The 2018 economy: What to watch

- Published

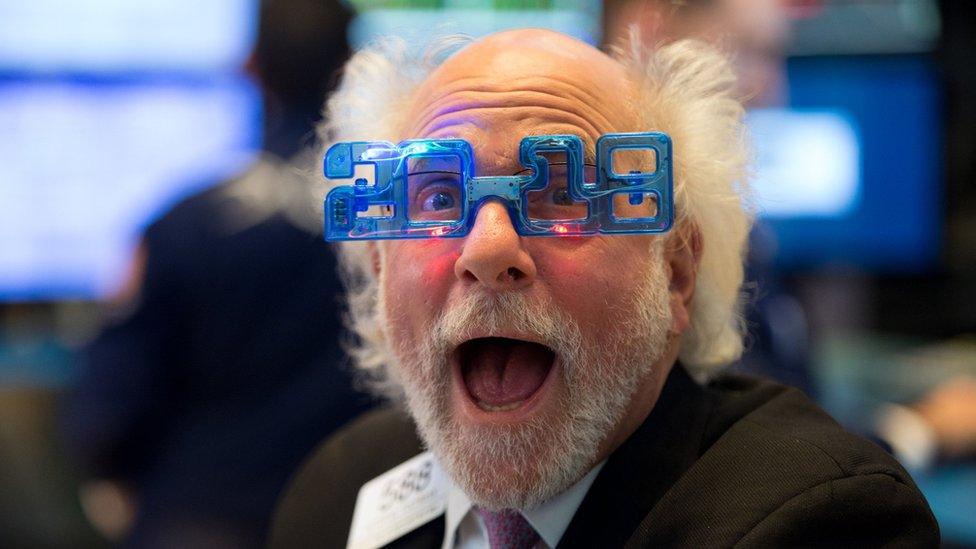

A trader works on the floor at the closing bell of the Dow Industrial Average at the New York Stock Exchange on December 29, 2017 in New York.

Global stock markets are closing out a blockbuster year.

In the US, the S&P 500 topped 2,670, rising more than 400 points or about 19% over the year.

Japan's Nikkei also gained nearly 20%. Even the UK's FTSE indexes hit record highs, ending the year more than 7% ahead.

As Morgan Stanley analysts put it, for shareholders at least, the year has been "absurdly good".

So what drove the growth and will it continue? Here are some factors to consider in 2018.

Global boom

The global economy is forecast to grow, but growth is expected to slow in some regions

A major driver of stock market growth in 2017 was a booming global economy that surpassed expectations.

Will the growth continue? Forecasters say basically, yes.

The OECD, external is predicting 3.7% growth in 2018, up from 3.6% this year.

IHS Markit, external expects growth of about 3.2%, while the forecasts of Bank of America Merrill Lynch, external and Goldman Sachs, external are a bit rosier at 3.8% and 4%, respectively.

One boost will come from the US, where many economists expect new tax cuts to provide a temporary economic jolt, with forecasts for GDP growth of about 2.5%.

The increase is expected to translate into stock market gains, although less than in 2017.

Morgan Stanley predicts the S&P 500 will reach 2,750 in 2018. Bank of America Merrill Lynch, external expects it could hit 2,800, while Goldman Sachs forecasts a rise to 2,850 as corporate profits climb.

"While there are potential pitfalls in store for 2018, the weight of the evidence as we move toward the New Year remains bullish," Baird analysts wrote in a December report.

In some regions, however, it may prove hard to beat the prior year.

Economists expect growth in China to slow, and say it will be difficult for Europe to match its 2017 expansion, which was the fastest in a decade.

In the UK, PwC, external predicts GDP growth will slow to 1.4%, while Moody's Analytics, external predicts 1.3% growth.

