What is in Republican tax plan?

- Published

What is in the US tax plan?

US lawmakers have unveiled the final draft of a bill set to be the most significant overhaul of the US tax code in a generation.

After weeks of politicking, lobbying and vote-trading, the Republican-controlled Congress is set to vote on the plan.

If it passes it will give President Donald Trump an early Christmas present - his first major piece of legislation since taking office.

Republicans say the tax cuts for businesses and families will unleash investment, spending and growth.

But critics say it will result in a huge transfer of wealth from poor to rich, and future generations will have to pay for it.

So what are the key points in the plan?

Lower corporate taxes

It's being described as the biggest single drop in corporation tax in US history.

Under current law, businesses face a range of tax rates, starting at 15% and rising to 35% on taxable income over $10m.

The new plan creates a single 21% corporate rate, effective in 2018.

That is low, but not quite as low as the 20% rate included in earlier versions of the plan.

No health insurance requirement

Current law requires people to carry health insurance or face a tax penalty.

That mandate is eliminated in the new code, a provision that the Joint Committee on Taxation projects could raise $318bn, since it is expected to lead to 13 million fewer people with insurance coverage.

The tax bill has aroused opposition, since many of the benefits go to the wealthy and large corporations

Lower individual rates, temporarily

The US currently has seven tax brackets ranging from 10% to a top rate of 39.6%, which applies to income above about $418,000 for individuals and $471,00 for couples.

Under the new plan, some of those rates fall, including the top rate, which would be 37%, applicable to income over $500,000 for individuals and $600,000 for couples.

The lower rates expire after 2025.

Less inheritance tax

Under current law, inheritances worth more than about $5.5m for individuals and roughly $11m for couples are subject to a 40% tax.

The new plan roughly doubles the amount of inheritance exempt from tax.

That provision expires after 2025.

Larger standard deductions, but fewer targeted perks

Under current law, taxpayers can either claim a standard deduction or opt to deduct specific items.

The new plan roughly doubles the standard deduction to $12,000 for individuals and $24,000 for married couples.

In exchange for that boost - which expires after 2025 and is intended to make the itemising option less attractive - the plan eliminates a slew of targeted benefits, such as deductions for moving expenses and tax preparation costs.

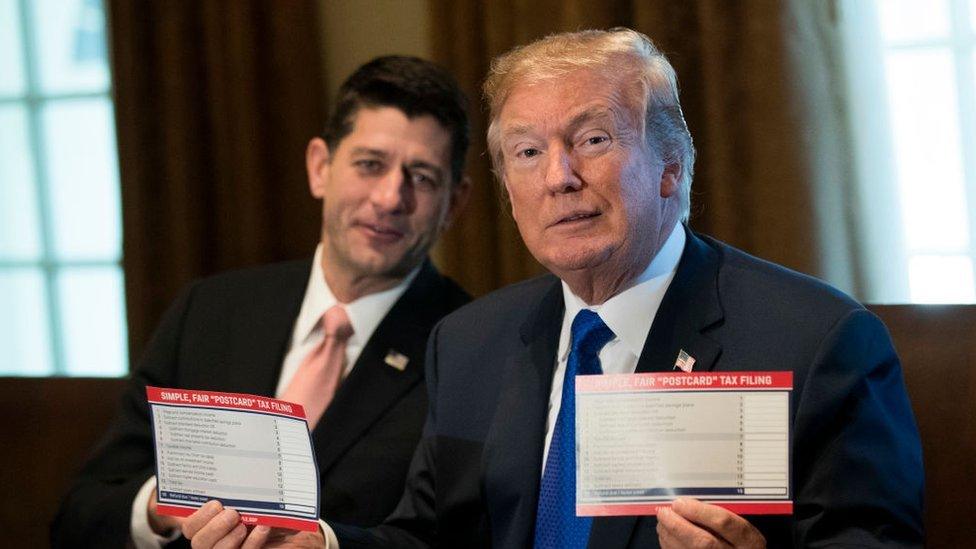

Speaker of the House Paul Ryan has championed the tax efforts. He says he wants families to be able file their taxes on a post card.

More oil drilling

Republicans in the Senate attached a measure that will open the Arctic National Wildlife Refuge to drilling. That made it into the final version.

House Ways and Means Chairman Kevin Brady (R-TX) addresses questions from reporters during the final negotiations

An expanded child tax credit

The Republican plan eliminates the personal exemption, which was worth roughly $4,000 and could be claimed for each member of a family.

To offset that move, the plan expands a tax credit for children.

That is currently worth $1,000 per child for families who make less than a certain amount. Under the new plan, it would be worth $2,000 and available to more families.

Debate over how much the child tax credit would be worth almost killed the bill, after Senator Marco Rubio, Republican from Florida, said he wanted the provision structured to be more generous for low income families.

The benefit expires after 2025.

Lower taxes on overseas profits

Multinational companies currently pay US taxes on income earned abroad.

The new plan changes the code to a so-called territorial system, making companies responsible for income earned in the US.

It also creates new rules to prevent companies from unfairly taking advantage of the shift.

The plan also imposes one-time, ultra-low tax rates for corporate profits currently being held offshore, charged at 15.5% on liquid assets and 8% for illiquid assets.

US President Donald Trump has rallied support for tax changes, which he says will boost economic growth

Lower pass through taxes

Under current law, owners of businesses organised as so-called pass through entities pay taxes on profits based on the personal rate (since the profits "pass through" to the owners).

The new bill allows for 20% of that income to be deducted for households making less than $315,00. After that, the perk is only available to some businesses.

Some business 'loopholes' stay

Republicans had threatened to eliminate a number of industry specific benefits. But the final version is less aggressive than earlier proposals.

For example, the bill preserves tax perks for wind energy.

Other changes

The plan caps the deduction for state and local taxes at $10,000. Preserving some kind of deduction was important to Republicans from high-cost states such as California, New Jersey and New York.

It also retains the mortgage interest deduction, a priority of the powerful property lobby, while lowering the cap on what new mortgages are eligible for the perk from $1m to $750,000.

The bill does not subject graduate school tuition waivers to taxes, as had been proposed.

The plan also maintains, and temporarily expands, deductions for certain medical expenses.

- Published2 December 2017

- Published5 December 2017

- Published28 January 2019

- Published30 September 2017