Stock markets hit record highs – here are three reasons why

- Published

- comments

Not too hot, not too cold - but just right.

Goldilocks' requirements for the perfect bowl of porridge are similar to the requirements of an attractive economy.

Not too hot - growth busting out the lights raising fears about sustainability and rampant inflation.

And not too cold - economic slowdowns and recessions pulling down business profitability and weighing on equity valuations.

Market investors certainly sense that 2018 will see a continuation of a global "Goldilocks economy". Why?

Firstly, there is the gentle recovery in economic growth and increasing demand for companies products across the major drivers of the world economy - Japan and the Asian emerging markets; the Eurozone and, most importantly, America.

Secondly, there is the continuing stable expansion of that other engine of the world economy - China.

It is the first time since the financial crisis that such a growth "synchronisation" has happened.

Thirdly, there is little evidence of increasing inflationary pressures, meaning interest rates are likely to remain at close to historically low levels.

That leads to the economically benign sum: growth (leading to higher company profits) + low inflation + easy monetary policy.

Which equals good news for equities.

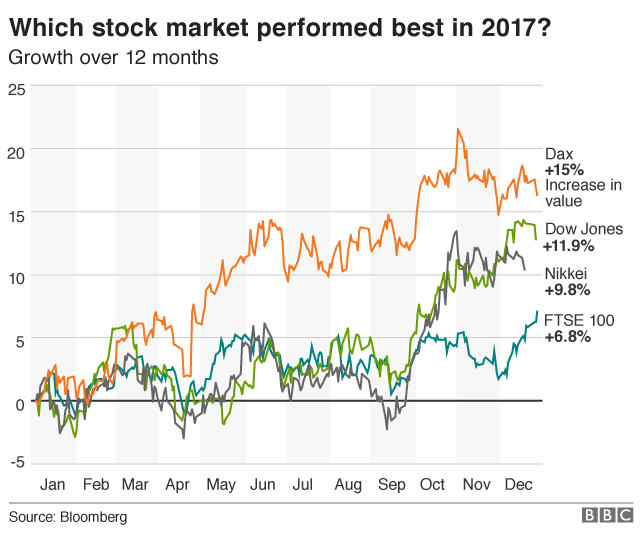

On Thursday, the Dow Jones Industrial Average in America pushed through 25,000 for the first time in its history.

And on Friday the FTSE 100 index of leading companies listed in the UK closed at a new record high.

Bit by bit

There's another codicil to this story, which is minimising investor jitters over when does "very high" turn into its well-known cousins "scarily high" and "unsustainably high".

Although markets are hitting record levels, the day-by-day increases are relatively modest.

Unlike at the time of the dotcom boom in the late 1990s, when we last saw such a sustained run of market growth, overall volatility (the rate of increase or decrease) is low.

That is easing any fears that there is a sudden correction downwards around the corner.

Now, it is of course just at the time of heightened calm that we need to be at our most vigilant.

And anyone who says "it is different this time" should be gently pointed towards the rapid stock market sell-offs of 2015 and early 2016, led by the precipitate collapse of the Chinese markets.

And the fact that the dotcom boom and the supposed "new normal" of sustained growth in the 2000s ended in crisis and market carnage.

Bear markets follow bull markets like seagulls follow trawlers, ready to feast on the overconfident exuberance of investors chasing valuations ever higher.

For now, the bulls are in charge and the bears are quiet.

And Goldilocks is enjoying her porridge, at just the economically right temperature.

- Published4 January 2018