US tax changes

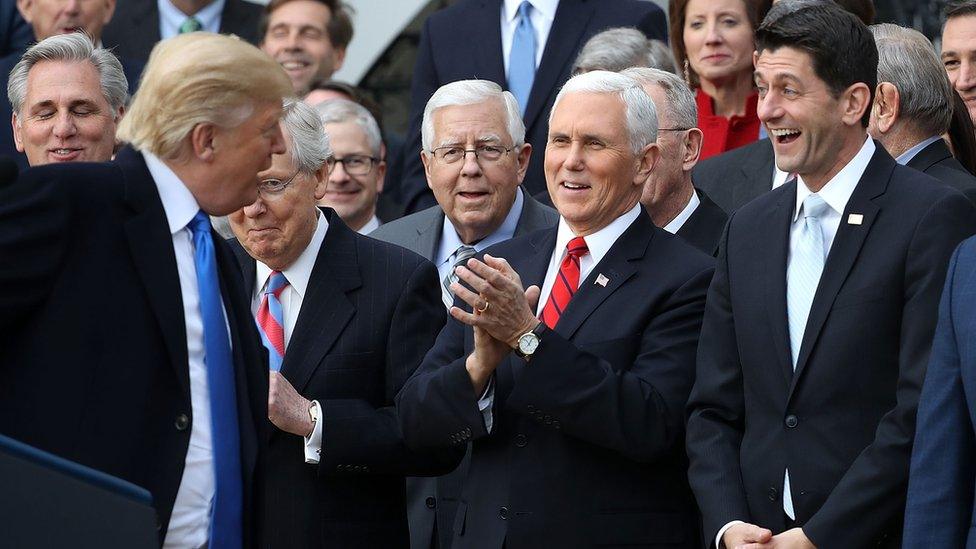

The tax overhaul, which will slash corporate rates, is a victory for Republicans

In the US, one factor boosting stocks in 2017 was optimism that Republicans would deliver corporate tax cuts - and they did, passing the most significant overhaul of the US tax code in a generation.

In 2018, we'll start to see how companies and consumers respond to the cuts.

Will excess cash lead to a flurry of corporate mergers or new investment? Will multinationals adopt different tax strategies? Will revenue declines caused by the cuts lead politicians to slash US welfare programs, exacerbating the gap between rich and poor and stirring political tension?

Some analysts worry the stimulus will cause the economy to overheat, and lead the Federal Reserve to raise rates more aggressively than planned.

Such a move, which comes as banks in other countries are also removing stimulus, could raise the risk of triggering a recession.

But most economists aren't anticipating that will happen in 2018.

"With robust growth momentum and no major economic imbalances or other key recession risk indicators flashing red, we see no obvious reason why the expansion needs to end any time soon," Goldman Sachs analysts wrote this month.

Trade fights

Negotiations over Nafta are expected to be resolved in 2018.

The election of US President Donald Trump sparked fears of trade wars and increased protectionism.

He took some steps in that direction in 2017, withdrawing the US from the Trans-Pacific Partnership and ramping up some disputes with Canada.

It should become clearer in 2018 how much of his rhetoric will turn into reality, as negotiations over the North American Free Trade Agreement (Nafta) come to a head.

President Trump continues to threaten to scrap the deal, but he faces opposition from within his own party, as well as powerful business associations.

"There are extensive trade ties among the three North American economies, and an abrupt end of the agreement would impart adjustment costs on many businesses in the three countries," Wells Fargo analysts wrote.

Officials hope to wrap up the discussions this spring before election campaigns in Mexico and the US get underway.

Also pending is an investigation of intellectual property theft in China.

Tech stocks

Amazon is estimated to account for about 44% of all e-commerce sales in the US

Technology giants - including big names such as Facebook, Amazon, Netflix and Google - powered US stock markets this year, while shaking up traditional sectors including car-makers, department stores, grocers, media giants, banks and advertisers.

The tech firms, which are becoming increasingly global, are likely to remain strong stock picks in 2018, said Jill Hall, an equity strategist at Bank of America Merrill Lynch.

But the digital behemoths are also facing backlash over their increasing dominance, a groundswell spurred in part by concerns about crippling cyber breaches and the proliferation of fake news on the social media platforms.

Will 2018 be the year when US regulators take action?

In Europe, authorities have already stepped up enforcement of tax, privacy and competition rules. Scott Kessler of CFRA Research predicts additional action in Europe and possibly the US, yielding at least one more multi-billion dollar fine in 2018.

- Published27 December 2017

- Published24 October 2017

- Published14 August 2017