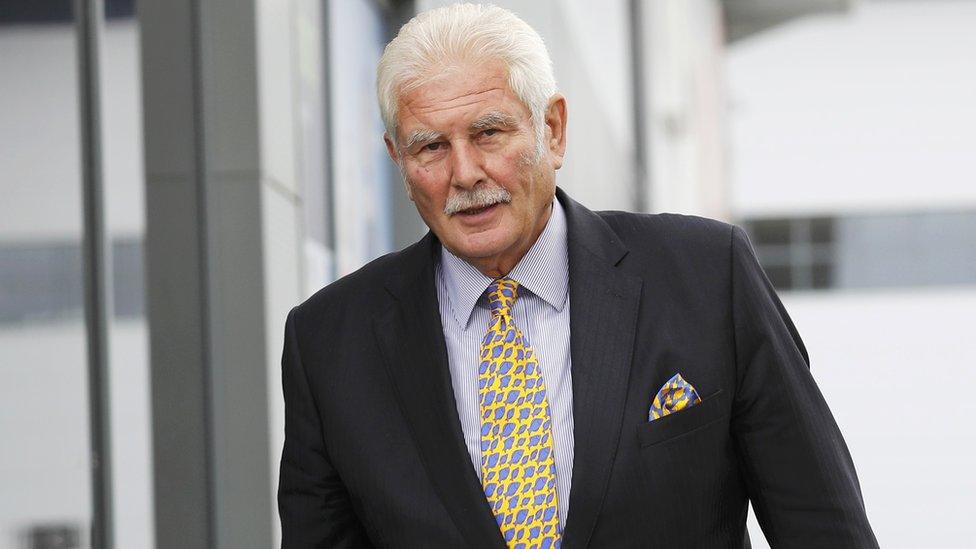

Chairman Keith Hellawell, who some investors said was accountable for a string of management and governance failures, narrowly survived a vote to get rid of him in September.

Shares in Sports Direct, which will report first-half results on Thursday, were down 2.2% in afternoon trading.

- Published8 December 2017

- Published24 November 2017

- Attribution

- Published19 October 2017

- Published6 September 2017